7 June 2016

Brexit or Brin? What does the printing industry think?

In the run-up to the EU referendum on 23 June 2016, there has been no shortage of support for either view. But what's the stance of the UK's printing and packaging companies? We canvassed opinions from BPIF members, and this is what we have uncovered.

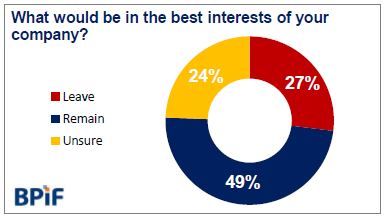

Considerably more of the industry is in the 'remain' camp than in the 'leave' camp. But there are still a significant number of undecideds who could yet have a major say on the final referendum results.

The main concerns regarding the potential impact on the printing industry should the UK public endorse Brexit and vote to leave the EU are:

- The impact upon supply chains

- Access to EU markets

- The ability to attract investment from companies in the EU

45% of respondents thought that their supply chains would be negatively impacted should the UK leave the EU. This response drowned out the 1% believing that leaving the EU would positively influence their supply chains. 37% of respondents did not envisage any impact, with the remaining 17% unsure if the impact would be favourable or unfavourable. There were similar results when rating the impact on access to trade in EU markets and attracting investment from EU companies.

One generally perceived positive impact was the expectation of a reduction in the regulatory burden on business as a result of leaving the EU.

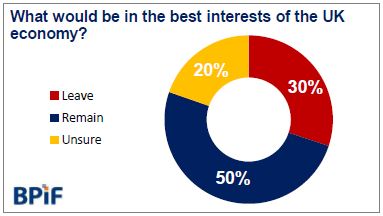

Opinions were not widely different when respondents were asked their opinions on what would be the best course of action for the UK economy.

There were slightly fewer undecided respondents when asked what would be in the best interest of the UK economy as a whole. Both the 'remain' and 'leave' grew marginally from the company perspective. Currently, exactly half of the BPIF membership believes that the UK should remain within the EU.

As might be expected, the biggest concerns regarded access to EU markets, supply chains and the level of foreign direct investment to the UK.

Many printing and packaging companies source their supplies from outside the UK - hence the concerns regarding supply chains - but there is also a significant number of companies that rely on customers outside the UK too. Responses to the survey indicated that 81% had some reliance on exports, either directly or indirectly through their clients exporting.

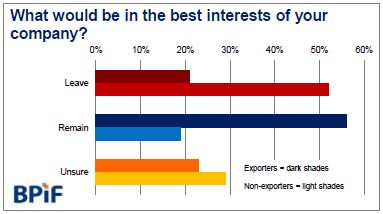

Views differed greatly when responses were analysed separately for exporters (including indirect exporters) and non-exporters. Understandably, companies that traded with the EU exhibited a majority (56%) in favour of remaining in the EU. But the converse is true for companies that do not export - a small majority (52%) believe it is in the interest of their companies for the UK to leave the EU.

Company size also has a bearing on the responses, with larger companies more likely to express a desire to remain within the EU than smaller companies.

The BPIF online survey (EU referendum - Brexit or Brin?) went live at the end of March and has stayed active throughout April and May. At the time of analysis, we had full, complete, cleansed and de-duplicated response data from 131 companies representing a combined turnover of £750 million and employing 7,701 people. The vast majority of responses are from managing directors/owners or other company directors. The results have been weighted so as to be representative of the BPIF's membership.

Downloads The General Election drives a 12% increase in JICMAIL panel volumes in Q2 2024

The General Election drives a 12% increase in JICMAIL panel volumes in Q2 2024

11 September 2024

The latest quarterly results from JICMAIL reveal that July's snap election prompted a healthy boost in mail volumes in Q2 2024, while at the same time the amount of time consumers spent looking at their mail and retaining it in the home increased across all mail types.

Intergraf Economic News (Paper Prices) - September 2024

Intergraf Economic News (Paper Prices) - September 2024

16 September 2024

Access the latest edition of the Economic Newsletter for the European Printing Industry for data on paper consumption, and pricing data for pulp, paper, and recovered paper.