9 October 2017

Northern Ireland PMI - new orders rise at fastest rate in year-to-date

The September data from the Ulster Bank Northern Ireland PMI® - produced for Ulster Bank by IHS Markit - signalled a further sharp increase in new orders at Northern Ireland companies, supporting the fastest rise in business activity in the year-to-date. The rate of job creation also accelerated.

On the price front, companies faced a sharper rise in input costs, while the rate of output price inflation eased slightly.The Northern Ireland private sector continued to defy political and economic uncertainty in September, seeing further marked increases in output and new orders that were both the fastest in 2017 so far. Local firms are also faring better than their counterparts across the UK as a whole at present, with the acceleration in growth contrasting with signs of a slowdown at the UK level.

NI economy defying uncertainty

The Northern Ireland private sector continued to defy political and economic uncertainty in September, seeing further marked increases in output and new orders that were both the fastest in 2017 so far. Local firms are also faring better than their counterparts across the UK as a whole at present, with the acceleration in growth contrasting with signs of a slowdown at the UK level. Part of the improvement in new business was reflective of continued growth

Growth in export orders

Part of the improvement in new business was reflective of continued growth of new export orders. Sterling weakness continues to act as a tailwind for exports, helping firms to secure new work in the Republic of Ireland in particular. The strength of demand across the border and in the euro area in general is also a factor helping new business from outside the local market to increase.A key highlight from the latest survey findings was the sharpest rise in employment since mid-2014. This suggests some level of confidence among firms that external factors won't negatively impact demand too much in the near-term at least. This is supported by data on business confidence which rose to a four-month high in September.

Sharp rise in employment

A key highlight from the latest survey findings was the sharpest rise in employment since mid-2014. This suggests some level of confidence among firms that external factors won't negatively impact demand too much in the near-term at least. This is supported by data on business confidence which rose to a four-month high in September."Sector data offered some solace for local retailers, pointing to a rebound in growth following signs of stagnation during the summer. Services remained a strong

Retails report rebound in growth

Sector data offered some solace for local retailers, pointing to a rebound in growth following signs of stagnation during the summer. Services remained a strong performer, and registered the fastest pace of job creation for over a decade. Manufacturing growth remained solid while construction remained the main area of concern, although even here there was some positive news as new orders increased for the first time in seven months.Sterling weakness is a double-edged sword for firms. While the currency is helping companies to secure new export orders, it is also acting to push up input costs. The rate of cost inflation quickened to a four-month high in September, with strong price rises across all monitored sectors. This, coupled with the aforementioned uncertainty, sounds a note of caution as we head towards the year-end.

Sterling weakness also pushing up costs

Sterling weakness is a double-edged sword for firms. While the currency is helping companies to secure new export orders, it is also acting to push up input costs. The rate of cost inflation quickened to a four-month high in September, with strong price rises across all monitored sectors. This, coupled with the aforementioned uncertainty, sounds a note of caution as we head towards the year-end.

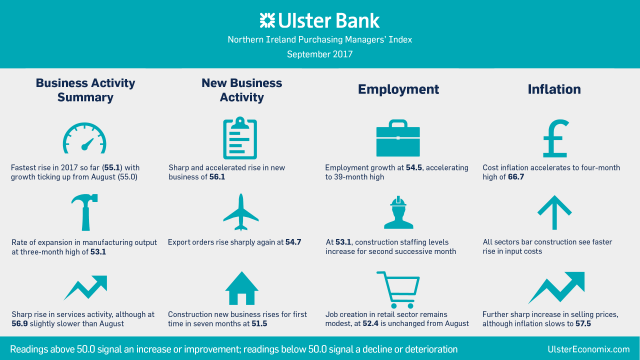

The main findings of the September survey were as follows:

- The headline seasonally adjusted Business Activity Index ticked up to 55.1 in September from 55.0 in August, signalling a marked monthly rise in activity in the Northern Ireland private sector, and one that was the strongest in the year-to-date. The overall expansion was led by the retail sector, with services also seeing a sharp increase in activity.

- Total new business increased substantially in September, with the rate of growth the strongest since last December.

- Sterling weakness helped firms to secure greater volumes of new export orders, with new business from the Republic of Ireland mentioned in particular.

- Rising workloads fed through to a further increase in staffing levels. Moreover, the rate of job creation quickened to the sharpest since June 2014. The main driver of employment growth was services where staffing levels rose at the fastest pace in just over a decade.

- Despite higher capacity, backlogs of work continued to rise amid strong new order growth.

- The rate of input cost inflation quickened for the second month running and was the fastest since May. Panellists often linked higher input prices to sterling weakness, while increases in staff costs and fuel prices were also mentioned.

- Output prices also rose sharply as companies passed on higher cost burdens to clients. That said, the rate of inflation eased slightly from August.

Source: Richard Ramsey, Chief Economist Northern Ireland, Ulster Bank.

Downloads Intergraf Economic News (Paper Prices) - April 2024

Intergraf Economic News (Paper Prices) - April 2024

19 April 2024

Access the latest edition of the Economic Newsletter for the European Printing Industry for data on paper consumption, and pricing data for pulp, paper and recovered paper.

Two Sides Global Campaign Reports Increasing Greenwashing As Organisations Focus On Sustainability

Two Sides Global Campaign Reports Increasing Greenwashing As Organisations Focus On Sustainability

25 April 2024

Two Sides has challenged over 2,650 organisations found to be communicating greenwashing messages to their customers. Over 1,180 organisations have, so far, removed misleading anti-paper statements.

The BPIF is the printing industries champion. By becoming a member you join a diverse and influential community. We help you solve business problems, connect you to new customers and suppliers and make your voice heard in government.

Call 01676 526030