12 June 2019

Northern Ireland PMI - third successive fall in activity

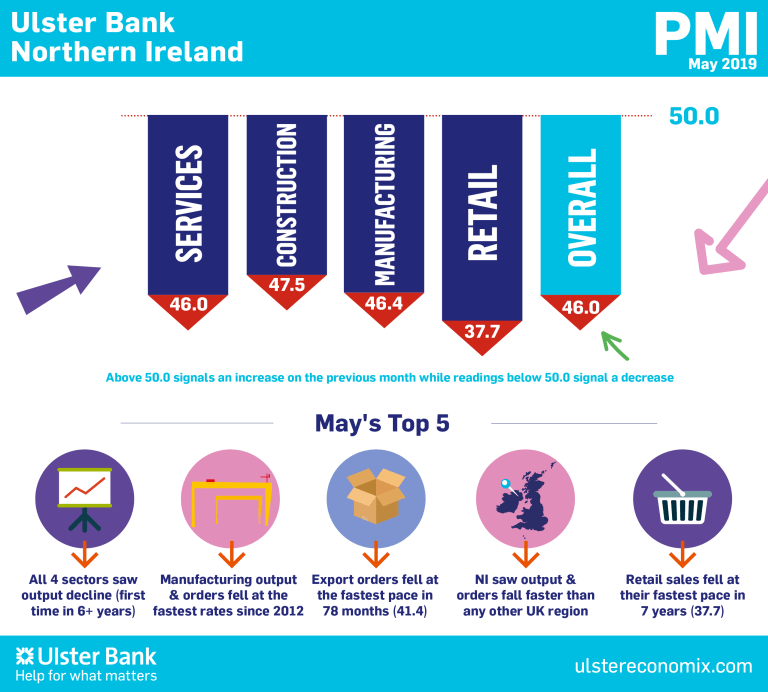

The latest Ulster Bank Northern Ireland PMI® report - produced for Ulster Bank by IHS Markit - indicated that the Northern Ireland private sector remained in contraction territory. Activity and new business continued to fall markedly, often linked to Brexit uncertainty. In turn, companies lowered their staffing levels again. There was some relief on the price front, as the rate of input cost inflation eased. That said, the extent of input price increases far outweighed that of selling charges again during the month.

Commenting on the latest survey findings, Richard Ramsey, Chief Economist Northern Ireland, Ulster Bank, said:

"What the latest PMI suggests is that the global slowdown which had been impacting other economies is now clearly evident within Northern Ireland. Brexit stockpiling by manufacturing companies had been inflating the performance of local firms in recent months. Now that the rapid phase of stockpiling activity has passed, the latest PMI data reflects the reality of current demand. This is weakening in both the domestic and overseas markets, with output at 76-month low and orders falling at an 81-month low.

"It's not just manufacturing that is weakening; all four sectors saw falling output for the first time in six years. Respondents in the retail sector pointed to sales activity falling at the fastest rate since May 2012, and retailers are scaling back their employment activity as a result.

"Looking ahead, orders books across all sectors suggest that the current period of weakness will continue. Construction firms have now reported falling orders for nine-successive months and retailers have been reporting falling sales every month in 2019 to date.

"In terms of employment, whilst private sector firms are continuing to reduce staffing levels, it should be remembered that this is from record employment highs and the labour market remains relatively strong. Notably, despite the current challenges, the level of pessimism amongst respondents regarding the 12-months ahead has eased. Indeed, Northern Ireland firms expect output to have risen in a year's time. So whilst firms expect challenges in the short-term - citing Brexit as one of the key factors - their expectations for the longer-term are marginally better."

The main findings of the May survey were as follows:

The headline seasonally adjusted Business Activity Index posted below the 50.0 no-change mark for the third month running in May, signalling an ongoing period of decline in Northern Ireland private-sector output. At 46.0, the reading was up fractionally from 45.8 in April. For the first time in more than six years, all four monitored sectors saw activity decrease. According to respondents, Brexit uncertainty was the main factor leading output to decline, while there were again mentions of the negative impact of the lack of government at Stormont.

New business decreased for the fourth successive month. Meanwhile, the rate of decline in new export orders continued to accelerate, and was the steepest in six-and-a-half years. As has been the case throughout 2019 so far, Northern Ireland companies lowered staffing levels in May. Panellists reported the non-replacement of leavers amid falling workloads. Falling new orders and ongoing Brexit uncertainty led companies to work through outstanding business.

Although input prices continued to increase at a sharp pace in May, the rate of inflation softened to the joint-weakest in almost three years. Companies responded to increases in input costs by raising their output prices. That said, the rate of charge inflation was only slight, and the second-weakest in 38 months. Companies expressed optimism in the 12-month outlook for business activity for the first time in four months, amid hopes that the securing of new contracts would support growth. That said, Brexit uncertainty meant that sentiment remained relatively weak, with firms in Northern Ireland by far the least optimistic in the UK.

Source: Richard Ramsey, Chief Economist Northern Ireland, Ulster Bank.

Downloads Intergraf Economic News (Paper Prices) - March 2024

Intergraf Economic News (Paper Prices) - March 2024

18 March 2024

Access the latest edition of the Economic Newsletter for the European Printing Industry for data on paper consumption, and pricing data for pulp, paper and recovered paper. Data for packaging papers and board is also available with this edition.

STUDY EXPOSES HIGH COST OF PHARMACIES PRINTING MEDICAL INFORMATION LEAFLETS

STUDY EXPOSES HIGH COST OF PHARMACIES PRINTING MEDICAL INFORMATION LEAFLETS

7 March 2024

Intergraf welcomes the release of a study by our partner MLPS (Medical Leaflet = Patient Safety), a subgroup of the European Carton Manufacturers Association (ECMA) shedding light on the potential economic costs associated with the proposed use of Print on Demand (PoD) leaflets in the pharmaceutical legislation revision.

The BPIF is the printing industries champion. By becoming a member you join a diverse and influential community. We help you solve business problems, connect you to new customers and suppliers and make your voice heard in government.

Call 01676 526030