19 January 2015

Northern Ireland - corporation tax

Legislation that could pave the way for Northern Ireland's corporation tax powers to be devolved has been published.

The Corporation Tax (Northern Ireland) Bill should allow Northern Ireland to set its own rate of corporation tax from April 2017.

The current rate paid by businesses in Northern Ireland is 21 per cent; compared to 12.5 per cent in the Republic of Ireland - this has stimulated debate for a lower rate to attract investment to Northern Ireland.

Read more about Northern Ireland's corporation tax developments on the BBC website here.

Downloads Intergraf Economic News (Paper Prices) - March 2024

Intergraf Economic News (Paper Prices) - March 2024

18 March 2024

Access the latest edition of the Economic Newsletter for the European Printing Industry for data on paper consumption, and pricing data for pulp, paper and recovered paper. Data for packaging papers and board is also available with this edition.

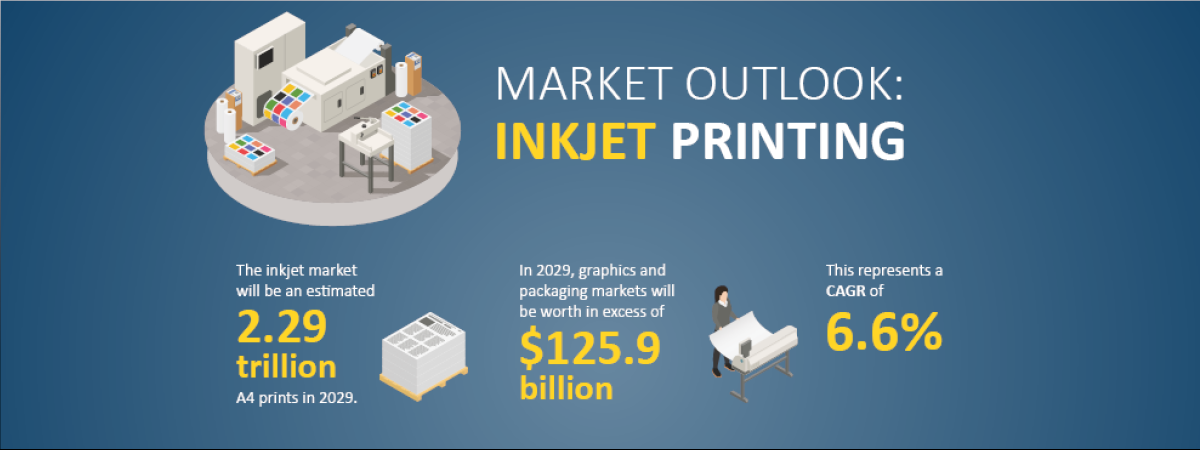

UK to follow global expansion of inkjet printing

UK to follow global expansion of inkjet printing

21 March 2024

The latest expert analysis from Smithers identifies the potential of the latest generation of inkjet systems to improve profitability across the global print market. Read more about the new report The Future of Inkjet Printing to 2029.

The BPIF is the printing industries champion. By becoming a member you join a diverse and influential community. We help you solve business problems, connect you to new customers and suppliers and make your voice heard in government.

Call 01676 526030