January 2024

Northern Ireland - stuck in second gear

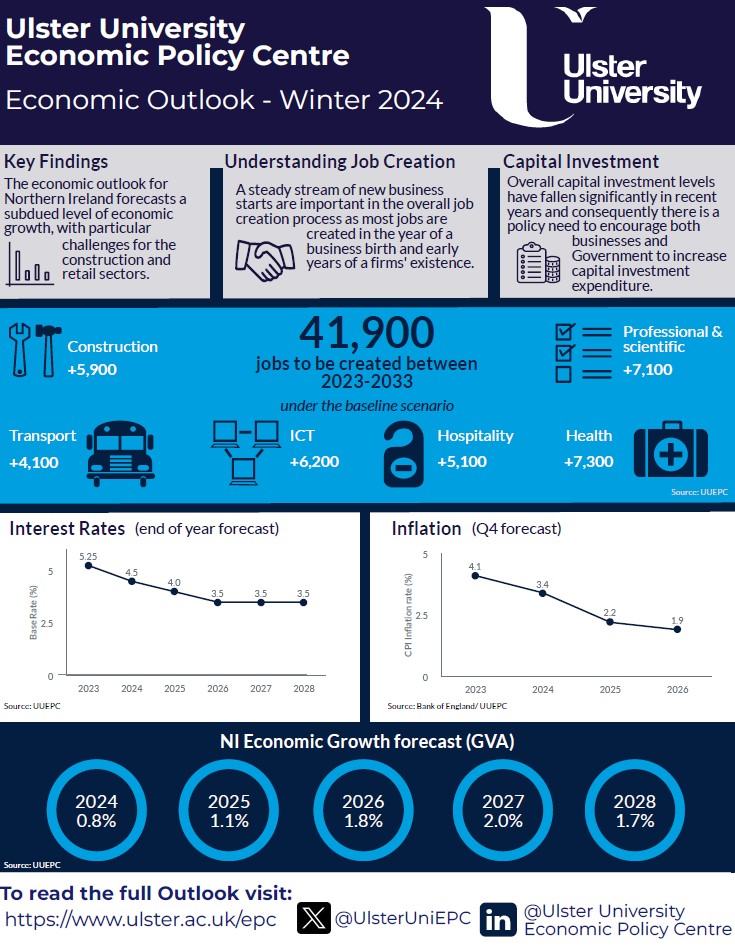

UUEPC have released their economic forecasts for 2024 and beyond suggesting subdued level of economic growth. The forecasted growth rate for Northern Ireland in 2024 is 0.8%, representing a slight decrease of 0.1% compared to last year. Low-level growth predictions are a similar outlook for the UK at 0.7%. This means that there remains the risk of a technical recession.

Despite low growth, UUEPC forecast an additional 41,900 jobs could be created in Northern Ireland by 2033 in a baseline scenario, in an upper scenario 77,600 jobs could be created. Jobs in Health and Social Work and the Professional and Scientific sectors are estimated to experience the largest increase in jobs.

The current cycle of monetary tightening appears to have peaked, but there remains a significant divergence in expectations about the pace of interest rate reductions between the Bank of England and the wider financial markets. The markets are now anticipating base rates in the region of 4.0% to 4.25% by years end, but Andrew Bailey, the Bank of England Governor, is sticking to his "higher for longer" mantra, implying perhaps only two quarter-point reductions this year. For our part, the UUEPC is striking a middle ground with three quarter-point reductions over the course of the year.

Of course all this is data dependent. It takes approximately 18-24 months for the full impact of interest rate rises to fully transfer through to the economy and therefore many of the more recent rises have still to take effect. As a result, with an economy already in very low growth mode, the risk of a technical recession remains high, but in that scenario one would expect the Bank to reduce interest rates more quickly.

Either way, it is essential that both the UK Government (Conservative or Labour) and any returning Executive focus on economic policies to take us out of this current low growth gear.

Source: UUEPC Outlook - Winter 2024

Geopolitical concerns are likey to remain elevated with uncertainties regarding US and UK elections, conflict in the Middle East and Ukraine, and NI's continued political limbo but employment growth remains positive and there has been some indication of stronger growth at the end of 2023. Hopes are building that the Bank of England and Government will indeed be able to navigate a soft landing for the economy. Ulster University economists are calling for more productivty growth, driven not just by labour market growth but increased capital investment.

Download and read the full Outlook below.

Downloads Pay Review Data, Wage Benchmarking and Cost of Living – MAY 2024 UPDATE

Pay Review Data, Wage Benchmarking and Cost of Living – MAY 2024 UPDATE

May 2024

We have collated data from multiple sources that should be useful for BPIF members that are approaching internal pay reviews, and/or are having a closer look at their pay and benefits structure. The datafile, first published in February 2023, has been updated with the latest available data - and additional content on factors exerting pressure on pay settlements in 2024.

Output and order growth maintained in Q1 - confidence boost for Q2 as growth expectations rise

Output and order growth maintained in Q1 - confidence boost for Q2 as growth expectations rise

May 2024

The UK’s printing and printed packaging industry has performed positively in terms of output and order growth in Q1, though lacking any dramatic improvements. However, the confidence outlook has undoubtedly taken a step up for Q2 – and orders and output are expected to grow more strongly.