15 June 2017

Pick-up in output and orders for NI manufacturers

The May data from the Ulster Bank Northern Ireland PMI® - produced for Ulster Bank by IHS Markit - points to a pick-up in new order growth during May, supporting a further solid increase in output. The rate of job creation also accelerated as firms responded to current workloads and positive expectations around future new work. Meanwhile, both input costs and output prices rose at slower rates than in April.

Commenting on the latest survey findings, Richard Ramsey, Chief Economist Northern Ireland, Ulster Bank, said:

"Eleven months have passed since the EU referendum. Over this period the rate of private sector growth amongst local firms has been broadly in line with the growth rate in the eleven months prior to the vote. However, in May, Northern Ireland, like most other regions of the UK, saw a slowdown.

"Business activity expanded, as it has expanded in each of the last eight months, but the rate of expansion remained below the average rate that prevailed before the downturn. New orders though picked up, with demand strongest from export markets. Indeed, order books from export markets have been expanding at a faster rate than the pre-downturn long-term average in each of the last eight months.

"The exchange rate has been a factor behind Northern Ireland's strong export performance since last autumn. But sterling weakness has also pushed up input costs alongside the price of goods and services. Last month, firms reported an easing in inflationary pressures, with input and output price inflation slipping to five- and six-month lows respectively. That said, inflationary pressures remain elevated by historical standards.

"The most encouraging indicator in the latest survey concerned employment. Firms increased their staffing levels at their fastest rate in 13 months. The pick-up in the pace of job creation was due solely to the services industry, with all other sectors signalling a slowdown in employment growth. Service sector firms increased their staffing levels in May at the fastest rate in 17-months. This follows a sustained period of subdued growth.

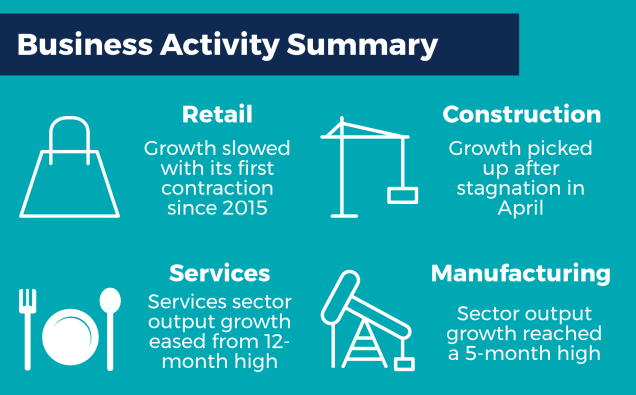

"Other encouraging signs were evident within manufacturing. Output and new orders amongst manufacturing firms picked up markedly in May. Meanwhile the opposite trend was evident within retailing. Following its recent purple patch, retail activity has slowed markedly. Both retail sales and orders dropped marginally in May with sales growth at its weakest since December 2015. Construction firms reported lacklustre growth, with new orders falling for the third month in a row. The construction sector firms also signalled that they expected activity to be broadly unchanged over the next 12 months. Conversely, business confidence for the year ahead amongst all other sectors improved in May. It remains to be seen whether this optimism is justified. Political developments at home and abroad will have a significant bearing on this going forward."

Key highlights include:

•Global output growth (53.7) just shy of January's 13-mth high

•Growth accelerates in US, France, Germany & Japan

•Chinese composite PMI picks up from 7-mth low to 51.5

•Russia, India & China propel Emerging Markets PMI to 52.2

•Eurozone composite PMI unchanged at 56.8 a 6-yr high

•Italian (55.2) & Spanish (57.2) PMIs ease from their recent highs but still record robust rates of growth

•Developed Market manufacturing PMI (54.1) remains just shy of recent 35-mth high

•UK composite PMI (54.5) slows to a 3-mth low. Most regions post slower growth rates with East Midlands in top spot 57.9

•RoI business activity accelerates to a 4-mth high (58.8)

•NI firms' output growth slows 53.5 but employment growth accelerates to a 13-mth high. Inflationary pressures ease

Downloads

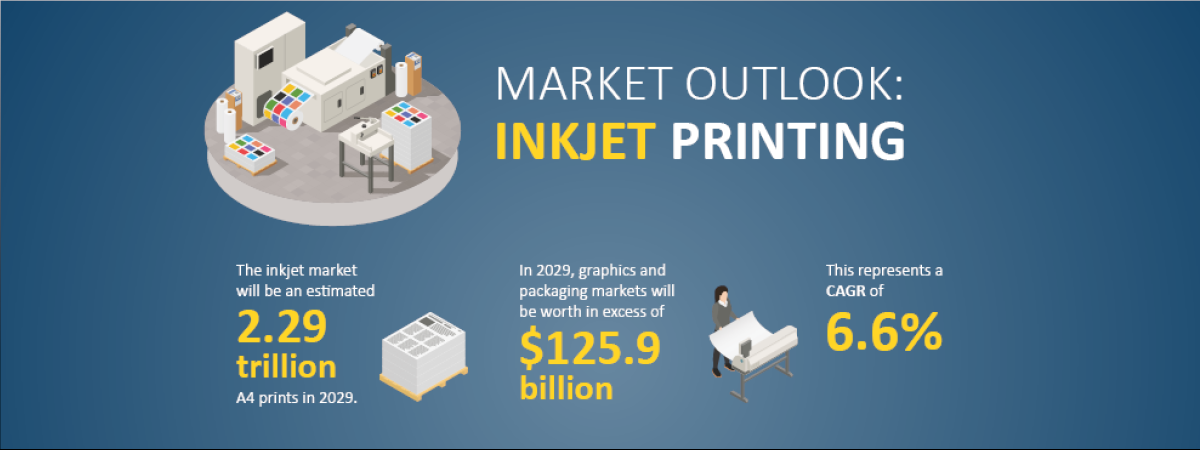

UK to follow global expansion of inkjet printing

UK to follow global expansion of inkjet printing

21 March 2024

The latest expert analysis from Smithers identifies the potential of the latest generation of inkjet systems to improve profitability across the global print market. Read more about the new report The Future of Inkjet Printing to 2029.

Intergraf Economic News (Paper Prices) - April 2024

Intergraf Economic News (Paper Prices) - April 2024

19 April 2024

Access the latest edition of the Economic Newsletter for the European Printing Industry for data on paper consumption, and pricing data for pulp, paper and recovered paper.

The BPIF is the printing industries champion. By becoming a member you join a diverse and influential community. We help you solve business problems, connect you to new customers and suppliers and make your voice heard in government.

Call 01676 526030