14 May 2018

Northern Ireland PMI – modest growth in business activity

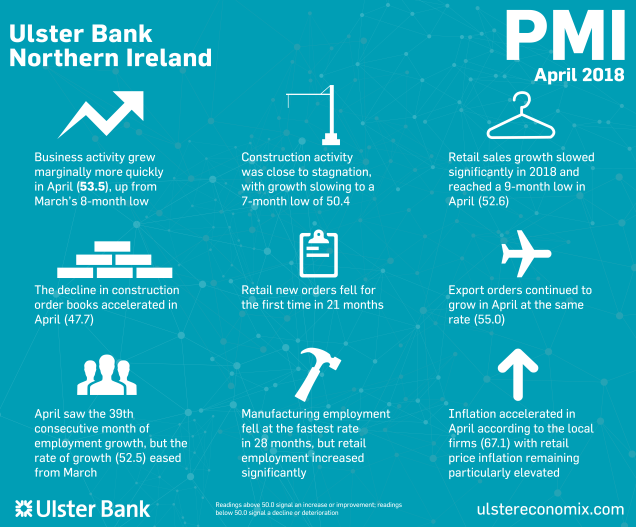

The release of April data from the Ulster Bank Northern Ireland PMI® report – produced for Ulster Bank by IHS Markit – signalled a mild acceleration in private sector business activity growth, while new orders continued to increase, albeit only marginally quicker than March's 17-month low. Nonetheless, despite subdued demand pressures, backlogs of work increased further, prompting firms to hire additional staff. In line with a strong and accelerated rate of input cost inflation, businesses reported a further marked increase selling charges.

Commenting on the latest survey findings, Richard Ramsey, Chief Economist Northern Ireland, Ulster Bank, said:

"The March PMI saw a slowdown in growth resulting from factors including the Beast from East weather episode and it was anticipated that there would be a rebound in April. The latest report shows that this has indeed come to pass. However it has been a more muted one than expected in Northern Ireland and the UK as a whole, unlike the Republic of Ireland which has rebounded with vigour. This suggests that the slowdown in Northern Ireland is related to underlying issues, rather than just a weather-related blip.

"In terms of the sub-sectors, services was the fastest growing in April, but it is still growing at well-below its pre-downturn, long-term average. Manufacturing, on the other hand, is holding up well relative to its long-term average, despite slowing last month. Construction saw business activity close to stagnation and order books falling for the second month in a row. Meanwhile retail has seen a significant slowdown in activity and new orders since the turn of the year, whilst inflationary pressures have been soaring.

"Despite lower than expected business activity growth, there has actually been a surge in business optimism for the year ahead, driven by rising confidence within manufacturing and services. Indeed, retail was the only sector to report a slide in business confidence for the year ahead. Linked to this is the strong export performance highlighted in the latest report, with export markets continuing to be the main source of growth, and export orders growing significantly faster than domestic orders. With manufacturers more exposed to international markets and retailers, as well as construction firms, much more reliant on the domestic market, this helps explain the differential in confidence within the sectors."

The main findings of the April survey were as follows:

The headline seasonally adjusted Business Activity Index increased to 53.5 in April, up from 53.2 in March, to signal a solid and faster pace of expansion in the Northern Ireland private sector. Furthermore, all four sectors covered by the survey recorded expansions in activity, and the rate of growth was above the UK average. Output growth was partly attributed to successful tendering for contracts. Underpinning the latest rise in acitivty was sustained growth of new orders. According to anecdotal evidence, new client acquisitions and advertising campaigns supported the rise in new sales. That said, the pace of expansion was only marginally quicker than March's 17-month low.

As has been the case in every month since February 2015, employment was raised by Northern Ireland businesses. Panellists noted that increased workloads had prompted them to recruit new staff. Nonetheless, capacity pressures persisted, with backlogs of work rising for a tenth straight month in April. Northern Ireland firms faced further cost rises during April. The rate of input price inflation was steep overall and accelerated on that seen in March. Panellists reported unfavourable exchange rate movements, higher energy prices and wage increases as factors driving up operating expenses. In response, selling charges were raised to partly offset higher cost burdens, continuing a run of inflation that began in November 2015.

Source: Richard Ramsey, Chief Economist Northern Ireland, Ulster Bank.

Downloads Intergraf Economic News (Paper Prices) - March 2024

Intergraf Economic News (Paper Prices) - March 2024

18 March 2024

Access the latest edition of the Economic Newsletter for the European Printing Industry for data on paper consumption, and pricing data for pulp, paper and recovered paper. Data for packaging papers and board is also available with this edition.

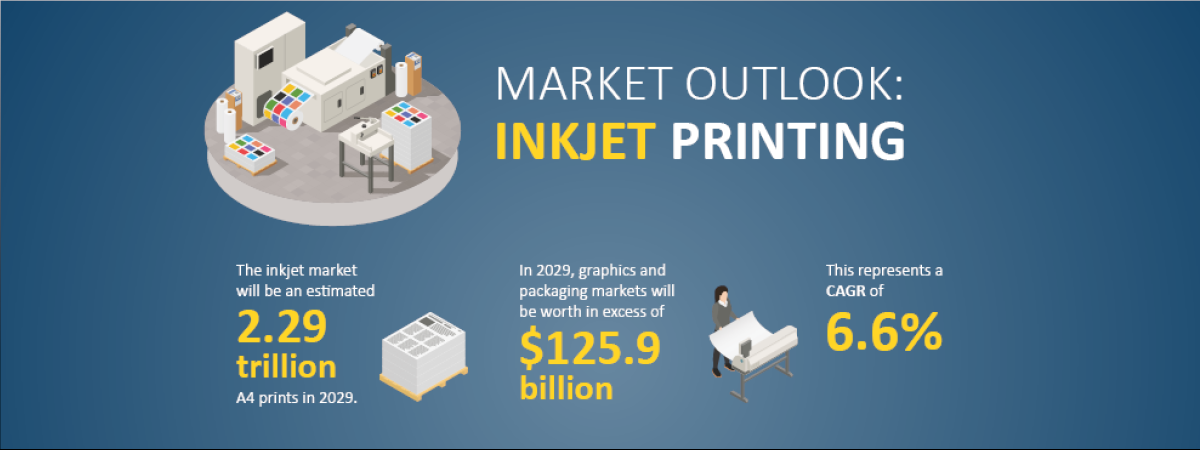

UK to follow global expansion of inkjet printing

UK to follow global expansion of inkjet printing

21 March 2024

The latest expert analysis from Smithers identifies the potential of the latest generation of inkjet systems to improve profitability across the global print market. Read more about the new report The Future of Inkjet Printing to 2029.

The BPIF is the printing industries champion. By becoming a member you join a diverse and influential community. We help you solve business problems, connect you to new customers and suppliers and make your voice heard in government.

Call 01676 526030