14 March 2011

Important changes to Corporation Tax (CT) filing and payment to come into effect next month

From April 2011, all Corporation Tax payments will have to be made electronically, and all company tax returns must be filed online for accounting periods ending after 31 March 2010. The returns will also have to be filed using a specified data format, known as Inline XBRL or iXBRL.

There are a number of options for electronic payment, including: Direct Debit; debit or credit card via the BillPay service; your own bank or building society's internet or telephone banking service; a BACS or CHAPS transfer; by Bank Giro or at participating Post Offices. Companies will be able to file online either through commercially available software or by using HMRC's own CT filing software, which is aimed at companies with less complex tax affairs. To sign up for Corporation Tax online filing visit the HMRC Website. and then click "Register for Corporation Tax Online"

Intergraf Economic News (Paper Prices) - March 2024

Intergraf Economic News (Paper Prices) - March 2024

18 March 2024

Access the latest edition of the Economic Newsletter for the European Printing Industry for data on paper consumption, and pricing data for pulp, paper and recovered paper. Data for packaging papers and board is also available with this edition.

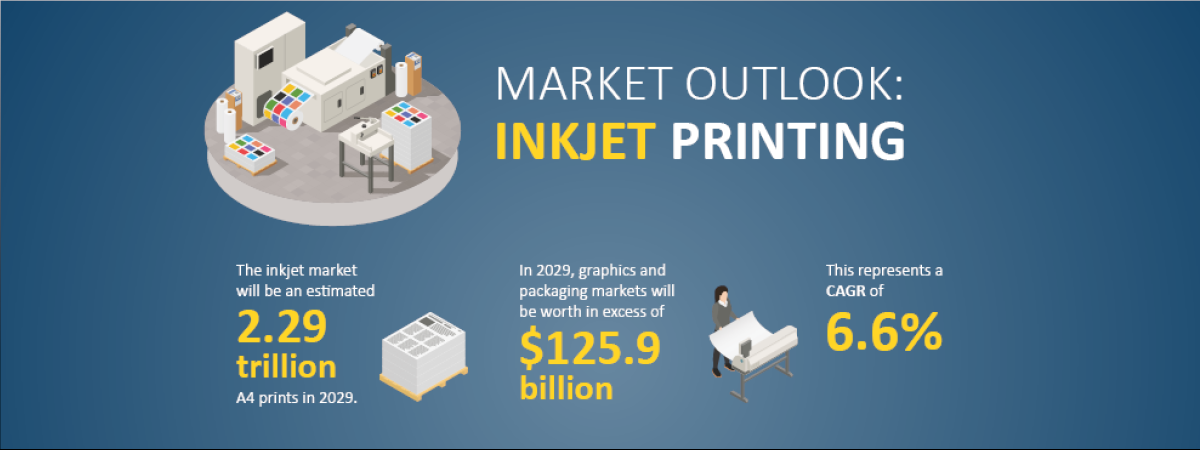

UK to follow global expansion of inkjet printing

UK to follow global expansion of inkjet printing

21 March 2024

The latest expert analysis from Smithers identifies the potential of the latest generation of inkjet systems to improve profitability across the global print market. Read more about the new report The Future of Inkjet Printing to 2029.

The BPIF is the printing industries champion. By becoming a member you join a diverse and influential community. We help you solve business problems, connect you to new customers and suppliers and make your voice heard in government.

Call 01676 526030