8 July 2019

Northern Ireland PMI - private sector downturn deepens

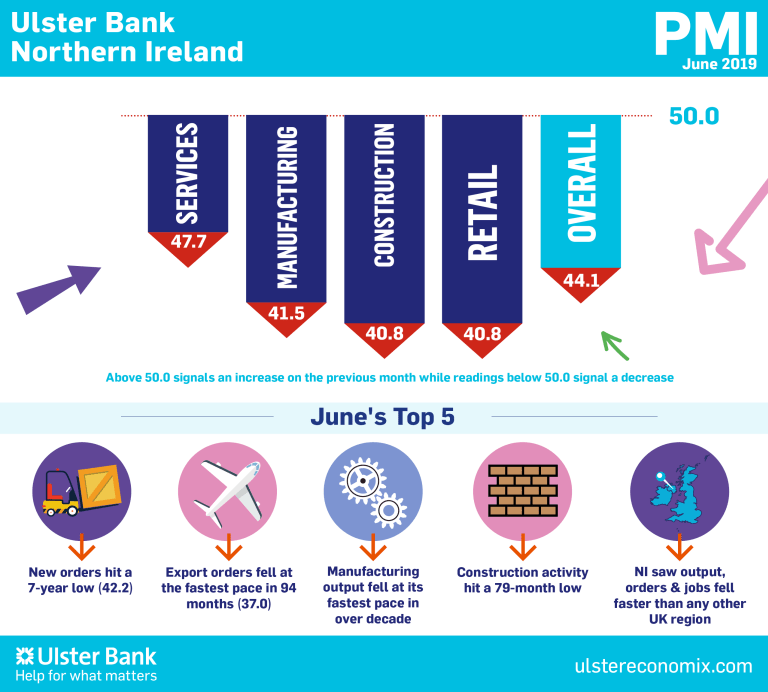

The June data from the Ulster Bank Northern Ireland PMI® - produced for Ulster Bank by IHS Markit - signals a deepening downturn in the Northern Ireland private sector. Brexit uncertainty led to sharper falls in output and new orders, with firms pessimistic regarding the 12-month outlook.

Commenting on the latest survey findings, Richard Ramsey, Chief Economist Northern Ireland, Ulster Bank, said:

"In the early part of 2019, it was difficult to get a true handle on where the Northern Ireland private sector was. We had a range of manufacturing firms stockpiling due to Brexit, which in some respects skewed the output figures. Now that the period of intensive stockpiling has passed, we are perhaps getting a truer reflection of the real state of play. And what we are now seeing is that all of the PMI's key indicators declined over the first half of the year, including output, employment, new orders and exports. After six years of growth, it appears that the economic cycle has turned. The severity or otherwise of that downturn will depend on a range of factors. The kind of Brexit that we see will of course be a major factor. But what is in no doubt is that the private sector overall is currently in a weaker state.

"Of particular concern are new orders and exports. Both domestic and overseas order books are contracting at a rapid rate, which suggests that activity will be subdued in the coming months. Indeed, export orders fell at their fastest pace in almost eight years. The manufacturing sector appears particularly weak at present, with output falling at its fastest pace in June for more than a decade. However, all sectors were in decline in June, with construction and retail also seeing very marked declines in activity.

"Northern Ireland is not alone in seeing a marked deterioration in business conditions in June. The UK as a whole reported a slump in manufacturing and construction activity as well, while service sector activity slowed to near stagnation. Global manufacturing is also in a downturn with US / China trade wars having a dampening effect. However, Northern Ireland's downturn is more pronounced than the UK's. Indeed, Northern Ireland's private sector posted the fastest rates of decline in output, new orders and employment of all the UK regions last month.

"However, it needs to be remembered that the Northern Ireland labour market is cooling from record levels, and indeed many firms who were having difficulty recruiting may not see that as entirely a bad thing. The decline in the employment figures in the latest PMI is therefore not concerning at this stage. The challenge will be whether that trend continues into the six and 12 months ahead."

The main findings of the June survey were as follows:

The headline seasonally adjusted Business Activity Index fell to 44.1 in June from 46.0 in May. The reading signalled a marked monthly reduction in output, and one that was the strongest since November 2012. Brexit and associated market uncertainty were behind the latest fall in activity, according to respondents. The decline was the fourth in as many months, and the most pronounced of all 12 UK regions covered. Steep declines were seen in construction, retail and manufacturing. Brexit uncertainty was also reportedly the main factor behind a sharp decline in new orders. New business decreased for the fifth successive month, and to the greatest extent in seven years. New export orders also fared badly, falling at a considerable pace that was the steepest since August 2011.

Falling new orders fed through to a further reduction in backlogs of work. Employment decreased for the sixth successive month in June. That said, in contrast to a number of the other variables monitored by the survey, the rate of job shedding softened to the weakest in four months.

The rate of input cost inflation ticked up from May's 22-month low and was broadly in line with the series average. Where input prices rose, panellists often linked this to higher staff costs. The rate of output price inflation also quickened, but remained modest. Business sentiment turned negative again in June, with companies pessimistic regarding the 12-month outlook for output for the fourth time in the past five months.

Source: Richard Ramsey, Chief Economist Northern Ireland, Ulster Bank.

Downloads Intergraf Economic News (Paper Prices) - March 2024

Intergraf Economic News (Paper Prices) - March 2024

18 March 2024

Access the latest edition of the Economic Newsletter for the European Printing Industry for data on paper consumption, and pricing data for pulp, paper and recovered paper. Data for packaging papers and board is also available with this edition.

STUDY EXPOSES HIGH COST OF PHARMACIES PRINTING MEDICAL INFORMATION LEAFLETS

STUDY EXPOSES HIGH COST OF PHARMACIES PRINTING MEDICAL INFORMATION LEAFLETS

7 March 2024

Intergraf welcomes the release of a study by our partner MLPS (Medical Leaflet = Patient Safety), a subgroup of the European Carton Manufacturers Association (ECMA) shedding light on the potential economic costs associated with the proposed use of Print on Demand (PoD) leaflets in the pharmaceutical legislation revision.

The BPIF is the printing industries champion. By becoming a member you join a diverse and influential community. We help you solve business problems, connect you to new customers and suppliers and make your voice heard in government.

Call 01676 526030