10 February 2020

Northern Ireland PMI - slower fall in activity amid stabilisation in new orders

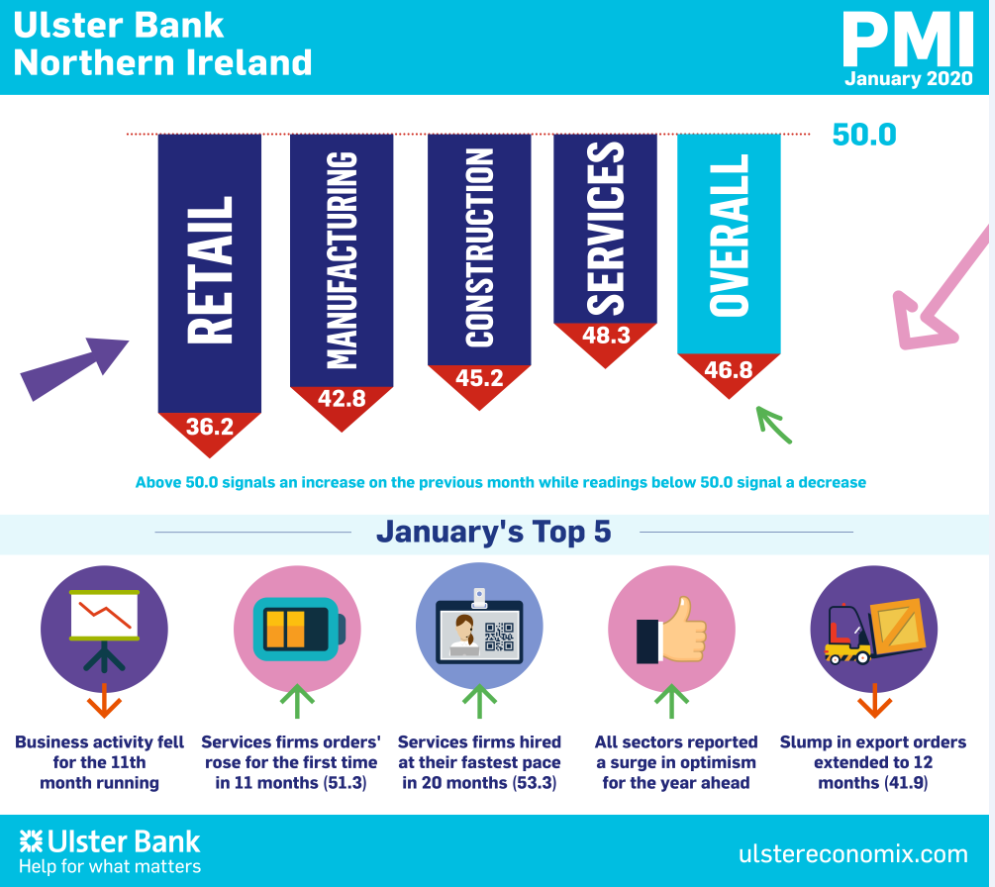

The January data from the Ulster Bank Northern Ireland PMI® - produced for Ulster Bank by IHS Markit - saw the Northern Ireland private sector move towards stabilisation amid a reduction in near-term uncertainty. Business activity fell at a softer pace thanks to broadly unchanged new order volumes. Meanwhile, firms raised their staffing levels for the second month running and business confidence was the highest since April 2018.

Commenting on the latest survey findings, Richard Ramsey, Chief Economist Northern Ireland, Ulster Bank, said:

"Brexit and political uncertainty blighted the UK private sector in December, resulting in only one region, London, managing to record growth in output. January was a different story though, with nine of the 12 regions posting an increase in business activity last month and only one recording a fall in employment. Clearly the decisive General Election result and the passing of the Withdrawal Bill in Parliament provided a much-needed boost to business confidence.

"Unfortunately, Northern Ireland wasn't one of the nine UK regions to record business activity growth last month. However, the rate of decline did ease. And following 12 months of contraction, the fall in new orders appears to have bottomed out. This reflects, a notable pick-up in domestic demand, but concerningly the export orders slump continues.

"Despite the overall weak demand in Northern Ireland's private sector, the pace of hiring has picked up, driven by the services and construction sector. The services sector's improvement can also be seen in a return to growth in new orders.

"The resurrection of Stormont has clearly provided a boost to business sentiment, and indeed all sectors now expect growth in business activity in a year's time. Construction firms are their most optimistic about the year ahead than at any time since the series began in March 2017. What is of course key though is the extent to which this increasing business confidence translates into rising business activity.

"Brexit uncertainty continues to be cited as the main factor behind the decline in new business from abroad. This issue is likely to remain until at least there is clarity on what the future trading agreement with the EU will be."

Key Quarterly Data for Q4 2019

- Business Activity, New Orders, Employment & Export Orders all posted 4 consecutive quarters of contraction

- Business Activity = 43.8 (lowest since Q4 2012 = 28 quarter low)

- New Orders = 42.5 (lowest since Q2 2012 = 30 quarter low)

- Employment = 49.4 (best quarter since Q4 2018)

- Exports = 40.3 (slightly better than Q3's 31 quarter low)

Sectoral Business Activity / Output Q4 2019

- Manufacturing = 48.8 (Best quarter since Q1 2019 but third successive quarter of contraction)

- Services = 47.2 (Best quarter since Q1 2019 but third successive quarter of contraction)

- Construction = 38.8 (weakest quarter since Q4 2012 = 28 quarter low and fifth successive quarter of contraction)

- Retail = 30.7 (weakest quarter since Q4 2008 and fifth successive quarter of contraction)

Source: Richard Ramsey, Chief Economist Northern Ireland, Ulster Bank.

Downloads Intergraf Economic News (Paper Prices) - March 2024

Intergraf Economic News (Paper Prices) - March 2024

18 March 2024

Access the latest edition of the Economic Newsletter for the European Printing Industry for data on paper consumption, and pricing data for pulp, paper and recovered paper. Data for packaging papers and board is also available with this edition.

STUDY EXPOSES HIGH COST OF PHARMACIES PRINTING MEDICAL INFORMATION LEAFLETS

STUDY EXPOSES HIGH COST OF PHARMACIES PRINTING MEDICAL INFORMATION LEAFLETS

7 March 2024

Intergraf welcomes the release of a study by our partner MLPS (Medical Leaflet = Patient Safety), a subgroup of the European Carton Manufacturers Association (ECMA) shedding light on the potential economic costs associated with the proposed use of Print on Demand (PoD) leaflets in the pharmaceutical legislation revision.

The BPIF is the printing industries champion. By becoming a member you join a diverse and influential community. We help you solve business problems, connect you to new customers and suppliers and make your voice heard in government.

Call 01676 526030