13 March 2018

Northern Ireland PMI - activity rises but orders and jobs slip

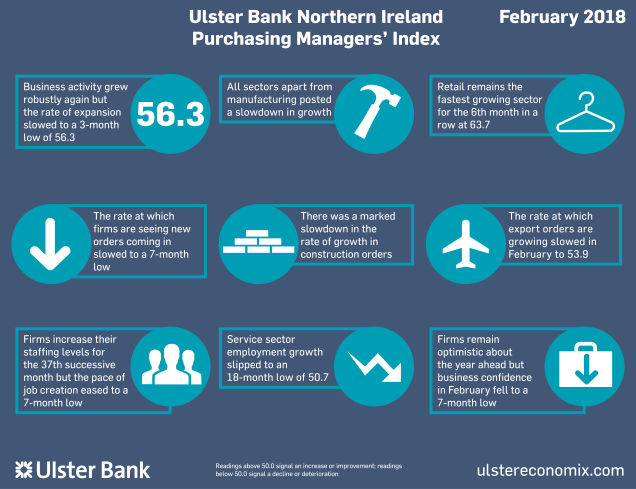

The February data from the Ulster Bank Northern Ireland PMI® report – produced for Ulster Bank by IHS Markit – signalled that the Northern Ireland private sector remained comfortably inside growth territory. That said, rates of expansion in output, new orders and employment all eased over the month. On the other hand, inflationary pressures intensified, with sharper rises in both input costs and prices charged.

Commenting on the latest survey findings, Richard Ramsey, Chief Economist Northern Ireland, Ulster Bank, said:

"Northern Ireland's private sector continued to report broadly favourable business conditions in February. However, there was a moderation in the rates of growth in a number of key indicators. Local firms reported an easing in output growth but the rate of expansion remained robust and above the pre-recession historical average. Confidence about the year ahead, new orders and employment all fell to seven-month lows in February. Meanwhile inflationary pressures intensified again with input costs rising at their fastest rate in nine months. Retailers continue to bear the brunt of these cost and price increases.

"All sectors saw an easing in the rates of expansion in orders with the slowdown most marked amongst services and construction firms, though this follows multi-year highs. Meanwhile manufacturing was the only sector to report faster rates of output growth last month with activity growing at its fastest rate in almost three-and-a-half years.

"In terms of employment, although it was the 37th successive month that firms increased their workforce numbers, the pace of job creation eased in February, with manufacturing and services firms seeing the biggest slowdown in their rates of hiring. Indeed the rate at which service sector businesses are increasing their headcount slowed to an 18-month low.

"Overall, whilst the numbers suggest that the local private sector continued to grow in February, there were clear indications of a slowdown, with a dip in optimism about the year-ahead also evident. With the prospect of trade wars between Europe and the US, alongside the uncertainty about a range of political issues, this is perhaps to be expected. Indeed it would be unsurprising if this trend of easing back further from the multi-year highs at the start of the year continued in the months ahead."

The main findings of the February survey were as follows:

- Business activity grew robustly again but the rate of expansion slowed to a 3-month low of 56.3

- All sectors apart from manufacturing posted a slowdown in growth

- Retail remains the fastest growing sector for the 6th month in a row at 63.7

- The rate at which firms are seeing new orders coming in slowed to a 7-month low

- There was a marked slowdown in the rate of growth in construction orders

- The rate at which export orders are growing slowed in February to 53.9

- Firms increase their staffing levels for the 37th successive month but the pace of job creation eased to a 7-month low

- Service sector employment growth slipped to an 18-month low of 50.7

- Firms remain optimistic about the year ahead but business confidence in February fell to a 7-month low

Source: Richard Ramsey, Chief Economist Northern Ireland, Ulster Bank.

Downloads Intergraf Economic News (Paper Prices) - March 2024

Intergraf Economic News (Paper Prices) - March 2024

18 March 2024

Access the latest edition of the Economic Newsletter for the European Printing Industry for data on paper consumption, and pricing data for pulp, paper and recovered paper. Data for packaging papers and board is also available with this edition.

STUDY EXPOSES HIGH COST OF PHARMACIES PRINTING MEDICAL INFORMATION LEAFLETS

STUDY EXPOSES HIGH COST OF PHARMACIES PRINTING MEDICAL INFORMATION LEAFLETS

7 March 2024

Intergraf welcomes the release of a study by our partner MLPS (Medical Leaflet = Patient Safety), a subgroup of the European Carton Manufacturers Association (ECMA) shedding light on the potential economic costs associated with the proposed use of Print on Demand (PoD) leaflets in the pharmaceutical legislation revision.

The BPIF is the printing industries champion. By becoming a member you join a diverse and influential community. We help you solve business problems, connect you to new customers and suppliers and make your voice heard in government.

Call 01676 526030