February 2022

Energy Sector Update from Schneider Electric

Energy wholesale prices have simply exploded, and we are in a full-blown energy price crisis. It is virtually certain that the government will have to act, with the taxpayer likely to underwrite mitigation measures to protect the billpayer. Expect this help to be focussed on the domestic market and the poorest. For this reason, the government has so far rejected requests for VAT to be reduced, as it wouldn't target help at the least well-off. For businesses who hadn't fixed their price last summer, or who weren't fully hedged for 2022, eye-watering increases are being seen. Some 'auto-adjusting' passthrough charges for renewable subsidies have been cut due to high market prices (the Contracts for Difference cost), however this is lost in the noise of the stratospheric commodity prices being seen.

So what is happening? This is a story of market panic, underpinned by global economic recovery, supply concerns and geopolitics. European gas storage stocks are very low, exacerbated by Russian exports that have also been very low in comparison to recent years. The Russians say they are meeting their obligations, which is likely true, however in normal times the price signals being screamed from Europe would be met with surging supply through pipelines. Instead, more of a trickle. Suspicions are that Russia is playing politics with its threatened invasion of Ukraine and wants Europe to comply. Meanwhile, it also wants Europe to approve the already-constructed NordStream 2 pipeline across the Baltic Sea direct to Germany, because it could then bypass Ukraine - through which much Russian gas currently flows to Europe. Ukraine currently earns significant transit fees for this gas. The supply shortfall is being made up to an extent by LNG tankers from the US and Middle East, but at a price (we are competing with bubbling Asian markets). Meanwhile, a cold and relatively windless few months has combined with French nuclear outages to drive up the proportion of European electricity being generated by gas, and to a lesser extent, coal. The gas price spike therefore causes an electricity price spike. And because fossil fuels are dirty, carbon allowance prices are surging to record highs too, as dirtier generation inflates demand for emissions trading permits - which boosts electricity prices even more.

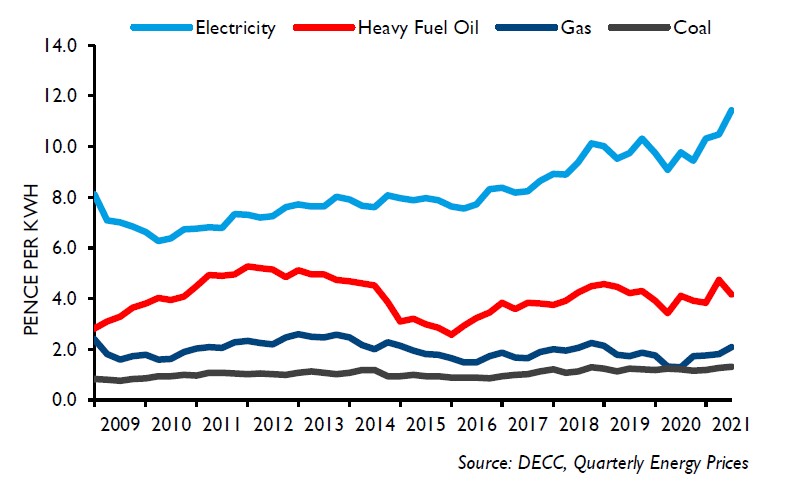

MANUFACTURING INDUSTRY FUEL PRICES - IN CASH TERMS

The effect on prices is scarcely believable. Oil is the least impacted so far. In the period since the last Outlook's analysis, Brent crude has risen $6, or around 8%, to $90 / barrel. Meanwhile, sterling has fallen around 2% against the dollar to $1.34/£, meaning that the rise in oil prices has been higher for UK customers - 9.4%. Compared with a year ago, Brent crude is around 40% higher.

The effect on prices is scarcely believable. Oil is the least impacted so far. In the period since the last Outlook's analysis, Brent crude has risen $6, or around 8%, to $90 / barrel. Meanwhile, sterling has fallen around 2% against the dollar to $1.34/£, meaning that the rise in oil prices has been higher for UK customers - 9.4%. Compared with a year ago, Brent crude is around 40% higher.

Gas markets have actually fallen back from unprecedented levels pre-Christmas, but that offers little solace. Year-ahead natural gas wholesale quotations (out of April 22) have more than doubled since the last Outlook, that year-ahead price is essentially 5 times the price from a year ago. Electricity year-ahead markets are an incredible 84% up compared to our last update and are 3.7 times the level seen a year ago. To break things down into a unit cost basis, electricity wholesale prices were around 5.5p per unit (or kWh) last February - but are now essentially 20p per kWh. This doesn't include grid, transportation, or tax.

These are unprecedented times in European energy markets, and the fallout has the potential to eclipse Covid at the top of the political agenda in 2022.

To understand the impacts in more detail, Schneider Electric is hosting a webinar (European Energy Markets Overview: Decarbonisation & Price Volatility) on Wednesday 16 February at 2pm. If interested, you can register on the link below.

Source: David Hunter, Director of Market Studies at Schneider Electric

Downloads Intergraf Economic News (Paper Prices) - March 2024

Intergraf Economic News (Paper Prices) - March 2024

March 2024

Access the latest edition of the Economic Newsletter for the European Printing Industry for data on paper consumption, and pricing data for pulp, paper and recovered paper. Data for packaging papers and board is also available with this edition.

UK to follow global expansion of inkjet printing

UK to follow global expansion of inkjet printing

March 2024

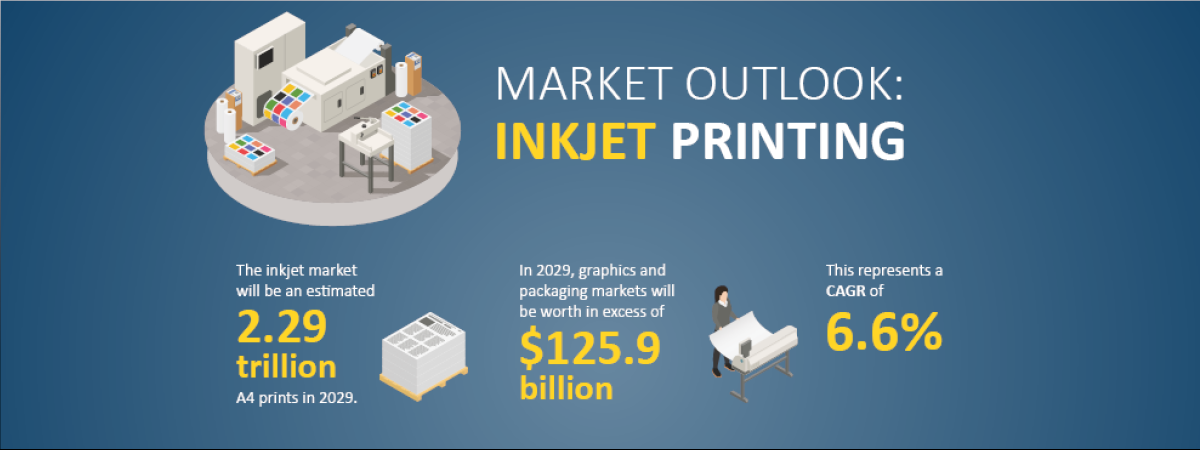

The latest expert analysis from Smithers identifies the potential of the latest generation of inkjet systems to improve profitability across the global print market. Read more about the new report The Future of Inkjet Printing to 2029.