18 October 2019

DfE NI monthly economic update – October 2019

In its latest economic outlook update, the OECD projects that the global economy will grow by 2.9% in 2019, a downward revision of 0.3pps from its May outlook. Likewise, global growth in 2020 is expected to be 3.0%, which is 0.4pps lower than the May projection. These are the weakest annual projected growth rates since the financial crisis. Growth in the Euro Area is expected to be 1.1% in 2019 before falling to 1.0% in 2020. The UK economy is forecast to 1.0% in 2019 and by 0.9% in 2020.

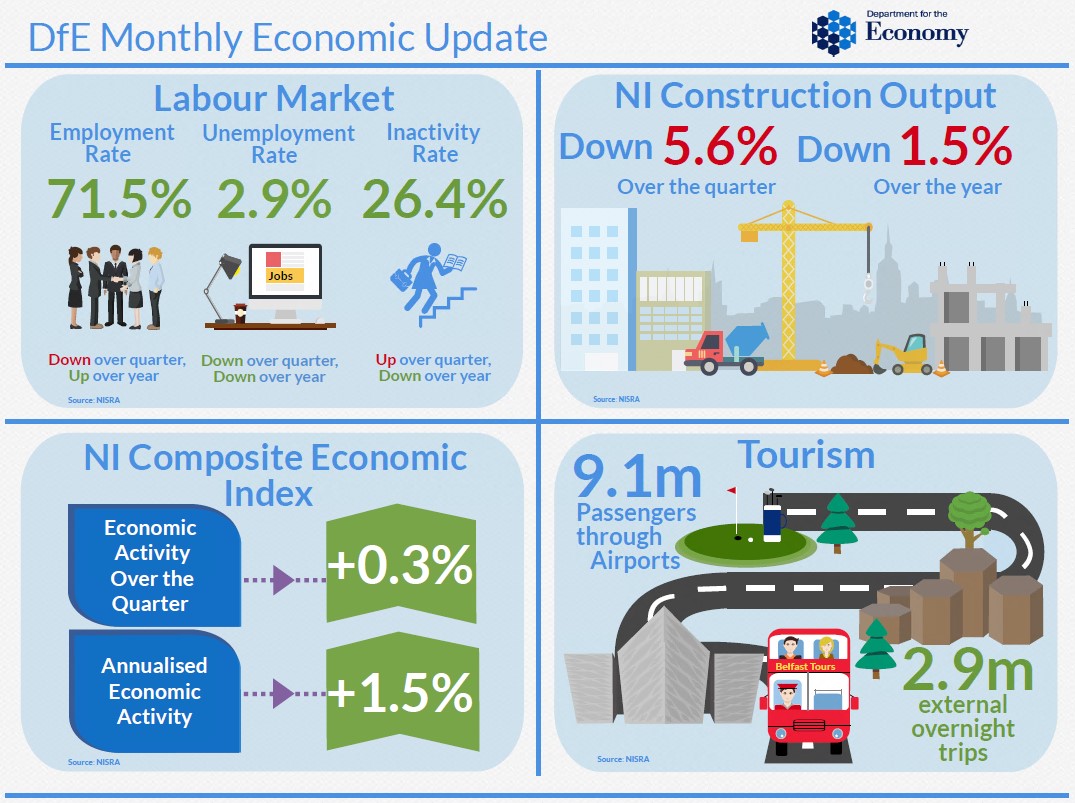

The latest Northern Ireland labour market statistics show that the estimated unemployment rate for the period June-August 2019 decreased over both the quarter and the year to 2.9%. The NI rate is below the UK (3.9%), the RoI (5.3%) and the EU (6.3%) rates. The employment rate stood at 71.5%, down by 0.3pps over the quarter but up by 1.7pps over the year. The economic inactivity rate remains the highest of all UK regions at 26.4%.

The latest Northern Ireland Composite Index indicates that economic output increased by 0.3% over the quarter and by 1.0% over the year to Q2 2019. The increase over the year was driven by an increase in the Production sector (+0.6pps), the Services sector (+0.3pps) and the Public sector (+0.2pps), but was partially offset by a decrease in the Construction sector (-0.1pps). The average annualised output growth for the four quarters to Q2 2019 was 1.5% compared to the previous four quarters.

According to the latest NI Construction Bulletin the total volume of construction output in Q2 2019 decreased by 5.6% compared with Q1 2019 and was 1.5% lower compared with the same quarter in 2018. The decrease from the previous quarter was driven by a 6.0% fall in Repair and Maintenance and 2.8% decline in New Work. Despite fluctuations, the total volume of construction output in NI has been on an upward trend since Q4 2013.

There were an estimated 2.9 million overnight trips made by external visitors in the year to March 2019, up from 2.6 million in the year to March 2018. External visitor spend fell slightly however to £660 million, down from £665 million in the previous 12 month period. There were 9.1 million air passengers flowing through Northern Ireland airports in the year up to March 2019. This represents a 7% increase on the previous 12 month period to March 2018.

The latest Ulster Bank PMI indicated that the local private sector moved deeper into contraction as EU Exit and associated economic uncertainty impact negatively on firms. Business Activity fell from 45.4 in August to 43.6 in September, its lowest since November 2012. The pace of decline in employment, new orders and exports all accelerated last month relative to August. Business Sentiment dropped to a record low during September.

The latest NI Chamber of Commerce Quarterly Economic Survey highlights the deterioration of Northern Ireland's economic performance this quarter. Many of its key indicators are negative and at an 8+ year low. NI is the bottom performing UK region for 8 of the 14 key manufacturing balances and 10 of the 14 key services balances, suggesting that the impact of EU Exit uncertainty is being felt more harshly in NI than anywhere else.

The latest AIB Brexit Sentiment Index reports that economic and political uncertainty around EU Exit continues to weigh heavily on business sentiment in NI. Almost half of NI SMEs (47%) say that EU Exit is having a negative impact on their business now and two thirds (66%) have either postponed or cancelled investment/expansion plans.

Source: DfE Analytical Services Division October 2019

Downloads Pay Review Data, Wage Benchmarking and Cost of Living – MAY 2024 UPDATE

Pay Review Data, Wage Benchmarking and Cost of Living – MAY 2024 UPDATE

16 May 2024

We have collated data from multiple sources that should be useful for BPIF members that are approaching internal pay reviews, and/or are having a closer look at their pay and benefits structure. The datafile, first published in February 2023, has been updated with the latest available data - and additional content on factors exerting pressure on pay settlements in 2024.

Intergraf Economic News (Paper Prices) - April 2024

Intergraf Economic News (Paper Prices) - April 2024

19 April 2024

Access the latest edition of the Economic Newsletter for the European Printing Industry for data on paper consumption, and pricing data for pulp, paper and recovered paper.

The BPIF is the printing industries champion. By becoming a member you join a diverse and influential community. We help you solve business problems, connect you to new customers and suppliers and make your voice heard in government.

Call 01676 526030