15 January 2016

NI business activity rises for eighth month running

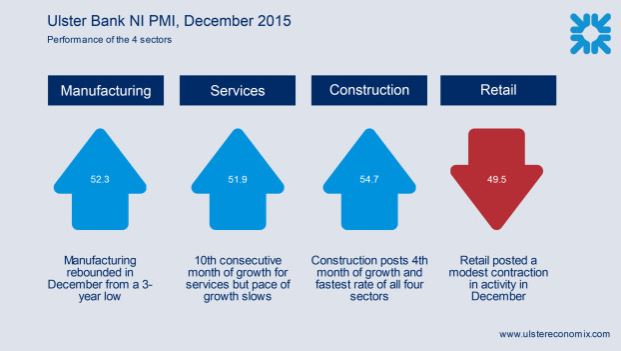

The Ulster Bank NI PMI for December has been released.

The PMI is a monthly survey of carefully selected companies. It provides an advance indication of what is happening in the private sector economy by tracking variables such as output, new orders, employment and prices.

- The headline seasonally adjusted Business Activity Index posted 52.3 in December, down marginally from 52.6 in November but continuing to signal a solid expansion in private sector output in Northern Ireland.

- Activity has now risen in each of the past eight months

- According to respondents, improving market conditions and rising new export business had contributed to the increase in activity.

- Manufacturing production returned to growth following a fall in November.

- Total new business rose for the eighth consecutive month in December.

- Moreover, the rate of growth quickened for the second month running and was the fastest since August.

- Higher new business led to a build-up of backlogs of work, the second in as many months.

- Firms increased their staffing levels for the eleventh successive month during December.

- Three of the four (manufacturing, construction, services, and retail) monitored sectors posted higher employment, the exception being manufacturing.

- Input prices increased at the fastest pace for a year at the end of 2015, with a number of respondents highlighting rising staff costs.

- The service sector posted the strongest rate of inflation, with the latest increase the fastest since April 2014.

- Output prices at Northern Ireland companies rose for the second month running in December.

- The rate of inflation was slight and broadly in line with that seen across the UK economy as a whole.

Commenting on the latest survey findings, Richard Ramsey, Chief Economist Northern Ireland, Ulster Bank, said:

"Overall, last year can be viewed as a game of two halves. The first six months of the year were disappointing, with marginal growth in output, falling exports, and subdued rates of growth in orders and employment. However, the second half saw an acceleration in output, new orders and employment growth. Furthermore, exports returned to growth too. Inflationary pressures were also subdued in the first half of last year but have been picking up since.

"This overall improvement conceals contrasting fortunes at a sector level. The retail and construction sectors experienced a significant turnaround in performance, with falling output in the first half of 2015 being replaced with expansion in the latter half of the year. The services sector maintained the same growth rate in both periods. Meanwhile manufacturing was the only sector to post a notably weaker growth rate in the second half of the year.

"The latest survey for December offers some signs of encouragement. For example, export orders returned to growth and new orders expanded at their fastest rate in four months. Meanwhile output and employment growth eased slightly relative to November. However, there are signs of inflationary pressures returning, linked to rising wages. This is particularly evident within the services sector with input cost inflation hitting a 20-month high in December.

"Within manufacturing it was encouraging to see output and new orders return to growth in December following contraction in November. This improvement may yet prove to be a blip rather than the start of an improving trend. Indeed, manufacturers reported an acceleration in job losses in December with staffing levels falling at their fastest rate since June 2013. Given the large scale redundancy announcements made last year, but yet to take effect, this trend is expected to continue. Conversely, the pace of employment growth within the services and retail sectors increased last month. Services firms are now hiring at a faster rate than the long-term average before the downturn. The same holds true for retailers and this was despite a dip in retail sales and a further decline in retail orders last month. Construction continues to perform strongly across the full range of business indicators. However, this improvement is largely linked to activity in Great Britain.

"Looking to 2016, as the Chancellor highlighted this week, there are a number of significant risks on the horizon. Northern Ireland will not be immune to these challenges going-forward, alongside the ongoing fiscal austerity."

The full report, comment and slides are available on the Ulster Bank economics website on the link below.

Downloads

Intergraf Economic News (Paper Prices) - March 2024

Intergraf Economic News (Paper Prices) - March 2024

18 March 2024

Access the latest edition of the Economic Newsletter for the European Printing Industry for data on paper consumption, and pricing data for pulp, paper and recovered paper. Data for packaging papers and board is also available with this edition.

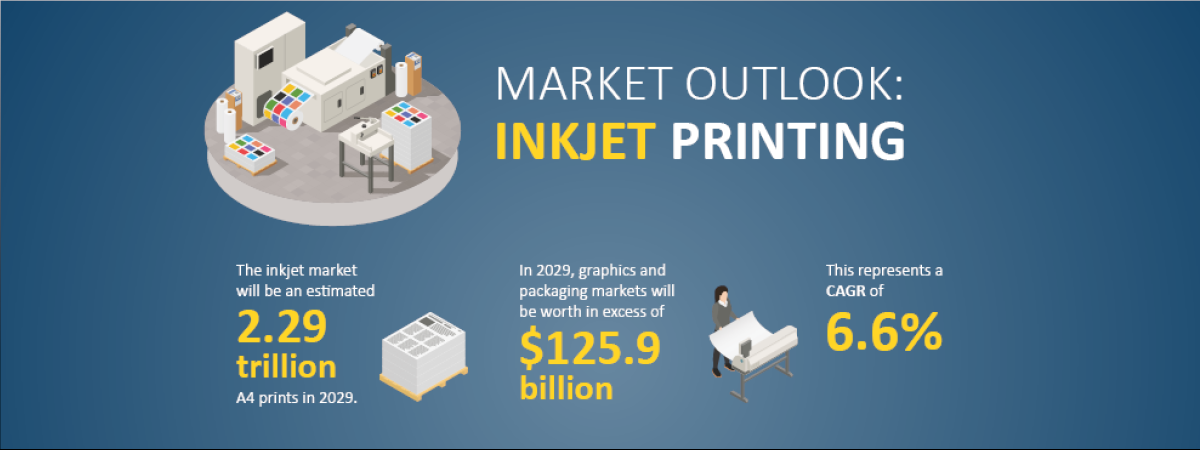

UK to follow global expansion of inkjet printing

UK to follow global expansion of inkjet printing

21 March 2024

The latest expert analysis from Smithers identifies the potential of the latest generation of inkjet systems to improve profitability across the global print market. Read more about the new report The Future of Inkjet Printing to 2029.

The BPIF is the printing industries champion. By becoming a member you join a diverse and influential community. We help you solve business problems, connect you to new customers and suppliers and make your voice heard in government.

Call 01676 526030