30 September 2002

Insurance premiums

In common with all Insurance Companies, the underwriters of the BPIF Scheme are having to increase premiums. Steve Walker, the BPIF?s Commercial Products Manager, asked John Clegg, Branch Director of Aon Limited - Why?

John said that the reasons were many and had all come together at the same time. Retrospective legislation, increase in claims, lower interest rates and falling equity values had all had a direct impact on premiums.

The reasons cover 3 key areas:

1. Changes in Legislation

- In 1999 the House of Lords made it mandatory for the Courts to use The Ogden Tables of Life Expectancy when dealing with personal injury claims. This is estimated to have cost the industry £900M.

- The rise of the Conditional Fee Arrangements, often known as ?no win, no fee? arrangements, have made litigation almost risk free and led to a large increase in claims.

- Since The Woolf Report in 1999, the Courts can apply severe financial penalties for insurers for failure to comply with new procedures. This has lead to higher average claims settlements, as insurers are forced to settle claims, near the top of the potential value, rather than contest the claim with the risk of incurring higher costs.

- Abolition of claims agreements between insurers has led to higher claims.

- The Law Commission has reviewed the extent and level of damages in personal injury claims. Its recommendations are likely to have a significant effect on awards for damages for personal injuries. As the recommendations are also likely to be retrospective, there will be the potential for increases to existing claims.

2. Increases in Claims

- The losses sustained by insurers and reinsurers in the World Trade Centre Attack were without precedent with the likelihood that some re-insurers and Lloyds? Syndicates would fail, leading to substantial reductions in capacity. With less re-insurance capacity, premiums would increase and cover would be restricted.

- There has been a substantial increase in losses to property over the past few years. More volatile weather patterns have been seen and are widely predicted to worsen as a result of climate change.

- The Industry has seen an increasing trend of very large fire and theft losses. Many are arson related. There have also been changes to Fire Brigade Procedures whereby Firemen are now unlikely to enter burning buildings unless lives are at risk or where dangerous materials are involved. Business Interruption claims have increased due to a growing dependency on single suppliers and just in time manufacturing. Theft losses, particularly in relation to computer equipment, have risen sharply.

- New types of claims were also emerging, and gaining momentum, in relation to stress, violence, abuse, environmental tobacco smoke, sick building syndrome and acoustic shock.

- Settlements for personal injury claims are rising significantly higher rate than the Retail Price Index and, therefore, premiums have to rise to match the rise in claims, settlements and costs.

3. Impact of the Economy on the Insurance Industry

- With interest rates low, the investment income insurers could earn on new premiums had dropped significantly, again leading to higher premiums.

- Insurance Regulations require insurance companies to have certain levels of shareholder funds. Therefore the fall in share value meant that insurance companies needed to improve their profitability or write less business. In other words, rates must increase or the capacity of the market reduces. Similarly with falling equity values, companies have less funds available to support the insurance operations.

In conclusion John states that substantial increases in premiums are unavoidable, given the state of the market, with any rises dependent on the claims history of a company and the underwriters assessment of the risk in a new risk-averse environment.

The volatility of the insurance market has been caused by a number of factors all operating together to produce substantial rises. Some of the factors are international and reflected the general hardening of the insurance and re-insurance market whilst many are unique to the UK and stem from changes in legislation. This, added to an industry already suffering from poor profitability, and highlighted by the closure of the Independent, has lead to the situation we find today.

Intergraf Economic News (Paper Prices) - March 2024

Intergraf Economic News (Paper Prices) - March 2024

18 March 2024

Access the latest edition of the Economic Newsletter for the European Printing Industry for data on paper consumption, and pricing data for pulp, paper and recovered paper. Data for packaging papers and board is also available with this edition.

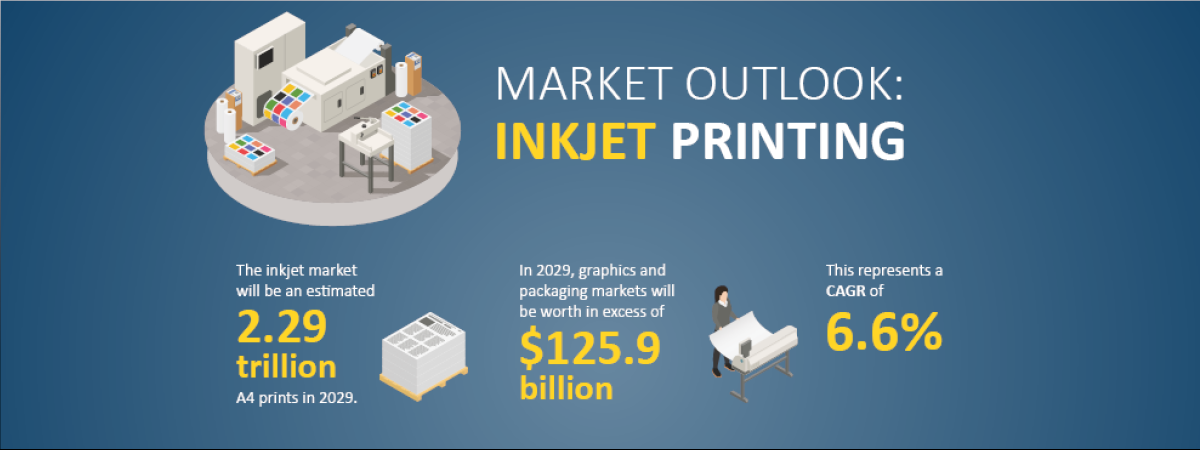

UK to follow global expansion of inkjet printing

UK to follow global expansion of inkjet printing

21 March 2024

The latest expert analysis from Smithers identifies the potential of the latest generation of inkjet systems to improve profitability across the global print market. Read more about the new report The Future of Inkjet Printing to 2029.

The BPIF is the printing industries champion. By becoming a member you join a diverse and influential community. We help you solve business problems, connect you to new customers and suppliers and make your voice heard in government.

Call 01676 526030