13 November 2015

Northern Ireland sees fastest increase in employment for five months

The latest Ulster Bank NI PMI has been released.

For those who don’t know, the PMI is a monthly survey of carefully selected companies. It provides an advance indication of what is happening in the private sector economy by tracking variables such as output, new orders, employment and prices across both manufacturing and service sectors.

The latest PMI is a mixed bag of positive and less positive news.

Here are the main points:

- The headline seasonally adjusted Business Activity Index posted 51.8 in October. This was down slightly from 52.9 in September but still signalling modest growth of output in the Northern Ireland private sector

- Activity has now risen in each of the past 6 months, although the latest expansion was weaker than the UK economy average.

- The overall rise in output was led by a solid increase in the construction sector.

- New business also continued to increase, albeit at a slight pace that was the slowest in the current six-month sequence of growth.

- Northern Ireland companies increased their staffing levels for the 9th month in a row, and at a solid pace that was the fastest since May.

- Panellists mainly linked higher employment to rising workloads. Retail posted the sharpest rate of job creation.

- Manufacturing was the only sector to record a decrease in employment.

- Outstanding business declined for the second month running, and at a slightly faster pace.

- The rate of input cost inflation remained relatively modest, despite quickening from the previous month.

- Higher wages and salaries had been the main contributor to cost inflation, according to respondents.

- Services posted the sharpest increase in input prices of the 4 monitored sectors.

- Companies continued to lower their output prices, with the latest reduction the third in as many months. That said, the decrease was only slight and weaker than that seen in September.

- Some panellists mentioned passing on lower input costs to clients amid competitive pressures.

Commenting on the latest survey findings, Richard Ramsey, Chief Economist Northern Ireland, Ulster Bank, said:

"Northern Ireland private sector firms reported their sixth successive month of growth in business activity and new orders in October. Whilst this trend is encouraging, there is no disguising the fact that a slowdown appears to be in train. Last month the pace of expansion in both business activity and new orders eased, with order books expanding at their weakest rate since April. Despite this slowdown, Northern Ireland’s staffing levels were increased at the fastest rate in five months. This improvement was driven by the retail and wider services sector. Indeed, the latest survey confirms that retailers are hiring at their fastest rate since the survey began. This is despite the marked slowdown in retail sales and orders from their recent highs. "The overall headlines conceal contrasting fortunes at a sector level. On a positive note, construction was the only sector to report a pick-up in growth in business activity, new orders and employment in October. This is likely to be due to improving workloads in Northern Ireland as well as robust rates of activity in Great Britain and the Republic of Ireland. Meanwhile retailers are still benefiting from the low / ‘noflation’ environment that has boosted households’ disposable incomes and encouraged consumer spending. "Of more concern, however, is the slowdown in the manufacturing and services sectors. Manufacturing is exposed to the wider global economic slowdown. Last month, manufacturing output growth was flat – the weakest rate in seven months. New orders, an indicator of future business activity, were also broadly flat in October following contraction in September. Furthermore, manufacturing employment fell for the second consecutive month and the fastest rate of decline since June 2013. This comes ahead of a significant number of high profile manufacturing redundancies already announced but to take place from the middle of next year. "Meanwhile the service sector saw the rate of growth in business activity slow to an eight-month low. The pace of growth in October remains significantly below the average growth rate that prevailed before the downturn. The same trend applies to service sector new orders as well. With demand for services easing, service sector firms are facing a squeeze on profit margins due to input cost inflation (primarily wage inflation). "Overall, the Northern Ireland private sector is still experiencing growth, but at a slowing rate, and with contrasting fortunes across the sectors. There are a number of headwinds evident, and with an ongoing global slowdown impacting particularly on the manufacturing sector, these are likely to intensify into 2016 and indeed beyond."

The full report, comment and slides are available on the Ulster Bank economics website on the link below.

Downloads Intergraf Economic News (Paper Prices) - March 2024

Intergraf Economic News (Paper Prices) - March 2024

18 March 2024

Access the latest edition of the Economic Newsletter for the European Printing Industry for data on paper consumption, and pricing data for pulp, paper and recovered paper. Data for packaging papers and board is also available with this edition.

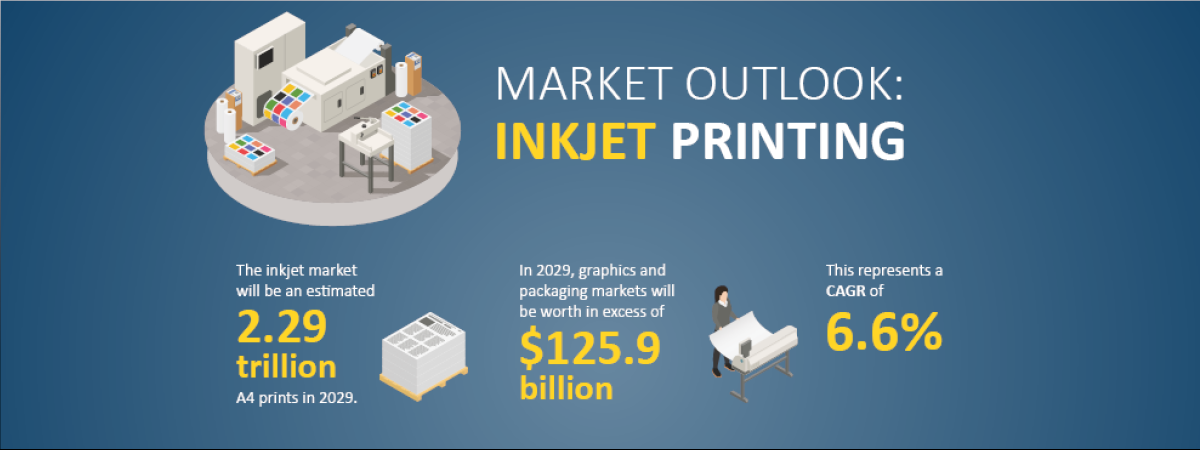

UK to follow global expansion of inkjet printing

UK to follow global expansion of inkjet printing

21 March 2024

The latest expert analysis from Smithers identifies the potential of the latest generation of inkjet systems to improve profitability across the global print market. Read more about the new report The Future of Inkjet Printing to 2029.

The BPIF is the printing industries champion. By becoming a member you join a diverse and influential community. We help you solve business problems, connect you to new customers and suppliers and make your voice heard in government.

Call 01676 526030