11 March 2014

Northern Ireland sees robust output growth in February

The latest Ulster Bank Northern Ireland PMI® report - produced for Ulster Bank by Markit - signalled a further sharp increase in business activity at Northern Ireland private sector firms, aided by another month of strong new order growth. Meanwhile, a marked easing in the rate of cost inflation was recorded, and companies lowered their output prices.

Commenting on the latest survey findings, Richard Ramsey, Chief Economist Northern Ireland, Ulster Bank, said:

"Northern Ireland's broad based economic recovery continued last month with all sectors posting further growth in business activity, employment and new orders. Northern Ireland's private sector firms have now reported an increase in business activity, employment and export orders for eight consecutive months. Meanwhile the level of new orders rose in February for the ninth month in a row.

"Whilst the pace of growth in business activity and new orders eased last month, the rates of growth still remain very strong. After all, the January survey saw new order growth at a record high and business activity expanded at its fastest rate in almost 10-years. Therefore the slight slowdown in growth in these two areas is coming from a very strong position. The UK and the Republic of Ireland, Northern Ireland's two key trading partners, also saw an easing in the pace of growth in business activity and new orders in their February PMI surveys, whilst local firms reported an easing in the pace of job creation in February, down from January's six-and-a-half-year high.

"Another encouraging sign in the latest Ulster Bank PMI report concerned inflation. Input cost inflation eased significantly in February, to its weakest rate since July 2012. Whilst this was largely due to an easing in cost pressures within the service sector, manufacturing firms signalled the slowest rise in input prices in 20 months. The one negative feature of the latest survey is the fact that local firms lowered their output prices in February for the first time in seven months; though this was solely due to price reductions in the service sector. On the other hand, the local construction industry raised its prices in February at the fastest rate since the series began. This feature is part of a wider improvement in business conditions for the construction sector. Indeed both output and employment growth within the construction sector accelerated in February, albeit from a low base. Whilst all sectors continue to report strong rates of growth, the retail sector reported the fastest rates of growth in output (sales), new orders and job creation."

Downloads Intergraf Economic News (Paper Prices) - March 2024

Intergraf Economic News (Paper Prices) - March 2024

18 March 2024

Access the latest edition of the Economic Newsletter for the European Printing Industry for data on paper consumption, and pricing data for pulp, paper and recovered paper. Data for packaging papers and board is also available with this edition.

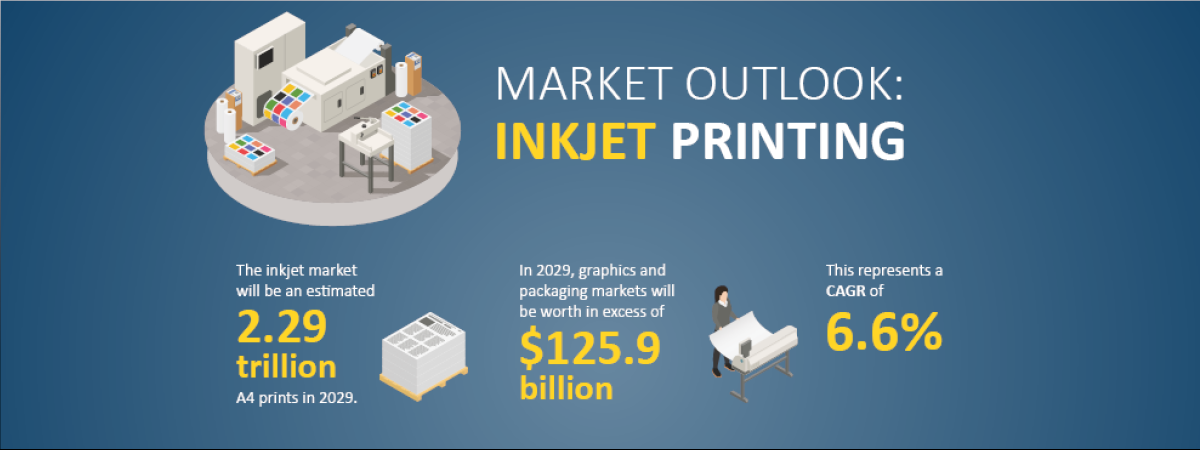

UK to follow global expansion of inkjet printing

UK to follow global expansion of inkjet printing

21 March 2024

The latest expert analysis from Smithers identifies the potential of the latest generation of inkjet systems to improve profitability across the global print market. Read more about the new report The Future of Inkjet Printing to 2029.

The BPIF is the printing industries champion. By becoming a member you join a diverse and influential community. We help you solve business problems, connect you to new customers and suppliers and make your voice heard in government.

Call 01676 526030