22 March 2023

Inflation: what goes up, must come down - but not just yet!

Around this time last year we published an article to help explain inflation - what it is, how it is measured, what causes it, how it might be controlled and why inflation matters - click here to get a reminder of that.

One year on, and just as it looked like inflation might have started a steady descent from its peak, we are now seeing that the downhill path may not be entirely straightforward.

It's time to provide an update on current inflation rates.

What's the current rate of inflation?

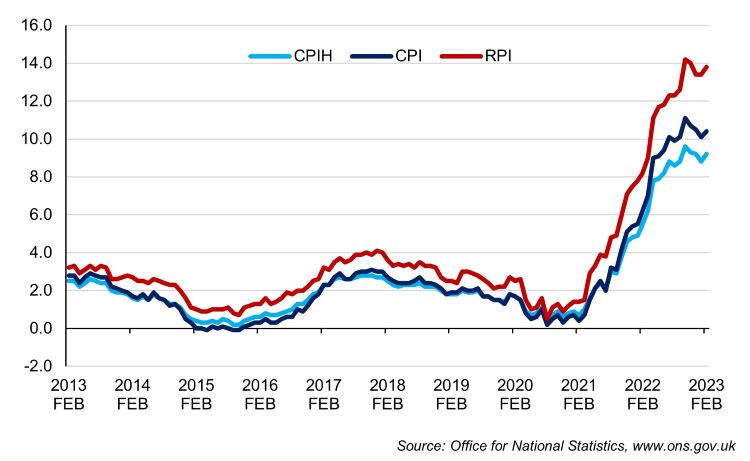

- CPI inflation was 10.4% in the 12 months to February 2023, up from 10.1% in January.

- CPIH inflation was 9.2% in the 12 months to February 2023, up from 8.8% in the 12 months to January.

- RPI inflation was 13.8% in the 12 months to February 2023, up from 13.4% in the 12 months to January.

ANNUAL INFLATION - %

The chart reminds us that just over two years ago we were still pondering whether interest rates would be forced to turn negative to combat deflationary pressures. Fast forward two years and we are still in an extended period of double-digit inflation that will renew pressure on the Bank of England's Monetary Policy Committee to increase interest rates for the eleventh time in fifteen months.

The largest upward contributions to the latest inflation figures have come from restaurants and cafes, food, and clothing. Downward contributions have come from recreational and cultural goods, and services (particularly recording media), and motor fuels.

Despite the latest upward movement in inflation, the longer-term outlook remains improved. As energy prices come down, inflation is expected to fall sharply to 2.9% per cent by the end of 2023, according to the forecasts provided by the Office for Budget Responsibility (OBR) in their March 2023 Economic and Fiscal Outlook - that was referred to heavily by the Chancellor as he delivered his Spring Budget.

And what has caused this improved outlook? Primarily a quicker than previously expected drop in wholesale gas prices, meaning that energy bills will fall below the energy price guarantee limits. Nevertheless, some concerns remain over domestically generated inflation from wage growth.

The improved outlook had meant that Interest Rates (currently at 4%) were expected to peak at around 4.25% later this year. The next decision on interest rates will be taken by the Bank of England's MPC on the 23rd of March, the surprise increase in inflation may encourage the next interest rate increase to be sooner rather than later.

QUARTERLY CPI INFLATION - %

What about the Printing Industry?

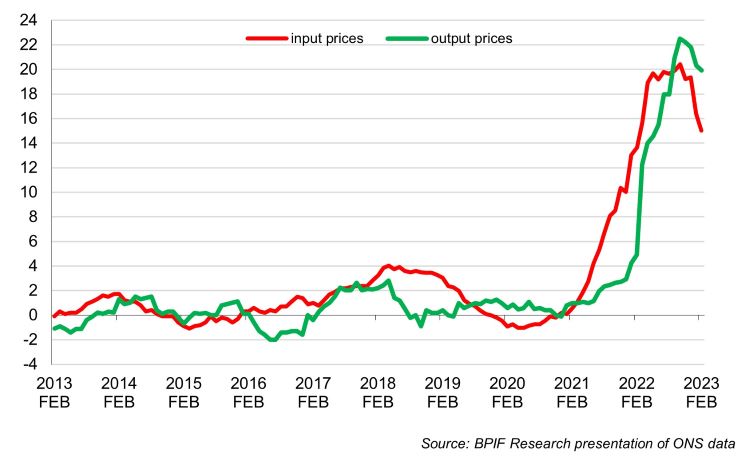

As well as Consumer Price Inflation, the ONS also calculates Producer Price Inflation (PPI), this comes from a monthly survey that measures the price changes of goods bought and sold by UK manufacturers. PPI provides a key measure of inflation, alongside other indicators such as the CPI.

The input price indices measure change in the prices of materials and fuels bought by UK manufacturers for processing. These are not limited to just those materials used in the final product, but also include what is required by the company in its normal day to day running.

The output price indices measure change in the prices of goods produced by UK manufacturers (these are often called 'factory gate prices').

As well as providing the headline rates of inflation for UK manufacturers the ONS provides some analysis categorised by industry sector. The sector most closely aligned with the majority of the printing industry is Printing and reproduction services of recorded media (SIC 18). This excludes printed cartons, labels and some items of printed stationery; but does include about 75% of the printing industry.

- Input price inflation for the printing industry was 15.0% in the 12 months to February 2023, down from 16.4% in January.

- Output price inflation was 19.9% in the 12 months to February 2023, down from 20.3% in the 12 months to January.

UK PRINTING INDUSTRY ANNUAL INPUT AND OUTPUT INFLATION - %

Printing industry output price inflation has been running higher than input price inflation for six months (shown by the green line being above the red line in the chart), this is unusual. Often there is a time lag of five to six months before price increases are passed through form inputs to outputs (reflecting client contracts, material stocks and often a general unwillingness to risk losing work by increasing prices). However, the severity of current inflation levels means that a significant gap built up as input prices increase outstripped price increases throughout 2021 and much of 2022. Even with a few months during which output price increase have been above input price increases, the latest indices tell us that, in the eight years since 2015, input prices have increased by over 40%, whilst output prices have increased by 30%. According to the ONS, over the same time period, the average cost of a pint of milk has increased by 67%.

Is there any further information on costs and prices in the printing industry?

BPIF members can access further analysis of the ONS PPI data for the UK printing industry here.

BPIF members also have access to a lot of further information in our quarterly Printing Outlook survey and report. Further information is available here.

There is also further information on pulp, paper and board prices available to members in the Intergraf Economic News reports. Further information is available here.

Downloads Mail response and attention continue on an upward trajectory in Q1 2024

Mail response and attention continue on an upward trajectory in Q1 2024

14 June 2024

JICMAIL - The Joint Industry Currency for Mail – has revealed that while the UK economy grappled with the recovery from a technical recession, those advertisers who maintained their confidence in the mail channel were rewarded with 43% year on year growth in purchases driven by mail.

Sustainability Research - industry efforts gain pace to improve sustainability impact and credentials

Sustainability Research - industry efforts gain pace to improve sustainability impact and credentials

6 June 2024

Access a special extract of the sustainability research conducted as part of the BPIF's Printing Outlook - quarterly survey of the state of trade in the UK's printing industry.