17 March 2005

Industry economist David Ross gives his views on this week’s budget

This was a pre-election Budget with a difference, as prudence rather than profligacy ruled the day. Despite first impressions, the Chancellor will raise more money than he will spend next year (£265m). He trumpeted loudly the help he would give home buyers, pensioners, working families and savers – the election sweeteners – but said sotto voce that he would raise taxes from companies operating in the North Sea and from anti-avoidance measures. To give away what he is promising, the Chancellor needs to raise revenue. Businesses will face a £2bn increase in their tax bill next year. Some £1.1bn of this will result from a one-off change of timing of corporation tax payments for oil companies operating in the North Sea. The balance is expected to come from moves to tackle tax avoidance and an end to stamp duty relief for commercial properties in disadvantaged areas. As compensation to business, Mr Brown has offered a cut in red tape – 1m fewer inspections and 650,000 fewer forms a year – and a reduction in the number of government regulatory agencies from 35 to 9. The headline-grabbing election sweeteners – a one-off £200 payment to pensioner households to offset council tax bills, a doubling of the stamp duty threshold on property from £60,000 to £120,000, child tax credit and pension credit to rise in line with earnings rather than inflation over the next three years – are laudable, but will have little or no effect on the printing industry. What it is looking for is less business regulation and a stable economic environment. Perhaps, by resisting the temptation to spend money he does not have, Mr Brown will come up trumps again. Looking at the economy, Mr Brown emphasised the stability that had been achieved in recent years. He noted that the economy had seen 50 consecutive quarters of growth and that inflation and interest rates in the years 1997-2004 were less than half what they had been in the 1979-1997 period. He mocked those who questioned his forecasts for growth last year; GDP growth of 3.1% was as the Chancellor had forecast. As to the future, Mr Brown left his growth forecasts unchanged from the pre-Budget report. In 2005, he expects GDP growth of 3-3.5%, well ahead of most independent forecasters, and growth of 2.5-3% in 2006. Inflation is forecast to be 1.75% this year rising to 2% in 2006 thus continuing to meet the government’s inflation target. The Chancellor forecasts borrowing in 2004/05 of £34bn, equivalent to 2.6% of GDP, falling to £32bn and £29bn in 2005/06 and 2006/07 respectively. He predicts that he will meet his fiscal ‘golden rule’ this cycle with a surplus of £6bn, down from £8bn previously forecast. However, it is the borrowing figures and the assumption that tax revenues will outstrip growth in the economy over the coming few years that opposition MPs and independent analysts find the most questionable aspects of the Budget. They continue to believe that tax increases, or spending cuts, are on the agenda for Budget 2006. Prepared for the BPIF by David Ross, Ross Economics and Editorial Services Ltd. Intergraf Economic News (Paper Prices) - March 2024

Intergraf Economic News (Paper Prices) - March 2024

18 March 2024

Access the latest edition of the Economic Newsletter for the European Printing Industry for data on paper consumption, and pricing data for pulp, paper and recovered paper. Data for packaging papers and board is also available with this edition.

UK to follow global expansion of inkjet printing

UK to follow global expansion of inkjet printing

21 March 2024

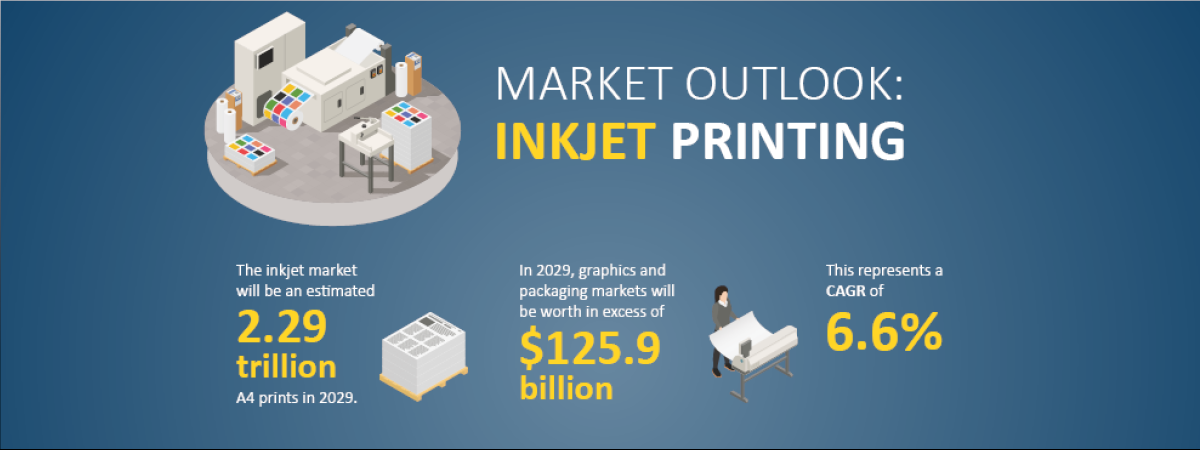

The latest expert analysis from Smithers identifies the potential of the latest generation of inkjet systems to improve profitability across the global print market. Read more about the new report The Future of Inkjet Printing to 2029.

The BPIF is the printing industries champion. By becoming a member you join a diverse and influential community. We help you solve business problems, connect you to new customers and suppliers and make your voice heard in government.

Call 01676 526030