23 April 2019

DfE NI monthly economic update - April 2019

In its latest Word Economic Outlook, the International Monetary Fund projects global growth at 3.3% in 2019, which is 0.2pps below its January 2019 projection, while the 2020 forecast remained unchanged at 3.6%. Economic activity in the Euro Area is anticipated to moderate from 1.8% in 2018 to 1.3% in 2019 and 1.5% in 2020.

UK projections have similarly been downgraded relative to January 2019 estimates, now forecast at 1.2% in 2019 and 1.4% in 2020. These projections assume an EU Exit deal is reached in 2019 and that the UK transitions gradually to the new regime.

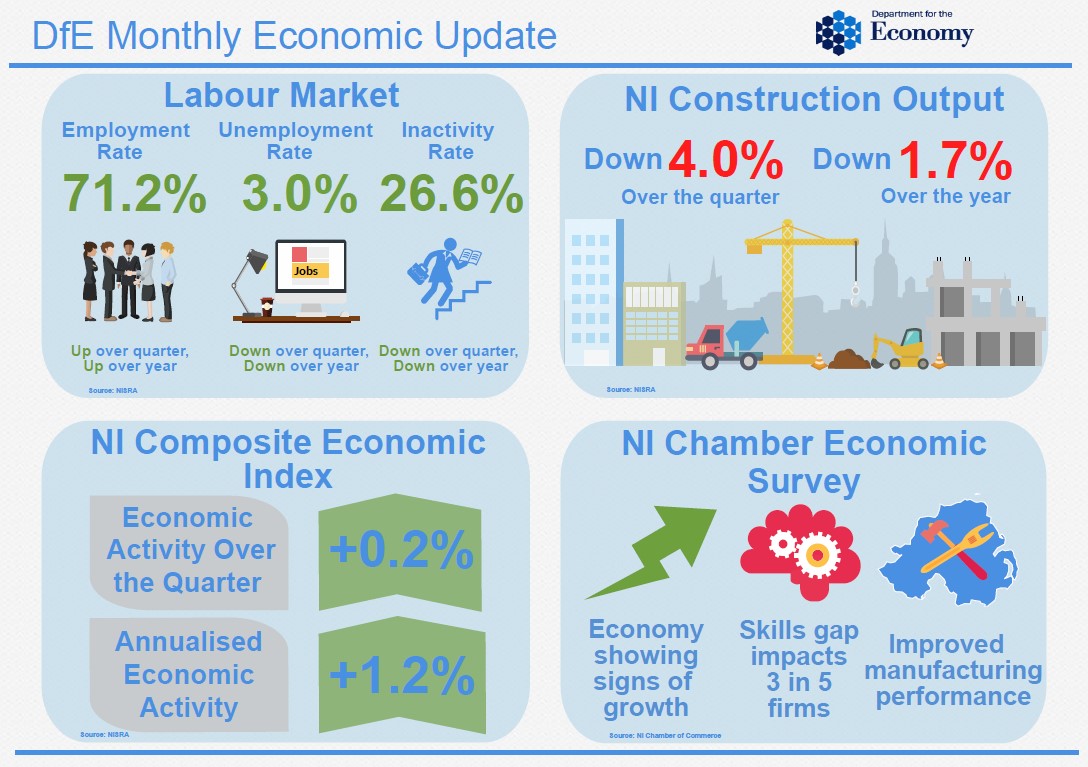

In Northern Ireland, the latest labour market statistics show that the unemployment rate has decreased over both the quarter (-0.5pps) and the year (-0.4pps) to 3.0%, the joint lowest on record and lower than the UK (3.9%), EU (6.5%) and ROI (5.3%) rates. The economic inactivity rate decreased over the quarter (1.0pps) and year (1.5pps) to 26.6% but remains the highest of the UK regions. At the same time the employment rate increased over the quarter and the year to 71.2%, but remains around 5 percentage points below the UK as a whole.

The latest results from the Ulster Bank PMI indicated a further deterioration in business conditions in March 2019. Business Activity fell for the first time since July 2016, bringing to an end a 29-month sequence of expansion, while employment levels have decreased to their greatest extent in almost six years. Volumes of new business continued to decline for the second month running, there was another monthly reduction in backlogs of work and new export orders fell sharply. Local businesses confidence sank further in March with the 12-month outlook pessimistic for the second successive month.

NISRA'S latest Quarterly Construction Bulletin showed that construction output in NI has fallen by 4.0% over the quarter and by 1.7% when compared to the same quarter in 2017. The decrease in overall output over the quarter was accounted for by a fall in both New Work (-0.4%) and Repair and Maintenance (-6.8%). Further decreases were registered in the sub-sectors of Housing and Other Work (-12.0% and -7.5%). The only area of growth was infrastructure which rose by 13.3% in Q4 2018.

The Latest NI Composite Economic Index shows output in NI increased by 0.2% over the quarter and 1.9% over the year. The annualised rate of growth increased by 1.2% to Q4 2018 compared to 1.4% estimated for the UK over the same period. Public and private sector growth increased over the quarter (0.2% and 0.1% respectively) and the year (2.2% and 0.6% respectively).

The latest NI Chamber of Commerce Quarterly Economic Survey noted the Northern Ireland economy still appears to be growing. The majority of key balances are positive with more businesses in manufacturing and services reporting increases in indicators such as sales and jobs than those reporting a fall. Businesses are still recruiting with 63% of manufacturers and 53% of services firms trying to recruit over the quarter. However, issues of uncertainty continue to rise with a reduction in business confidence and investment intentions.

The AIB Brexit Sentiment Index indicates that businesses continue to be concerned about the potential wider economic impacts of EU Exit. Reduced investment also continues to be prevalent with around two thirds of businesses postponing, cancelling or reviewing expansion plans.

Source: DfE Analytical Services Division April 2019

Downloads Intergraf Economic News (Paper Prices) - March 2024

Intergraf Economic News (Paper Prices) - March 2024

18 March 2024

Access the latest edition of the Economic Newsletter for the European Printing Industry for data on paper consumption, and pricing data for pulp, paper and recovered paper. Data for packaging papers and board is also available with this edition.

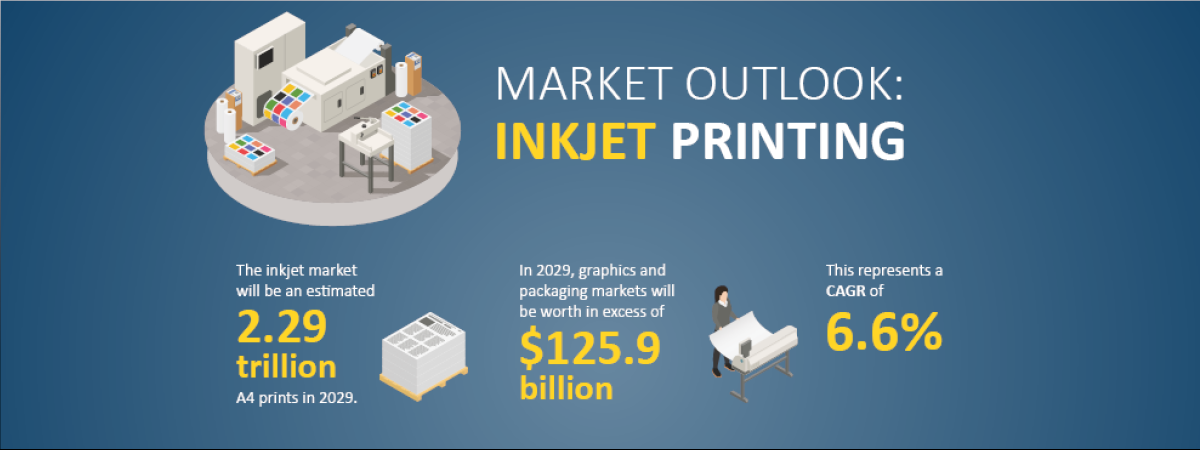

UK to follow global expansion of inkjet printing

UK to follow global expansion of inkjet printing

21 March 2024

The latest expert analysis from Smithers identifies the potential of the latest generation of inkjet systems to improve profitability across the global print market. Read more about the new report The Future of Inkjet Printing to 2029.

The BPIF is the printing industries champion. By becoming a member you join a diverse and influential community. We help you solve business problems, connect you to new customers and suppliers and make your voice heard in government.

Call 01676 526030