21 January 2019

Latest Northern Ireland PMI - new orders stagnate in December

The latest Ulster Bank Northern Ireland PMI® report - produced for Ulster Bank by IHS Markit - pointed to no change in new orders at the end of 2018. Meanwhile, business activity and employment continued to rise solidly, albeit at weaker rates than in November. Both input costs and output prices increased at marked rates again, but inflationary pressures showed some signs of easing at the end of the year.

Commenting on the latest survey findings, Richard Ramsey, Chief Economist Northern Ireland, Ulster Bank, said:

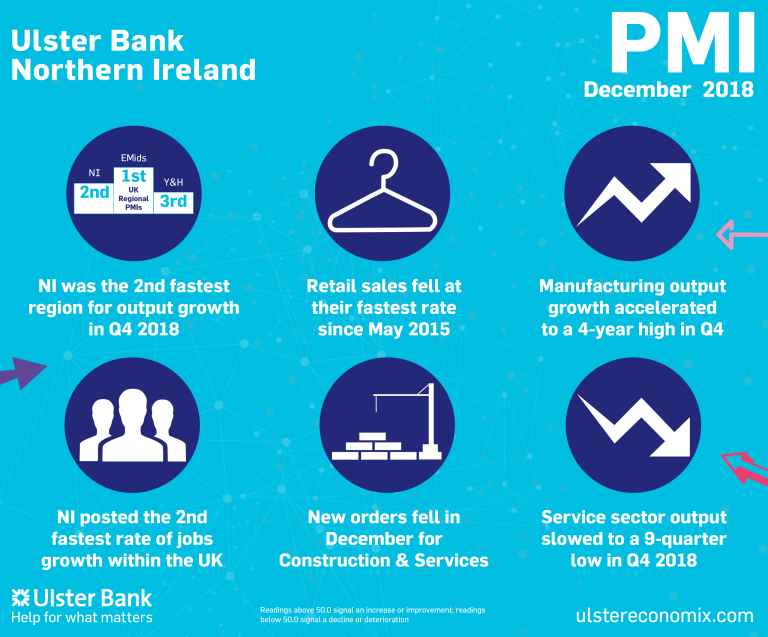

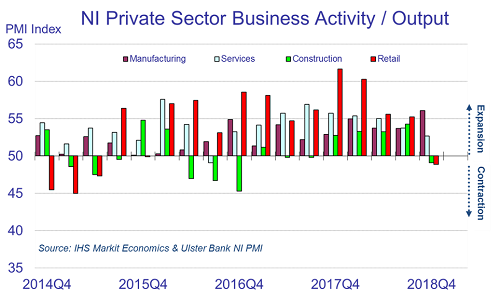

"According to the PMI surveys, Northern Ireland was the second fastest growing region in the UK in Q4 2018; although it should be noted that Q4 was Northern Ireland's weakest quarter for growth in output and new orders in nine quarters. Manufacturing remains the star performer with output and employment growth accelerating in Q4. Indeed, December saw manufacturing firms grow their staffing levels at the fastest rate in over three-and-a-half years, and the last quarter marked the fastest rate of manufacturing output growth in over four years. Elsewhere the theme is one of slower or subdued growth and decline. Service sector output decelerated in each of the last five quarters with the latest period the slowest rate of growth in nine quarters.

"Meanwhile construction and retail posted outright declines in activity/sales in Q4. Construction orders continue to fall and not surprisingly, given the logjam of public sector projects, construction firms expect activity to be even lower in 12-months' time. Northern Ireland may have climbed the regional rankings for output growth but remains rooted to bottom spot for future output, in 12- months' time. While construction firms are the most pessimistic, retailers' confidence for the year ahead has also fallen to new lows. Indeed, the fact that new orders stagnated in Northern Ireland's private sector in December doesn't bode particularly well for the start of 2019. Services firms saw orders fall for the first time in 26 months and construction orders fell for the fourth month running. On a slightly more positive note, export orders picked up marginally in December, albeit that growth remained modest. Perhaps more significantly, inflationary pressures eased in December with input costs rising at their weakest pace since August 2017. Indeed, retailers and manufacturing firms are seeing their costs rise at the slowest pace in more than two-and-a-half years. That said, Northern Ireland continues to have the highest rate of input cost inflation in the UK."

The main findings of the December survey were as follows:

The headline seasonally adjusted Business Activity Index posted 52.7 in December, signalling a further solid monthly rise in activity in the Northern Ireland private sector. That said, down from 53.7 in November, the reading pointed to a softer expansion. While some companies reported having seen new orders rise and increased their output accordingly, others signalled subdued market conditions. New orders were unchanged in December, thereby ending a 25-month sequence of expansion. Concerns around Brexit were reported, as well as a lack of confidence in the market.

With new order volumes unchanged, companies transferred spare resources to work on outstanding business. As a result, backlogs of work decreased for the fifth successive month, albeit marginally. Despite signs of softening workloads, companies in Northern Ireland continued to increase their staffing levels at the end of 2018. The rate of job creation was solid, slowing only slightly from the six-month high registered in November.

Input costs continued to increase at a sharp pace in December, albeit one that eased fractionally to a 16-month low. Higher staff costs and sterling weakness were reportedly the main factors leading input prices to rise. Output prices also rose again as companies passed on higher input costs to their customers. Business sentiment was among the lowest since the series began in March 2017. Brexit was the key reason for reduced sentiment among local firms, with concerns about the prospect of a no-deal scenario and uncertainty about the future arrangements with the EU adding to worries about Brexit itself.

Source: Richard Ramsey, Chief Economist Northern Ireland, Ulster Bank.

Downloads Intergraf Economic News (Paper Prices) - March 2024

Intergraf Economic News (Paper Prices) - March 2024

18 March 2024

Access the latest edition of the Economic Newsletter for the European Printing Industry for data on paper consumption, and pricing data for pulp, paper and recovered paper. Data for packaging papers and board is also available with this edition.

UK to follow global expansion of inkjet printing

UK to follow global expansion of inkjet printing

21 March 2024

The latest expert analysis from Smithers identifies the potential of the latest generation of inkjet systems to improve profitability across the global print market. Read more about the new report The Future of Inkjet Printing to 2029.

The BPIF is the printing industries champion. By becoming a member you join a diverse and influential community. We help you solve business problems, connect you to new customers and suppliers and make your voice heard in government.

Call 01676 526030