4 March 2021

How we’ve seen the industry make use of CBILS

The Coronavirus Business Interruption Loan Scheme (CBILS) was initially announced as part of the 2020 Budget and made available from 23rd March last year. With just a few weeks left before 31st March application deadline, Mark Nelson, director of Compass Business Finance, shares how he’s seen printers make use of the scheme.

“As an accredited lender from the outset, we were impressed at how quickly the British Business Bank rolled CBILS out and helped equip us to start supporting customers.

In the weeks that followed we were inundated with enquiries, turning the vast majority away, so we could focus on supporting businesses within sectors including, print and packaging where we have years of expertise and experience. Most of the requests we received during the first lockdown were for cashflow support so that businesses could weather the immediate pressures caused by a halt in production.

We also made ourselves available to talk to people and explain the options they had available. Particularly in the early days when there was a lot of misinformation and confusion in the market on who could access which schemes and how.

As we moved towards the summer and lockdown restrictions eased, a growing number of companies looked at strategic investments. One widely held misconception has been that companies can only make use of CBILS if their business has been adversely affected by coronavirus. If there’s been a negative effect on your cashflow - which could even have been caused by an increase in business - you are able to utilise the scheme.

The CBIL scheme has different variants, so where businesses had initially taken term loans, many were coming back to us for secondary or tertiary facilities to support specific aspects of their business. It is important businesses know they can access as many CBILS supported facilities as they need, to a maximum of £5million.

Well into our third lockdown, the ways in which we’re supporting businesses is as varied as it was before the pandemic, still utilising CBILS we’ve been supporting everything from Investments, Capital Release and Term Loans to Mergers and Acquisitions, New Ventures and Relocations.

The most important thing to consider now is whether your business will need finance for anything over the next 12-18 months. If so, it’s worth speaking to your finance provider before 31 March. We are expecting another business support scheme to be launched following CBILS, but it’s unlikely to be as favourable.”

Intergraf Economic News (Paper Prices) - March 2024

Intergraf Economic News (Paper Prices) - March 2024

18 March 2024

Access the latest edition of the Economic Newsletter for the European Printing Industry for data on paper consumption, and pricing data for pulp, paper and recovered paper. Data for packaging papers and board is also available with this edition.

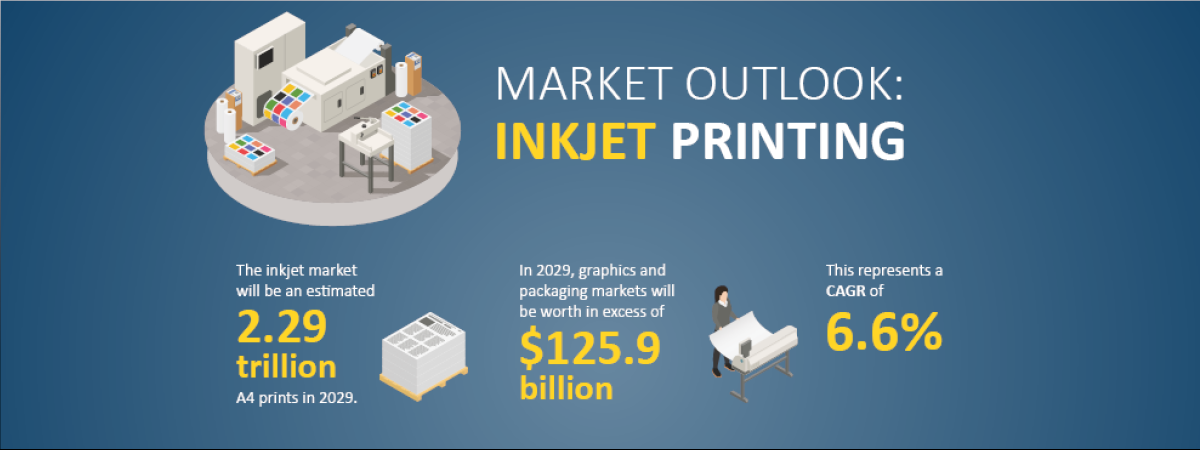

UK to follow global expansion of inkjet printing

UK to follow global expansion of inkjet printing

21 March 2024

The latest expert analysis from Smithers identifies the potential of the latest generation of inkjet systems to improve profitability across the global print market. Read more about the new report The Future of Inkjet Printing to 2029.

The BPIF is the printing industries champion. By becoming a member you join a diverse and influential community. We help you solve business problems, connect you to new customers and suppliers and make your voice heard in government.

Call 01676 526030