2 March 2021

Sending the ‘New Normal’ Packing – Graeme Lipman, Finance specialist & Director, BTG Advisory

In order to ensure things can get back to some level of normality on an economic level, we all need to acclimatise in the short term. That doesn’t mean accepting ‘the new normal’; it means riding out the storm in the hope that your business is fighting fit throughout 2021 and beyond.

The challenges facing businesses across the print and packaging sector are - to coin another now wearisome phrase - unprecedented. But there's no time to feel despondent. Nobody had foresight of this pandemic arriving on our shores but we all have hindsight of the months that have passed, and the businesses that can display agility and decisiveness will stand a better chance of surviving this bolt from the blue.

If we engross ourselves in the news, it can be difficult to find anything uplifting but what we're seeing at Begbies Traynor Group is that for every negative business outcome at the moment, there are positive narratives too.

The good, the bad, and the unknown

The good news is that by taking early advice, businesses can often get breathing space from operational difficulties. For those businesses that were profitable pre-Covid but now need help to ensure viability going forward, a fast-track Company Voluntary Arrangement is a shining example of a rescue solution suited to small and medium-sized businesses.

If your business is struggling under the weight of mounting liabilities caused by trading restrictions in the last six months, the fast-track CVA offers a real opportunity for viable businesses to release creditor pressure and safeguard the business itself. Eligible businesses can take quick action to prevent further financial decline, without detriment to creditors who typically receive greater returns under a CVA than if the company had to liquidate.

The CVA is conducted by a licensed insolvency practitioner and can only be initiated if the insolvency practitioner is confident that your business will be able to maintain payments consistently, as by failing to do so could lead to permanent closure.

There are other rescue and recovery measures that you may wish to seek advice on, depending on the individual circumstances your business is facing. This may involve negotiating with creditors to reduce your monthly overheads and ease immediate pressure, accessing emergency funding to boost cash flow, or placing your company into a formal insolvency process such as administration while a route forward is planned.

If the business is operationally sound - and you simply need a capital injection to plug a financial gap caused by lockdown restrictions - sourcing Cap-ex funding could be a solution. Our expert commercial finance team are able to source the right kind of finance through a number of competitive and trusted providers and we will scour the market to ensure you can access the most appropriate form of funding at the best possible rates.

Recently we managed to match a director with a private equity investor simply because that director rang for free advice. He was unsure whether his business should close, could be rescued, or even selling the company was an option. The business was highly profitable pre-Covid but had seen an 80% drop in revenue as the business relied on events taking place with capacity crowds. Concerned about his staff, his personal guarantees, and the business liabilities mounting, we were able to assess all possible options; one of these being a huge cash injection through private equity that will secure the future of the business in the medium term until - hopefully - events can get going once again. This business rescue started with a simple phone call and wasn't something that could have been answered and serviced through a Google enquiry - sometimes it's just good to talk.

The bad news in recent times is unescapable and some sectors have been hit harder than others. Business closures are inevitable and directors must seek early advice if they acknowledge that their company has become insolvent and they have a fiduciary duty to creditors in doing so. Our director and shareholder consultations are always free of charge and in the strictest confidence.

At the moment we're seeing incredible pressure not only in the print sector but on numerous other industries too. To avoid business closure through liquidation, we cannot emphasise enough the need for early advice. When liabilities are escalating and cash flow is dwindling, the options on the table begin to dwindle too.

And so, to the unknown - until the vaccination programme has worked its way through the age groups, businesses will continue to live through restrictions but that doesn't have to mean limitations. There is still support available in the form of government loans and potentially grants too - but this support is beginning to taper off so time is of the essence. Our Advisory team at Begbies Traynor Group can assist with your finance and funding queries along with other specialist services through our Corporate Finance division for mergers and acquisitions, our Eddisons division for property and asset valuations, and our recoveries team who help businesses struggling to get paid.

Regardless of the operational difficulties you might be facing at present, our expertise is just a phone call away and our suite of services means we can usually find the most efficient solution. Hopefully, by taking early advice, we can help steer your business towards new possibilities rather than simply accepting the 'new normal'.

Graeme Lipman is a Finance Specialist and Director at BTG Advisory, with a wealth of experience working with a variety of printing and packaging firms, from independent high-street operations to major multinational printworks.

Intergraf Economic News (Paper Prices) - March 2024

Intergraf Economic News (Paper Prices) - March 2024

18 March 2024

Access the latest edition of the Economic Newsletter for the European Printing Industry for data on paper consumption, and pricing data for pulp, paper and recovered paper. Data for packaging papers and board is also available with this edition.

UK to follow global expansion of inkjet printing

UK to follow global expansion of inkjet printing

21 March 2024

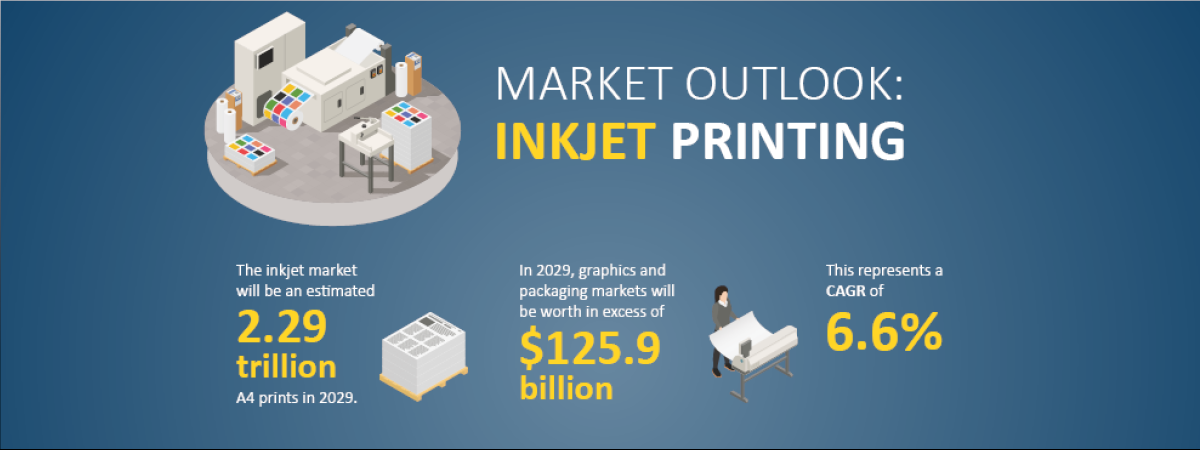

The latest expert analysis from Smithers identifies the potential of the latest generation of inkjet systems to improve profitability across the global print market. Read more about the new report The Future of Inkjet Printing to 2029.

The BPIF is the printing industries champion. By becoming a member you join a diverse and influential community. We help you solve business problems, connect you to new customers and suppliers and make your voice heard in government.

Call 01676 526030