3 August 2016

Economic Update

The ITS showed that the manufacturing sector continued to recover in the quarter to July, but output growth is expected to slow sharply in the quarter ahead. Meanwhile, optimism among the UK's manufacturers fell at its fastest pace since the financial crisis. However there was a boost to export competiveness from weaker sterling with exports orders expected to rise at an above average pace over the next quarter and competitiveness in the UK and non EU markets judged to have risen at its fastest pace since 2010.

Retailers reported that sales fell in the year to June while expectations for the year to August were at their weakest since January 2012. Labour market statistics revealed that the number of people in employment increased by 176,000 in the three months to May. This caused the unemployment rate to edge lower at 4.9%, the lowest since September 2005. Pay remained subdued despite the introduction of the National Living Wage in April. Annual growth in regular pay grew 2.4% in the private sector.

GFK released the Consumer Confidence Barometer in July. It shows the largest decline in consumer confidence since 1994. 60% of respondents expect the general economic situation to worsen over the next twelve months.

A recent Deloitte survey shows that sentiment among CFO's fell at the fastest pace since the survey started in 2007. 58% expected their capital spending to be lower and 66% expected hiring to be lower over the next three years.

However, the CBI LONDON analysis shows resilient in initial Brexit reaction. In a mixed picture, investment and hiring intentions remain relatively robust among many of the capitals firms. 41% of the 186 London firms surveyed after the referendum said they had planned to maintain their investment plans, with one in ten planning on actually increasing their plans. 16% reported that they are freezing the investment plans and 21% reducing them. 50% plan to continue to hire, 29% not planning and 12% reducing staff numbers.

Intergraf Economic News (Paper Prices) - March 2024

Intergraf Economic News (Paper Prices) - March 2024

18 March 2024

Access the latest edition of the Economic Newsletter for the European Printing Industry for data on paper consumption, and pricing data for pulp, paper and recovered paper. Data for packaging papers and board is also available with this edition.

UK to follow global expansion of inkjet printing

UK to follow global expansion of inkjet printing

21 March 2024

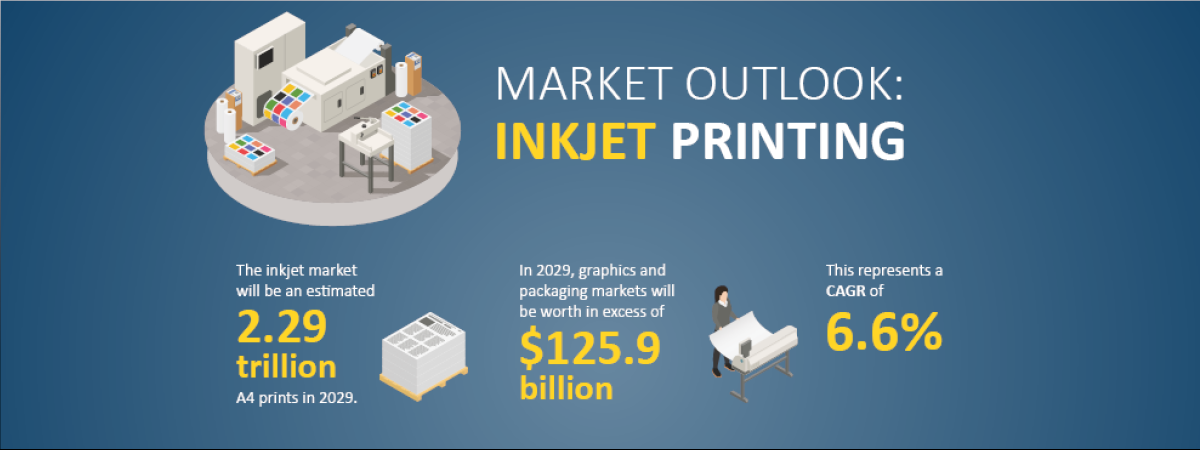

The latest expert analysis from Smithers identifies the potential of the latest generation of inkjet systems to improve profitability across the global print market. Read more about the new report The Future of Inkjet Printing to 2029.

The BPIF is the printing industries champion. By becoming a member you join a diverse and influential community. We help you solve business problems, connect you to new customers and suppliers and make your voice heard in government.

Call 01676 526030