25 March 2022

We don't talk about Inflation!

That used to be the case - alas, no longer. Inflation has well and truly grabbed the headlines in 2022. We'll have a closer look at the current rate of inflation shortly; but first, here's our inflation 101.

What is Inflation?

Simply speaking, inflation is the term used to describe the general increase in prices over a period of time. It is normally reported as a % increase over a year.

How is inflation measured?

The Office for National Statistics (ONS) continuously monitors the cost of over 700 items that consumers regularly purchase. This collection of goods and services is often referred to as the inflation shopping 'basket'. The basket includes everyday items such as bread or bus tickets, but also some large purchases like cars and holidays.

The contents of the basket are regularly reviewed, so as to reflect evolving consumer taste, and items can be removed and added. Most recently doughnuts, men's suits and coal have been removed, whilst meat-free sausages, canned pulses, sports bras, pet collars and antibacterial surface wipes have been added.

There are different types of inflation, the headline measures are now:

Consumer Prices Index (CPI). The CPI is produced to international standards and in line with European regulations, it is the inflation measure used in the government's target for inflation.

Consumer Prices Index including owner occupiers' housing costs (CPIH). CPIH is the most comprehensive measure of inflation. It extends the Consumer Prices Index (CPI) to include a measure of the costs associated with owning, maintaining and living in one's own home, known as owner occupiers' housing costs (OOH), along with Council Tax. Both are significant expenses for many households and are not included in the CPI.

Historically the Retail Prices Index (RPI) provided the headline rate of inflation. The RPI is no longer considered to meet the required standard. However, the ONS recognises that it is widely used in contracts and so continues to calculate and publish the RPI.

The ONS also collects data to calculate and monitor Producer Price Inflation - this is changes in the prices of goods bought and sold by UK manufacturers, including price indices of materials and fuels purchased (input prices) and factory gate prices (output prices). (More on this later.)

What causes inflation?

Mathematically, when the cost of items in the inflation basket goes up then there will be inflation. But what causes prices to increase?

Demand - if the economy is close to full employment and firms reach full capacity then they are likely to put up prices. If there are labour shortages then wages will increase and provide greater purchasing power which in turn will pull up prices (increased money supply, cut in interest rates and higher wages can all lead to demand-pull inflation).

Costs - if firms experience an increase in their costs that act as a constraint on supply and are passed on to consumers (increasing wages, material costs, energy costs and import prices and taxes can all lead to cost-push inflation).

Other factors such as exchange rates, inflation expectations, changes in the money supply and temporary shocks can influence inflation.

Can inflation be controlled?

In the UK the Bank of England has been tasked by Government with keeping inflation low and stable. The target is 2.0% for CPI inflation.

The Bank uses interest rates as the main tool to control inflation. An interest rate is the amount of money people get on any savings they have. It's also the charge they need to pay on their loans and mortgages. Higher interest rates make it more expensive for people to borrow money and encourages them to save. Therefore, when interest rates increase, people are inclined to spend less. In turn, a reduction in expenditure on goods and services acts as a brake on prices increase and inflation.

Conversely, lower interest rates mean it's cheaper to borrow money, and there's less of an incentive to save. This encourages people to spend and increases the rate of inflation.

The Bank of England sets the Bank Rate, more commonly known as the base rate, or simply the interest rate. This is the single most important interest rate in the UK because it influences all other interest rates. The Bank Rate determines the interest rate the Bank pays to commercial banks that hold money with us. It then influences the rates those banks charge people to borrow money or pay on their savings.

The Bank can also influence the money supply. By buying and selling bonds from financial markets (generally government bonds, or 'gilts'). This is called quantitative easing (or QE) and enables the Bank to increase the money supply by injecting more cash into the economy.

Why does inflation matter?

Inflation is effectively a decrease in the purchasing power of money. If household incomes do not keep parity with inflation, their real income falls (they can't afford to buy as much) and their standard of living declines. This is complicated further by the fact that individual prices change to different degrees and at different times - thereby affecting the relative purchasing power for distinct groups of consumers to different degrees. This leads to there being 'winners' and 'losers' as interest rates change - and can be a big societal issue.

Inflation is not all bad - is it?

A low and stable rate of inflation is considered to be healthy for economic growth. If inflation is too high or unpredictable it becomes more difficult for people to plan their expenditure, savings and investment. If it is low and predictable, then it is easier to account for it in contracts and wage reviews. Also, if people have some certainty that prices will be slightly higher in the future, they are more inclined to make purchase decisions sooner rather than later - thereby boosting economic growth.

What's the current rate of inflation?

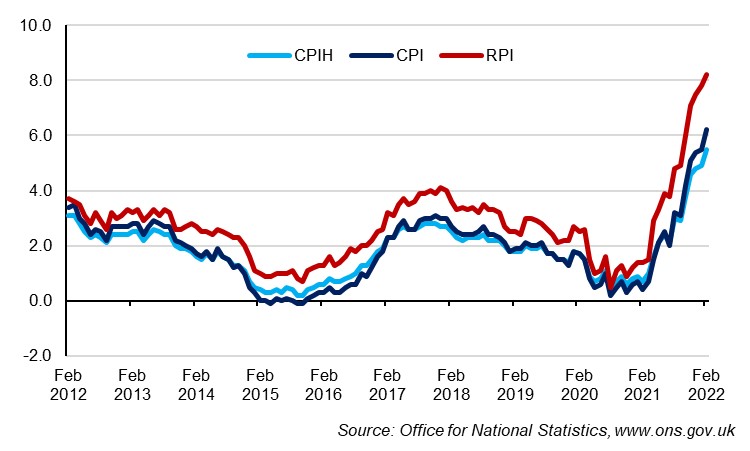

- CPI inflation was 6.2% in the 12 months to February 2022, up from 5.5% in January.

- CPIH inflation was 5.5% in the 12 months to February 2022, up from 4.9% in the 12 months to January.

- RPI inflation was 8.2% in the 12 months to February 2022, up from 7.8% in the 12 months to January.

ANNUAL INFLATION - %

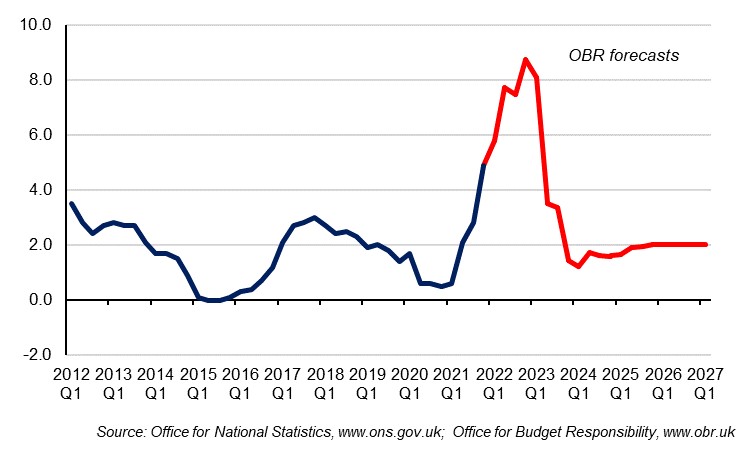

As recently as 2020 we had the prospect of deflation and negative interest rates. Times have changed, quickly. The 6.2% increase in CPI is the highest level of inflation experienced for 30 years - it has been stimulated by surging food, energy and fuel costs. Prices are rising faster than wages and there is an expectation that inflation could even reach double digits at some point this year. Fuel bills are expected to rise further, and tax changes will add to the pressure on household incomes.

Higher energy, freight and wage costs have been getting passed on to consumers, and Russia's invasion of Ukraine is further inflating the cost of commodities and energy.

QUARTERLY CPI INFLATION - %

What about the Printing Industry?

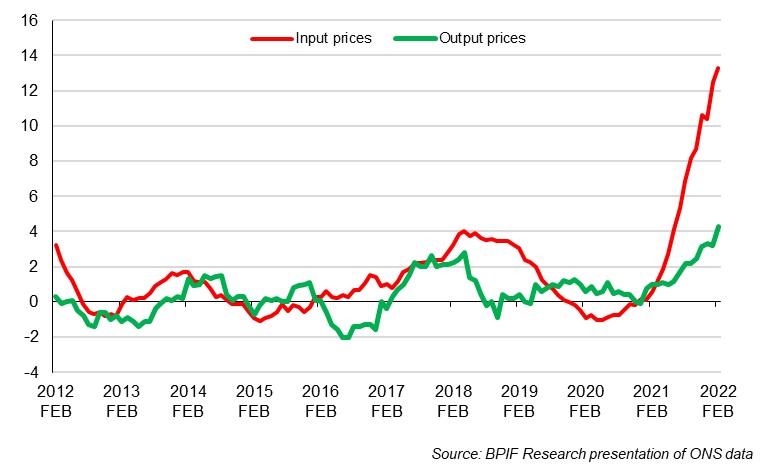

As mentioned, the ONS also calculates Producer Price Inflation (PPI), this comes from a monthly survey that measures the price changes of goods bought and sold by UK manufacturers. PPI provides a key measure of inflation, alongside other indicators such as the CPI.

The input price indices measure change in the prices of materials and fuels bought by UK manufacturers for processing. These are not limited to just those materials used in the final product, but also include what is required by the company in its normal day to day running.

The output price indices measure change in the prices of goods produced by UK manufacturers (these are often called 'factory gate prices').

As well as providing the headline rates of inflation for UK manufacturers the ONS provides some analysis categorised by industry sector. The sector most closely aligned with the majority of the printing industry is Printing and reproduction services of recorded media (SIC 18). This excludes printed cartons, labels and some items of printed stationery; but does include about 75% of the printing industry.

- Input price inflation for the printing industry was 13.3% in the 12 months to February 2022, up from 12.5% in January.

- Output price inflation was 4.3% in the 12 months to February 2022, up from 3.2% in the 12 months to January.

UK PRINTING INDUSTRY ANNUAL INPUT AND OUTPUT INFLATION - %

Is there any further information on costs and prices in the printing industry?

BPIF members have access to a lot of further information in our quarterly Printing Outlook survey and report. Further information is available here.

There is also further information on pulp, paper and board prices available to members in the Intergraf Economic News reports. Further information is available here.

Downloads Intergraf Economic News (Paper Prices) - March 2024

Intergraf Economic News (Paper Prices) - March 2024

18 March 2024

Access the latest edition of the Economic Newsletter for the European Printing Industry for data on paper consumption, and pricing data for pulp, paper and recovered paper. Data for packaging papers and board is also available with this edition.

STUDY EXPOSES HIGH COST OF PHARMACIES PRINTING MEDICAL INFORMATION LEAFLETS

STUDY EXPOSES HIGH COST OF PHARMACIES PRINTING MEDICAL INFORMATION LEAFLETS

7 March 2024

Intergraf welcomes the release of a study by our partner MLPS (Medical Leaflet = Patient Safety), a subgroup of the European Carton Manufacturers Association (ECMA) shedding light on the potential economic costs associated with the proposed use of Print on Demand (PoD) leaflets in the pharmaceutical legislation revision.

The BPIF is the printing industries champion. By becoming a member you join a diverse and influential community. We help you solve business problems, connect you to new customers and suppliers and make your voice heard in government.

Call 01676 526030