15 April 2020

OBR - Coronavirus Scenario

The Office for Budget Responsibility (OBR) was created in 2010 to provide independent and authoritative analysis of the UK's public finances.

During this unusual period, they will therefore try to bring together the latest evidence on how developments in the economy and asset markets and the Government's policy measures will feed through to the official measures of the public finances and to prospects for fiscal sustainability more broadly.

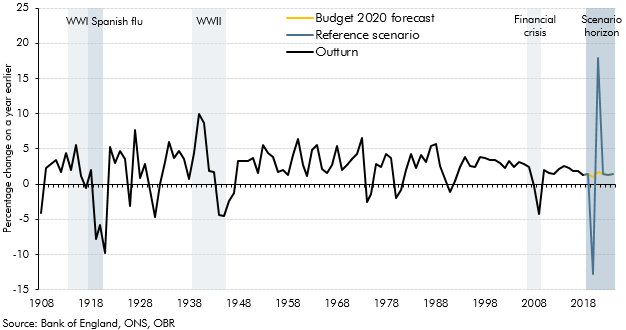

Evidence from past pandemics suggests that the economic impact of the coronavirus will arise much less from people falling ill or dying than from the public health restrictions and social distancing required to limit its spread. This will reduce demand for goods and services and the ability of businesses and public sector institutions to supply them. That means lower incomes, less spending and weaker asset prices, all of which reduce tax revenues, while job losses will raise public spending. The Government's policy response incorporates increased public spending, tax cuts and holidays, and loans and loan guarantees - most of which are designed to support household incomes and to limit business failures and layoffs. The Bank of England has taken further measures that will provide some direct support for demand in the economy, but more importantly should help households, firms and the Government finance themselves, and thereby limit the lasting damage to the economy's supply capacity.

The net effect of the coronavirus impact and the policy response is likely to be a sharp (but largely temporary) increase in government borrowing that will leave public sector net debt permanently higher as a share of GDP. However, the longer the period of economic disruption lasts, the more likely it is that the economy's future potential output will be ‘scarred' (thanks to business failures, cancelled investments and the unemployed becoming disconnected from the labour market). If that happens, the budget deficit would reverse less of its temporary rise as economic activity recovers, leaving the Government to confront a larger structural deficit and not just higher debt. Before the impact of the coronavirus became clear, the Government was content to run an ongoing deficit that would broadly stabilise the debt-to-GDP ratio over the medium term rather than reduce it - a judgement that it will no doubt re-visit in the wake of the current crisis.

The OBR produced an initial assessment of the potential impact of the coronavirus on the economy and public finances on 14 April, which is available on the link below. This was a scenario rather than a forecast, based on the illustrative assumption that people's movements (and thus economic activity) would be heavily restricted for three months and would get back to normal over the subsequent three months. The main value of the scenario is to sketch out the channels along which the economic disruption might manifest itself and what that would mean for the public finances, and to provide a reference point against which to assess new developments as they occur. It included initial broad-brush estimates of the costs of various policy interventions.

Rough judgement was that this would increase public sector borrowing this year by £218 billion relative to the OBR's March Budget forecast (to reach £273 billion or around 14 per cent of GDP). Once the crisis has passed and all the policy interventions have unwound, borrowing falls back relatively quickly to roughly the Budget forecast, but net debt would remain around £260 billion (10 per cent of GDP) higher by 2024-25. The OBR indicates how the impact might vary if the restrictions were in place for longer or shorter periods - but there are huge uncertainties both around the impact on the economy and what that would mean for the public finances.

In order to monitor the impact of economic, market and policy developments against both the Budget 2020 forecast and this coronavirus reference scenario, the OBR hope to build on their regular monthly commentary on the official public finances data to:

- Look at the evolution of relevant economic and market indicators.

- List the policy measures undertaken by the Government and explain what will determine their cost, how they will be reflected in the public finances data, and what has been assumed about them in our reference scenario.

- Monitor the evolution of the public finances and the extent to which they are likely to provide a true reflection of the underlying economic and fiscal position.

- Periodically update the reference scenario.

Follow the link below to go to the OBR website and read more about their Coronavirus reference scenario.

Source: Office for Budget Responsibility - Coronavirus reference scenario.

Downloads Pay Review Data, Wage Benchmarking and Cost of Living – MAY 2024 UPDATE

Pay Review Data, Wage Benchmarking and Cost of Living – MAY 2024 UPDATE

16 May 2024

We have collated data from multiple sources that should be useful for BPIF members that are approaching internal pay reviews, and/or are having a closer look at their pay and benefits structure. The datafile, first published in February 2023, has been updated with the latest available data - and additional content on factors exerting pressure on pay settlements in 2024.

Intergraf Economic News (Paper Prices) - April 2024

Intergraf Economic News (Paper Prices) - April 2024

19 April 2024

Access the latest edition of the Economic Newsletter for the European Printing Industry for data on paper consumption, and pricing data for pulp, paper and recovered paper.

The BPIF is the printing industries champion. By becoming a member you join a diverse and influential community. We help you solve business problems, connect you to new customers and suppliers and make your voice heard in government.

Call 01676 526030