12 December 2019

Northern Ireland PMI - sharpest fall in business activity for seven years

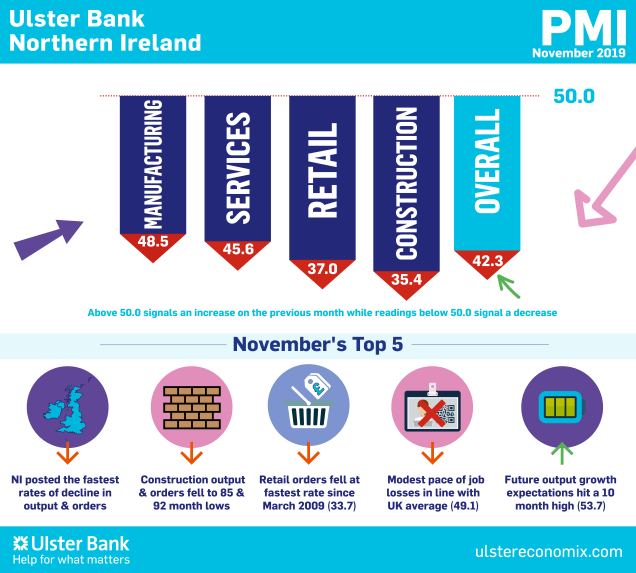

The November data from the Ulster Bank Northern Ireland PMI report - produced for Ulster Bank by IHS Markit - pointed to sharper declines in output and new orders at Northern Ireland companies, as Brexit uncertainty continued to weigh on activity. Employment also decreased, albeit at a relatively modest pace. Meanwhile, the rate of input cost inflation remained marked, but efforts to stimulate sales led companies to raise their selling prices at only a marginal pace.

Commenting on the latest survey findings, Richard Ramsey, Chief Economist Northern Ireland, Ulster Bank, said:

"One of the most striking aspects of the latest survey is the continued resilience of the labour market, with firms broadly maintaining their staffing levels despite a big fall-off in demand. Indeed, the pace of decline in business output and new orders fell to seven and seven-and-a-half-year lows respectively last month.

"All four sectors have posted falling output in six of the last seven months; however, the performance of retail and construction are of particular concern. Construction order books continued to shrink for the 15th month in a row and November marked the sharpest rate of decline in 92 months. It is a similar story for retailers with orders falling at their fastest pace since March 2009.

"In this environment, firms' desire to maintain staffing levels comes at a cost to profit levels. The latest survey shows that input price inflation continued to rise in November, but firms are not able to pass these increased costs onto their customers and indeed discounting is widespread in an attempt to generate new business.

"Firms therefore seem willing to take a hit to their profits in the short-term in the hope that conditions will improve once there is greater certainty around the situation with Brexit. Indeed, their expectations for the year ahead are relatively upbeat overall with an expectation that business conditions will have improved marginally in 12-months' time; albeit that this is largely confined to manufacturing and services.

"This may well prove to be overly optimistic however as even if a Brexit deal is passed there is still much to be decided around the new relationship with the EU and how any new arrangements would work. Uncertainty will therefore continue to be very much present in 2020."

The main findings of the November survey were as follows:

The headline seasonally adjusted Business Activity Index dropped to 42.3 in November from 44.9 in October. Output has now fallen in each of the past nine months, with the rate of contraction accelerating to the fastest for seven years. Brexit uncertainty was the main factor leading activity to decline, according to respondents. Brexit uncertainty was also to the fore with regards to the latest reduction in new orders. Respondents indicated a wariness among customers to commit to new projects. In line with the picture for business activity, the rate of decline in new orders accelerated and was the sharpest since May 2012.

Falling new orders fed through to another reduction in backlogs of work in November. Employment also decreased, but the rate of job cuts was only marginal and the slowest since February.

Companies in Northern Ireland recorded another marked monthly increase in input prices, albeit one that was the softest in six months. Wage rises and currency weakness were mentioned as factors leading input costs to increase. Despite input costs rising markedly, the rate of output price inflation was only marginal and slowed to a 44-month low. A number of firms offered discounts as part of efforts to boost sales. Businesses were confident regarding the 12-month outlook for output for the first time in four months during November. While Brexit continued to weigh on sentiment, some firms predicted greater certainty next year and a return to new order growth.

Source: Richard Ramsey, Chief Economist Northern Ireland, Ulster Bank.

Downloads Intergraf Economic News (Paper Prices) - March 2024

Intergraf Economic News (Paper Prices) - March 2024

18 March 2024

Access the latest edition of the Economic Newsletter for the European Printing Industry for data on paper consumption, and pricing data for pulp, paper and recovered paper. Data for packaging papers and board is also available with this edition.

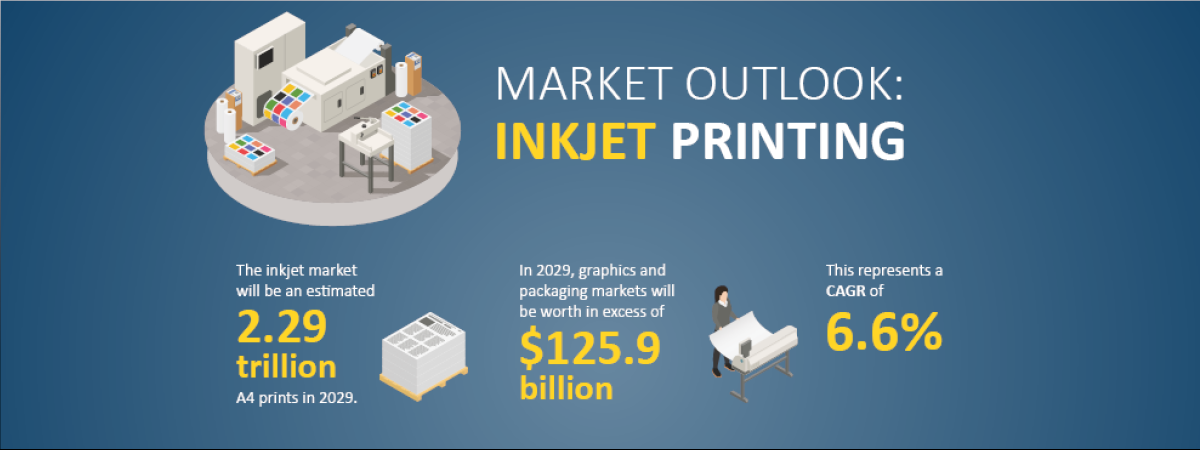

UK to follow global expansion of inkjet printing

UK to follow global expansion of inkjet printing

21 March 2024

The latest expert analysis from Smithers identifies the potential of the latest generation of inkjet systems to improve profitability across the global print market. Read more about the new report The Future of Inkjet Printing to 2029.

The BPIF is the printing industries champion. By becoming a member you join a diverse and influential community. We help you solve business problems, connect you to new customers and suppliers and make your voice heard in government.

Call 01676 526030