30 August 2018

Northern Ireland experiences fastest rise in output since January

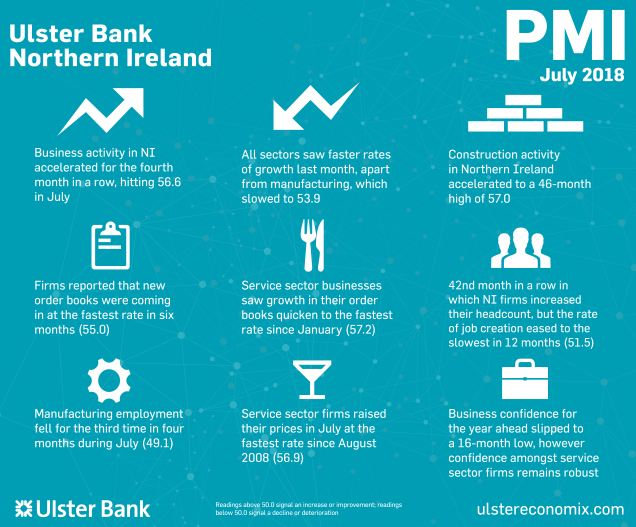

The July data from the Ulster Bank Northern Ireland PMI® report - produced for Ulster Bank by IHS Markit - pointed to marked increases in both output and new orders amid an unusually long spell of warm weather. That said, employment increased only slightly and business confidence eased. The rate of input cost inflation remained sharp, leading output prices to rise at a pace only slightly weaker than June's ten-year high.

Commenting on the latest survey findings, Richard Ramsey, Chief Economist Northern Ireland, Ulster Bank, said:

"Northern Ireland's private sector started the third quarter where it left off in June with output and new orders growth accelerating in July. This was the fourth month in a row that the pace of activity picked-up, with both these indicators hitting six-month highs. Northern Ireland's marked improvement last month contrasted with a notable slowdown in a number of English regions, which dragged the overall UK growth rate lower. Indeed, Northern Ireland's private sector recorded the fastest rate of growth of all the UK regions for both output and new orders.

"The pick-up in business activity in July was broad-based with all sectors bar manufacturing reporting faster rates of output growth. Construction activity accelerated to a 46-month high with the upswing mirroring a marked improvement within the UK's construction industry. Once again, the good weather was cited as a factor supporting demand across a range of sectors. Manufacturing activity moderated from its recent highs with new orders slowing to a 21-month low.

"Local firms have been increasing their headcount for the last three-and-a-half years. However, the pace of job creation eased to a twelve-month low in July due to reduced hiring within manufacturing and services. A number of firms report ongoing difficulties in recruiting suitable staff.

"Inflationary pressures also remain a key cause of concern amongst businesses. The North East knocked Northern Ireland off the UK top spot for input cost inflation in July. Northern Ireland firms though raised their prices at the fastest rate of all the UK regions and at their sharpest rate in a decade. With sterling depreciating further since the survey was conducted, we can expect inflationary pressures to continue to feature prominently as an issue in the coming months.

"Overall, current business conditions are very encouraging. The key question, however, is will it last? Significantly, Northern Ireland firms are the least optimistic about business activity for the year ahead of all the UK regions. The slide in local business confidence conceals contrasting performance within sectors. Services firms remain the most upbeat and resilient. But confidence within construction, retail and manufacturing firms hasn't been lower in the last 17 months. The local construction industry remains the least optimistic by quite some margin. Given the absence of decision-making around publicly-funded capital investment, coupled with recent legal challenges to procurement processes, the pessimism cited by local construction firms may be well placed."

The main findings of the July survey were as follows:

The headline seasonally adjusted Business Activity Index rose for the fourth month running to 56.6 in July, from 56.0 in June. The reading signalled the fastest rise in output in Northern Ireland since January, with the expansion much stronger than the UK average. A number of respondents mentioned that the unusually long period of good weather supported output growth. New orders also increased at a sharp and accelerated pace during July.

Backlogs of work increased for a thirteenth successive month in July amid rising new business. That said, the rate of accumulation was only slight, and the weakest since July 2017. The rate of job creation also eased and was the slowest for a year. Although the rate of input cost inflation eased in July, it remained substantial and much faster than the UK average. Sterling weakness was again a factor leading input prices to rise, according to respondents, while higher costs for fuel and staff were also mentioned. Companies responded to higher input costs by raising their selling prices. The rate of inflation in Northern Ireland was again the sharpest of all 12 UK regions, with charges increasing at a pace only slightly weaker than June's ten-year high. Business confidence dipped for the third month running in July, with optimism the second-lowest since the series began in March 2017.

Source: Richard Ramsey, Chief Economist Northern Ireland, Ulster Bank.

Downloads Pay Review Data, Wage Benchmarking and Cost of Living – MAY 2024 UPDATE

Pay Review Data, Wage Benchmarking and Cost of Living – MAY 2024 UPDATE

16 May 2024

We have collated data from multiple sources that should be useful for BPIF members that are approaching internal pay reviews, and/or are having a closer look at their pay and benefits structure. The datafile, first published in February 2023, has been updated with the latest available data - and additional content on factors exerting pressure on pay settlements in 2024.

Intergraf Economic News (Paper Prices) - April 2024

Intergraf Economic News (Paper Prices) - April 2024

19 April 2024

Access the latest edition of the Economic Newsletter for the European Printing Industry for data on paper consumption, and pricing data for pulp, paper and recovered paper.

The BPIF is the printing industries champion. By becoming a member you join a diverse and influential community. We help you solve business problems, connect you to new customers and suppliers and make your voice heard in government.

Call 01676 526030