15 April 2020

Northern Ireland PMI - COVID-19 leads to record fall in business activity

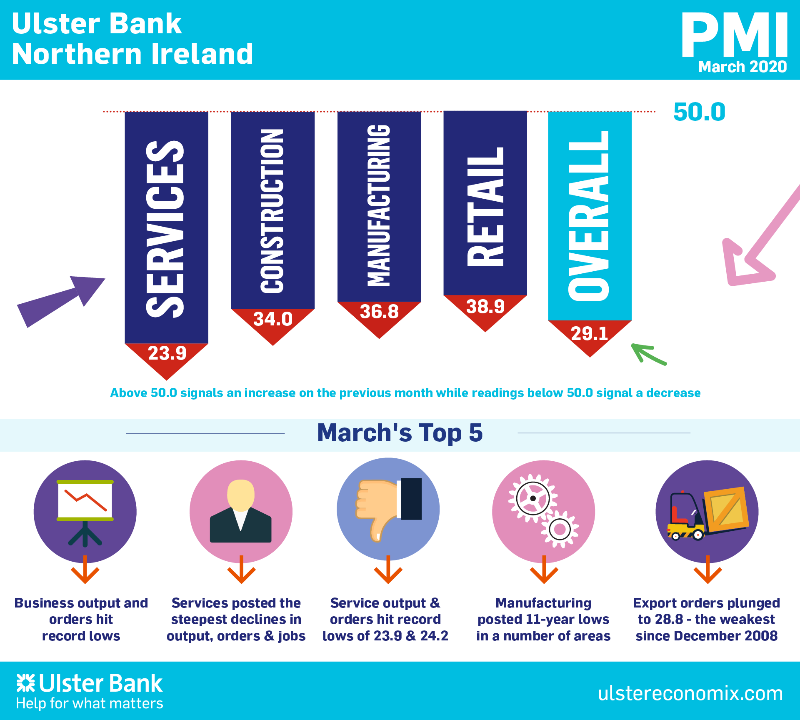

The Ulster Bank Northern Ireland PMI® report for March – produced for Ulster Bank by IHS Markit – indicated that the global coronavirus disease 2019 (COVID-19) pandemic caused a steep contraction in the Northern Ireland private sector, with both output and new orders falling at the sharpest rates since the survey began in August 2002. Companies reduced staffing levels substantially, while business confidence slumped.

Commenting on the latest survey findings, Richard Ramsey, Chief Economist Northern Ireland, Ulster Bank, said:

"Little did I know back in January when I was talking about the potential impact of coronavirus on the economy the extent to which it would come to affect all of our lives. At that stage, the concern was the indirect impact due to the lockdown in China, given China's key role as a driver of global supply-chains and the world economy. In a short period of time though, coronavirus went from an external threat to a very real and present internal one here in Northern Ireland, Ireland, the UK and Europe. Indeed, we are now seeing a true global pandemic and global economic lockdown.

"China was of course the first country to go into lockdown. The impact of that quickly became clear with the Chinese PMI plunging to a record low in February. Lockdowns have subsequently been implemented across Europe and beyond throughout March. These have met with the same result. The Eurozone's PMI fell to an all-time low in March with Germany, France, Spain and Italy all posting record falls. Closer to home, UK private sector activity slumped to an all-time low while the Republic of Ireland reported its weakest month in 11 years.

"We get some insight into the degree to which the lockdown here is having an impact on Northern Ireland's private sector through the latest Ulster Bank NI PMI.

"All 12 of the UK regions saw business activity plunge last month but Northern Ireland reported the steepest decline. Local firms saw output and orders fall at their fastest pace since the survey began in August 2002. Staffing levels are also being cut at their fastest rate in over nine-and-a-half years. Significantly, it is the services sector that is enduring the most alarming rates of decline. Given what has happened to the local hospitality sector this is perhaps not surprising.

"As sobering as March's data is though, the reality is that things are going to get worse for the economy before they get better. It is worth pointing out that 80% of the respondents in the Northern Ireland survey replied before the Prime Minister announced the full UK lockdown on 23 March. The April survey will be the first full month that the UK, Northern Ireland and Republic of Ireland economies will be under full lockdown conditions. Therefore the pace of contraction will accelerate further to fresh record lows. The local economy is enduring its fastest and deepest economic decline in a century. For a recovery to begin, the health emergency must pass. Only when the lockdowns are lifted will economists be able to gauge the strength and timing of the economic recovery in any meaningful way."

The main findings of the March survey were as follows:

The headline seasonally adjusted Business Activity Index fell considerably in March, posting 29.1 from 46.5 in February. Moreover, the rate of contraction was the sharpest in the survey's history, surpassing the previous record signalled at the height of the global financial crisis in early-2009.

A record contraction was also seen for new orders at the end of the first quarter, with company shutdowns and uncertainty caused by COVID-19 widely mentioned. Companies often responded to a sharp reduction in activity by lowering staffing levels, ending a three-month sequence of job creation. A further increase in input costs was recorded in March, but the rate of inflation softened to a 45-month low. Efforts to try and attract customers led companies to lower their selling prices for the first time in three months, with the manufacturing and service sectors leading price cutting. Sentiment among companies in Northern Ireland around the 12-month outlook for business activity fell sharply. More than half of all respondents predicted a fall in output over the coming year.

The full report for NI, and a report the UK Regional comparisons, are available to download below.

Source: Richard Ramsey, Chief Economist Northern Ireland, Ulster Bank.

Downloads

Intergraf Economic News (Paper Prices) - March 2024

Intergraf Economic News (Paper Prices) - March 2024

18 March 2024

Access the latest edition of the Economic Newsletter for the European Printing Industry for data on paper consumption, and pricing data for pulp, paper and recovered paper. Data for packaging papers and board is also available with this edition.

UK to follow global expansion of inkjet printing

UK to follow global expansion of inkjet printing

21 March 2024

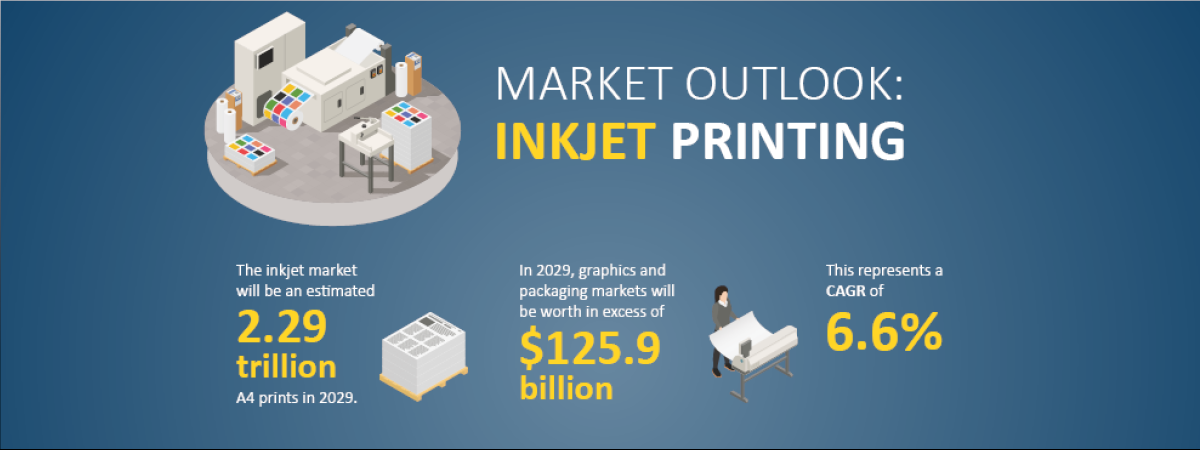

The latest expert analysis from Smithers identifies the potential of the latest generation of inkjet systems to improve profitability across the global print market. Read more about the new report The Future of Inkjet Printing to 2029.

The BPIF is the printing industries champion. By becoming a member you join a diverse and influential community. We help you solve business problems, connect you to new customers and suppliers and make your voice heard in government.

Call 01676 526030