20 May 2021

Ensuring due diligence is undertaken as part of your investment process.

Insurance is often only a minor consideration of the detailed due diligence undertaken as part of the investment process and is not normally examined in any great depth.

A comprehensive exercise encompassing the insurable risks will guarantee that the assets, people and future revenues of the business are adequately protected.

Here is your short guide for the processes of investigating.

Adverse impact on EBITDA

The aim of your investment is to grow the business, generate a return on investment and maximise earnings before interest, taxes, depreciation and amortization (EBITDA).

Without the appropriate insurance, your capital may have to be deployed to respond to any unforeseen issues that the portfolio company may encounter, including:

- Litigation

- Data breach/Cyber Crime

- Errors & omissions

- Allegations of negligence

- Misconduct

Any of which would have an adverse impact on your return on investment.

You are then likely to face allegations of negligence from investors of failure to undertake the proper due diligence, which, in addition to the stress and reputational damage, would also have an impact on your own operational insurances.

Protect Your Portfolio

There is a certain level of risk which is an inevitable part of investing, but why not mitigate the risks you can control by transferring these to a comprehensive insurance programme, which:

- Engineers risk

- Reduces claims

- Reduces costs

- Frees up capital to be used to grow the business and improve EBITDA

We consider the medium to long-term strategies of the business, so that our review is focussed on supporting these objectives.

Where growth strategy involves Mergers & Acquisitions (M&A), we offer support so that the insurance programme seamlessly accommodates this.

The Focus

YOU GIVE US

A copy of the portfolio companies’ insurance programme

WE DELIVER

We will perform an analysis, specifically focussing on:

- Benchmarking current premium levels

- Suitability of policy coverage against requirements

- Adequacy of sums insured/limits of indemnity

- Identifying onerous Exclusions and Conditions

- Scope for coverage enhancements

Then developing a strategy to implement the improvements to cover and gain cost efficiencies – either direct with the portfolio companies or in partnership with you.

Results Driven

CASE STUDY A

One of our private equity partners with over £1bn funds under management introduced us to assist Company X, specifically with regards to their Directors and Officers liability risk. Without our involvement the company’s D&O insurance premium would have increased by 100% in view of challenging market conditions. Our foresight and placement expertise ensured that the investee company successfully avoided this reduction in EBITDA, and cut premium cost in the process.

CASE STUDY B

Global events can vastly impact the cost of insurance risk transfer, and hence the return on investment in the business. We work closely with a large private equity fund with a specialism in hospitality and care, amongst others. The insurers of Company Y, a large hospitality hain, had applied a blanket policy exclusion for similar global crises across the insurance programme, leaving the company with a large liability exposure. We created both a 50% cost saving and coverage enhancement by sourcing cover with an alternative insurer, safeguarding the future of the business.

For further information and support, Visit the BPIF Insurance Services website.

Intergraf Economic News (Paper Prices) - March 2024

Intergraf Economic News (Paper Prices) - March 2024

18 March 2024

Access the latest edition of the Economic Newsletter for the European Printing Industry for data on paper consumption, and pricing data for pulp, paper and recovered paper. Data for packaging papers and board is also available with this edition.

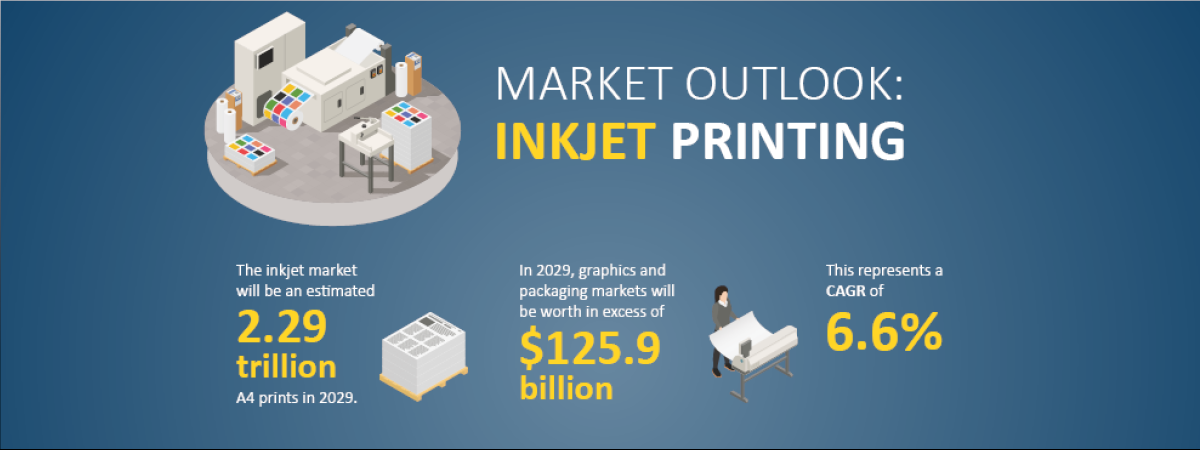

UK to follow global expansion of inkjet printing

UK to follow global expansion of inkjet printing

21 March 2024

The latest expert analysis from Smithers identifies the potential of the latest generation of inkjet systems to improve profitability across the global print market. Read more about the new report The Future of Inkjet Printing to 2029.

The BPIF is the printing industries champion. By becoming a member you join a diverse and influential community. We help you solve business problems, connect you to new customers and suppliers and make your voice heard in government.

Call 01676 526030