18 June 2015

HMRC finally issues new guidance on VAT treatment for direct mail

On 9 June HMRC published updated VAT Notices 700/24 (Postage, delivery charges and direct marketing) and 701/10 (Zero-rating of books and other forms of printed matter), clarifying at long last HMRC's position on the VAT treatment of postage and other direct mail services. Together with other leading trade bodies, we have pressing HMRC for this revised guidance ever since April 2012, when HMRC decided to strip bulk mail of its VAT-exempt status.

HMRC's decision three years ago led many suppliers to charities and financial services businesses that are unable to claim back or charge VAT to use "single sourcing" as a means of cutting out the VAT liability. This practice combined the postage cost with the production cost, meaning that the entire supply could be zero-rated.

Unfortunately though, the lack of any official guidance on this caused considerable uncertainty. In fact it was only after eighteen months of chasing by the Direct Marketing Association (DMA) that HMRC eventually confirmed that it did intend to issue new guidance, making it clear that single-sourcing, in their view, changed the nature of what was being supplied from zero-rated goods (print), to a fully VAT-able supply of a service.

As a consequence, we warned members last year that that there was now a real risk that HMRC might issue backdated VAT bills and penalties to companies that did not comply with their interpretation of the published guidelines. And since HMRC had still to issue their promised new guidance, the BPIF, DMA, and Charities Trade Group (CTG) all then lobbied the Treasury and HMRC to press them not to issue any retrospective charges and penalties until this guidance was published.

Following these representations, HMRC agreed that there would be no retrospective demands for VAT or penalties to those suppliers and their clients who were including postage as part of a supply of zero-rated print. HRMC also agreed how postage and other services should be treated in future, along with a forward implementation date of 1 April this year to give time to put in place alternative arrangements.

In fact it took until 9 June this year for HMRC to finally get around to publishing updated VAT Notices 700/24 and 701/10. However the implementation date has been revised to 1 August, meaning that the "transitional period" during which HMRC has agreed they will take no retrospective action against companies that applied VAT incorrectly will now end on 31 July 2015.

Intergraf Economic News (Paper Prices) - March 2024

Intergraf Economic News (Paper Prices) - March 2024

18 March 2024

Access the latest edition of the Economic Newsletter for the European Printing Industry for data on paper consumption, and pricing data for pulp, paper and recovered paper. Data for packaging papers and board is also available with this edition.

UK to follow global expansion of inkjet printing

UK to follow global expansion of inkjet printing

21 March 2024

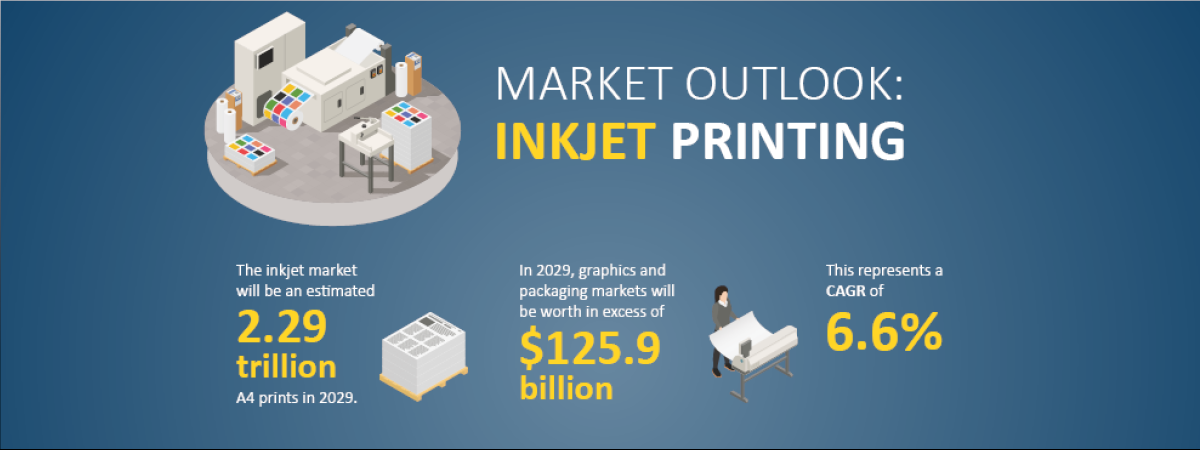

The latest expert analysis from Smithers identifies the potential of the latest generation of inkjet systems to improve profitability across the global print market. Read more about the new report The Future of Inkjet Printing to 2029.

The BPIF is the printing industries champion. By becoming a member you join a diverse and influential community. We help you solve business problems, connect you to new customers and suppliers and make your voice heard in government.

Call 01676 526030