14 December 2015

NI business conditions improve in November

The latest Ulster Bank NI PMI has been released.

The PMI is a monthly survey of carefully selected companies. It provides an advance indication of what is happening in the private sector economy by tracking variables such as output, new orders, employment and prices.

Here are the main points:

- The Northern Ireland private sector saw a general pick-up in growth momentum during November.

- Output, new orders and employment all rose at faster rates than in the previous month

- Backlogs of work increased for the first time since August

- The rate of cost inflation accelerated slightly and output prices increased fractionally

- The headline seasonally adjusted Business Activity Index rose to 52.6 in November from 51.8 in the previous month

- However, output in Northern Ireland continued to rise at a slower pace than the UK average

- Manufacturing production decreased for the first time in ten months

- Higher output was linked by respondents to new order growth, in turn supported by improved client confidence and advertising campaigns.

- New business increased at the fastest pace in three months.

- New export orders stagnated, meanwhile, amid reports that the strength of sterling had made new business from abroad harder to secure.

- Staffing levels rose at the fastest pace in 14 months during November amid higher output requirements.

- Three of the four monitored sectors posted increases in employment, the exception being manufacturing where job cuts were recorded for the third month running.

Commenting on the latest survey findings, Richard Ramsey, Chief Economist Northern Ireland, Ulster Bank, said:

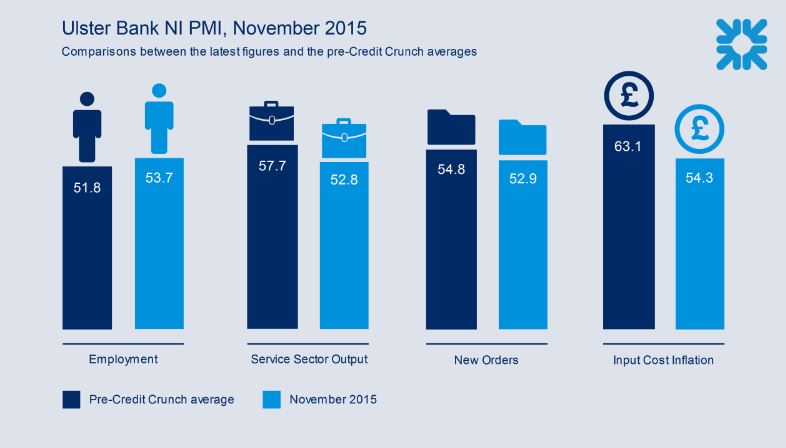

"Northern Ireland's private sector reported a notable improvement in business conditions in November. The pace of growth in business activity and new orders accelerated relative to the modest levels of expansion recorded in October. However, these rates of growth remain below the pre-recession historical average. Meanwhile firms increased their staffing levels at their fastest rate in 14 months. Furthermore, the pace of employment growth continues to rise at a faster rate than the pre-downturn long-term average.

"The improvement in services and construction firms concealed a slowdown in retail sales and outright contraction within manufacturing. Retail sales are easing from a period of very strong growth. However the performance of the manufacturing sector is of more concern, with output, new orders and employment all falling in November. Manufacturers have reduced their headcount in each of the last three months. This comes ahead of a significant number of high profile redundancies, already announced, but due to take place next year. While the return of pay rises coupled with 'noflation' will support consumer spending and therefore the retail sector next year, 2016 does not look as if it will be a great year for manufacturing."

"Underneath the positive headlines the performance at a sector level was somewhat mixed. The overall pick-up in the rate of growth in business activity, new orders and employment was due to the services and construction industries. The latter posted its strongest rates of growth in output and new orders in over a year.The full report, comment and slides are available on the Ulster Bank economics website on the link below.

Downloads Pay Review Data, Wage Benchmarking and Cost of Living – MAY 2024 UPDATE

Pay Review Data, Wage Benchmarking and Cost of Living – MAY 2024 UPDATE

16 May 2024

We have collated data from multiple sources that should be useful for BPIF members that are approaching internal pay reviews, and/or are having a closer look at their pay and benefits structure. The datafile, first published in February 2023, has been updated with the latest available data - and additional content on factors exerting pressure on pay settlements in 2024.

Intergraf Economic News (Paper Prices) - April 2024

Intergraf Economic News (Paper Prices) - April 2024

19 April 2024

Access the latest edition of the Economic Newsletter for the European Printing Industry for data on paper consumption, and pricing data for pulp, paper and recovered paper.

The BPIF is the printing industries champion. By becoming a member you join a diverse and influential community. We help you solve business problems, connect you to new customers and suppliers and make your voice heard in government.

Call 01676 526030