4 February 2016

Energy sector update from Schneider Electric

Wholesale gas and power prices have again fallen sharply over the last three months, as has Brent crude oil. Year-ahead power has receded 15%, with the annual gas contract trading a full 22% down on the previous quarter. The continuing global oversupply of oil, combined with fresh concerns over global economic prospects, has seen Brent crude fall 29% in the last three months to multi-year lows. Although recently there has been a sharp recovery, volatility is likely to continue in the market for some time.

The Iranian sanctions deal set the starting gun on the country’s intention to ramp up oil production, adding to global supply at a time when production from the US is holding strong and Russia/OPEC are continuing to keep the taps open. The very recent recovery is partially due to Russia ‘testing the water’ over possible coordinated production cuts with OPEC, however nothing concrete has emerged yet. These developments continue to point to a benign environment for commodity costs within industrial electricity supply contracts, although rising non-commodity charging elements (network costs, policy/subsidy charges) continue to dampen the downward effect.

Despite the notification of inadequate system margin (NISM) warning in November, the power grid has continued to cope with tighter margins this winter.Meanwhile, the Institution of Mechanical Engineers produced a report suggesting that there was a scenario where the UK could have a 55% shortfall in electricity supplies by 2025 due to insufficient investment in new generation and increasing electricity demand. While the warning is very much ‘worst case scenario’ driven by very pessimistic assumptions, it is a useful reminder of the need for UK energy policy to deliver the infrastructure investment needed to secure supplies. In related news, EDF has pushed back its final investment decision on Hinkley Point nuclear power station, which would be expected to provide 7% of UK electricity requirements from the middle of next decade.

Meanwhile, the ESOS (Energy Savings Opportunity Scheme) mandatory energy audit has passed its official compliance deadline with thousands of eligible firms still to engage with the process, and many more yet to demonstrate compliance even if they have started work. Whether you have met your deadline and would like advice on next steps to implement efficiency measures, or have yet to start on the route to compliance, you can contact Schneider Electric directly or through your local BPIF regional director.

Listen to Schneider Electric’s response, to the Mechanical Engineers report, in this interview for BBC Radio Scotland on the link below.

Downloads Intergraf Economic News (Paper Prices) - March 2024

Intergraf Economic News (Paper Prices) - March 2024

18 March 2024

Access the latest edition of the Economic Newsletter for the European Printing Industry for data on paper consumption, and pricing data for pulp, paper and recovered paper. Data for packaging papers and board is also available with this edition.

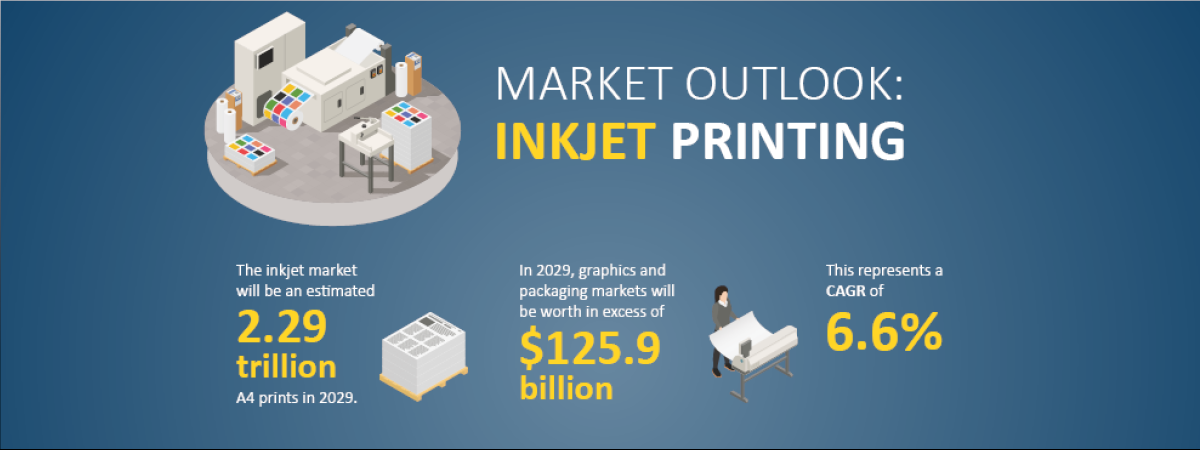

UK to follow global expansion of inkjet printing

UK to follow global expansion of inkjet printing

21 March 2024

The latest expert analysis from Smithers identifies the potential of the latest generation of inkjet systems to improve profitability across the global print market. Read more about the new report The Future of Inkjet Printing to 2029.

The BPIF is the printing industries champion. By becoming a member you join a diverse and influential community. We help you solve business problems, connect you to new customers and suppliers and make your voice heard in government.

Call 01676 526030