13 February 2023

Global print industry shows post Covid recovery and resilience in face of fresh challenges

DRUPA GLOBAL TRENDS REPORT

Messe Duesseldorf as organisers of drupa, are in a unique position to track industry trends across all markets and all regions. They have done this since 2013, by means of in-depth surveys run by Printfuture (UK) and Wissler (CH), using a panel of senior industry experts recruited from both printers and suppliers. After a 2yr break though the pandemic, the 8th drupa Global Trends Report was published in September 2022. The results show an industry across the globe that is, on average, a little more confident for the future than when last surveyed in 2019. A short summary has been made available for BPIF members.

Over 500 printers and suppliers from the drupa Expert Panel of senior decision makers completed the extended survey in the Spring. Globally 18% more printers described their company's economic condition as 'good' compared with those that reported it as 'poor'. For suppliers the net positive balance was even stronger at 32%.

As always, confidence varies between regions and markets. The Packaging market is thriving with Publishing and Commercial facing structural changes from digitisation but with signs of confidence returning. Regionally the picture is mixed with Europe clearly concerned about the consequences of the Russia/Ukraine war, but others e.g., Asia and South/Central America, expect trade to pick up further in 2023 as economic momentum builds post pandemic.

PRINTER GLOBAL MARKET ECONOMIC CONFIDENCE

Analysis of print volume in 2022 by press type, shows continuing decline in Sheetfed offset among Commercial printers matched by increases among Packaging printers. Flexo volumes continue to accelerate for Packaging printers, while all markets reported increased volumes using Digital toner cutsheet colour and all but Publishing with Digital inkjet rollfed colour.

PRINT VOLUME 2022 BY TECHNOLOGY

While there was virtually no increase in the proportion of turnover won by Web-to-Print installations between 2014 and 2019, over the last two years the proportion won by that means has shot up for those with such installations. Globally the increase is c.10% of turnover (from 17% of turnover to 26%) and this pattern is reflected to varying degrees across all markets.

% OF THOSE WITH W2P WITH >25% TURNOVER VIA W2P

Investment fell inevitably during the last two years, but printers and suppliers both reported strong plans for capital expenditure in 2023. Sabine Geldermann, Director drupa and Global Head Print Technologies at Messe Duesseldorf, commented: "Printers and Suppliers know they must innovate to succeed in the longer term. The shocks of the last two years pegged back investment, but the survey indicates that the industry expects recovery to start in 2023."

CAPEX PRINTERS 2022 - GLOBAL AND BY MARKET

Despite the active decline in the volume of Sheetfed offset in Commercial markets, this was the most popular press type for investment in 2023 across all markets except Packaging, where Flexo led, followed by Sheetfed offset. Digital toner cutsheet colour was the second most popular target for all other markets. Finishing equipment is the second most popular target for investment after new presses.

|

2023 PRINT TECHNOLOGY INVESTMENT TARGETS - GLOBAL AND BY MARKET |

||||

|

|

Global |

Commercial |

Publishing |

Packaging |

|

1st choice |

Sheetfed offset 31% |

Sheetfed offset 30% |

Sheetfed offset & Digital toner cutsheet colour 27% |

Flexo 39% |

|

2nd choice |

Digital toner cutsheet colour 18% |

Digital toner cutsheet colour 26% |

|

Sheetfed offset 34% |

|

3rd choice |

Flexo & Digital inkjet wide format 17% |

Digital inkjet wide format 25% |

Coldset offset 24% |

Gravure, Digital inkjet rollfed colour and Hybrid offset/flexo/digital 14% |

In which of the following print technologies do you plan to invest in the next 12 months?

Considering the print market itself, a lack of demand and competitive pressures remain the dominant concerns in the short term, but there is increasing attention to the lack of specialist skills. Over a longer 5-year period this moves up to be the second most important issue for both printers and suppliers, with the impact of digital media being the most important.

THE BIGGEST THREATS TO THE PRINT MARKET OVER THE NEXT 5 YEARS

Socio-economic pressures are having a major impact across the globe, although they vary in influence between regions. For example, 62% of printers in Asia chose Pandemics as the biggest threat, while in Europe this was chosen by 51%. And while 32% of European printers chose Physical wars, this was chosen by only 6% of those in South/Central America. Instead, 58% of them chose the threat of economic recession. Richard Gray, Operations Director at Printfuture, stated: "Socio-economic pressures are increasingly important to printers and suppliers alike, so much so that 59% thought these were now either as important or more important than print market pressures."

There is no getting away from the truth that however challenging market and broader economic conditions are, companies thrive who look ahead strategically, invest wisely in both equipment and their people, and seek out and grasp opportunities despite the ever-present threats. Perhaps the balance of opportunity and threat is best expressed in this extended quote from a commercial printer in the United Arab Emirates.

"On the plus side: Printing has evolved from simple ink on paper to a marketing item which attracts a customer towards a product or service. As such every print item, whether it is packaging or promotional display item, is used for promoting product and services. Subsequently we are continuously involving in providing the market with innovative printing without diluting turnaround time. As against illusional marketing methods on digital platforms, print products have a tangibility factor which connects well with human physiology.

"On the down side: Digital marketing and its direct influence on customers opting to buy goods and services on digital platforms. This would subsequently eliminate the role of print marketing on both commercial printing and commercial packaging, as customers have already made their decision to purchase a product or service from a digital purchasing platform which eliminates any marketing element from a packaging or commercial print item."

Commercial printer, United Arab Emirates

In collaboration with drupa, BPIF members are now able to both download the Executive Summary for free and join the expert panel. By joining the panel and participating in the annual survey, you receive a copy of the full report free (available to purchase on the drupa website).

What has the future in store for your print business?

Visit www.drupa.com/summary_EN to Download the Executive Summary.

Visit www.drupa.com.panel_regi_EN to join the drupa expert panel.

Source: drupa Global Trends Report, Messe Duesseldorf - www.drupa.com

Downloads

Intergraf Economic News (Paper Prices) - March 2024

Intergraf Economic News (Paper Prices) - March 2024

18 March 2024

Access the latest edition of the Economic Newsletter for the European Printing Industry for data on paper consumption, and pricing data for pulp, paper and recovered paper. Data for packaging papers and board is also available with this edition.

UK to follow global expansion of inkjet printing

UK to follow global expansion of inkjet printing

21 March 2024

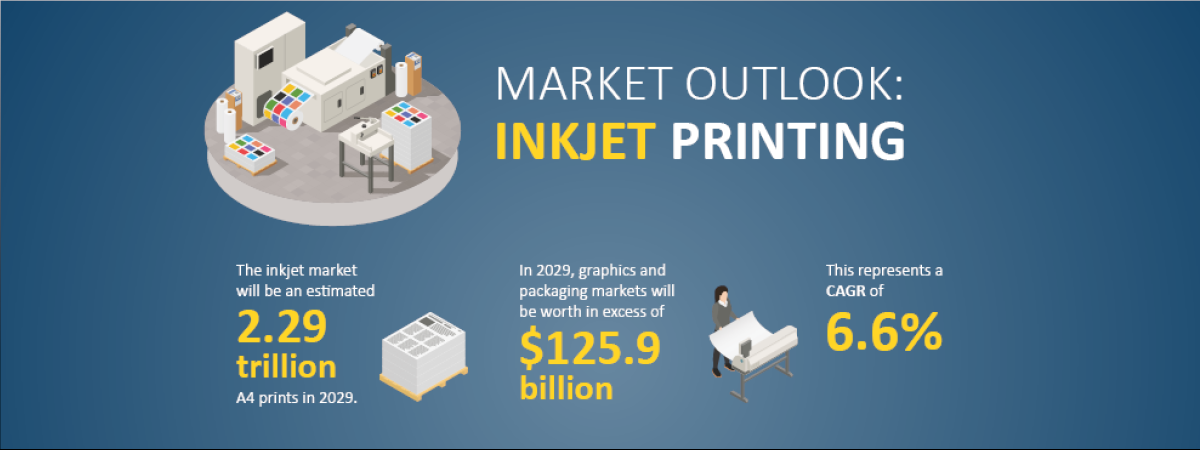

The latest expert analysis from Smithers identifies the potential of the latest generation of inkjet systems to improve profitability across the global print market. Read more about the new report The Future of Inkjet Printing to 2029.

The BPIF is the printing industries champion. By becoming a member you join a diverse and influential community. We help you solve business problems, connect you to new customers and suppliers and make your voice heard in government.

Call 01676 526030