14 May 2019

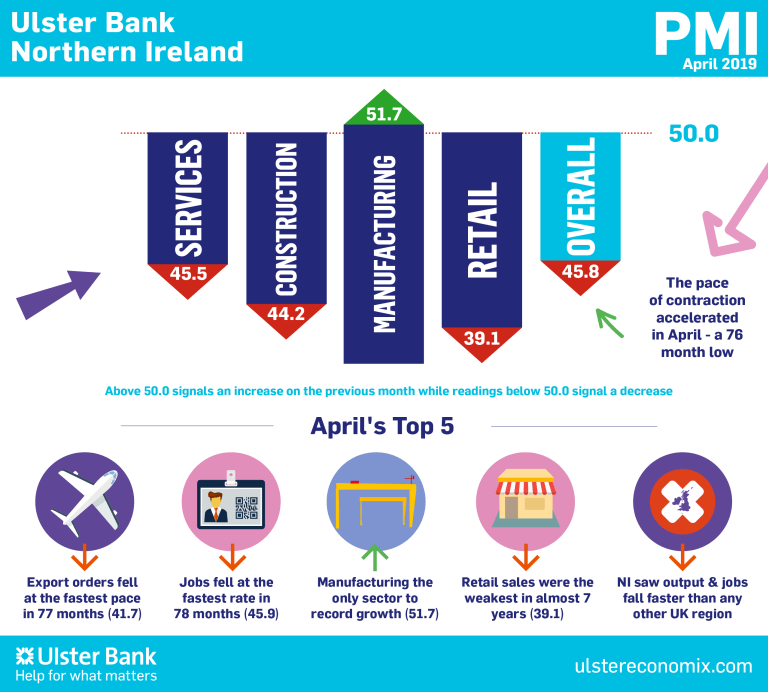

Northern Ireland PMI - sharpest fall in business activity since 2012

The latest Ulster Bank Northern Ireland PMI® report - produced for Ulster Bank by IHS Markit - signalled that the Northern Ireland private sector moved deeper into contraction territory.Business activity, new orders and employment all fell to the greatest extents since the final quarter of 2012, with Brexit and a lack of government at Stormont impacting negatively on operations. Weakening demand led companies to raise their selling prices at only a modest pace during the month, despite continued sharp input cost inflation.

Commenting on the latest survey findings, Richard Ramsey, Chief Economist Northern Ireland, Ulster Bank, said:

"April saw an improvement in business conditions across most of the UK regions. However, Northern Ireland was a notable exception to this trend. Indeed, rather than improving, the pace of contraction across a range of indicators accelerated. Private sector output, orders and employment posted their fastest rates of decline since the final quarter of 2012. As a result, Northern Ireland found itself at the bottom of the UK regional rankings for these measures. Brexit and the lack of a Stormont Executive continue to be cited as factors impacting negatively on local business. Looking ahead, there is no quick-fix for these issues.

"As in March, manufacturing remained the only sector to record an expansion in output. Renewed weakness was evident within services, retail and construction. All three of these sectors signalled a significant decline in activity in April. Services posted its weakest month since January 2013 and the slump in retail sales was the worst in almost seven years.

"Forward looking indicators continue to provide cause for concern. All sectors - including manufacturing - reported a quickening in the pace of contraction in new orders. Export orders fell at their fastest pace in 77-months which is a reflection of weakness in external markets. Notably, the Republic of Ireland - Northern Ireland's largest export market - saw output growth slip to one of its softest rates in six years. Faltering demand, whether from domestic or external sources, is increasingly filtering through to jobs. All sectors, bar construction, shed staff in April. Services firms reported their steepest declines in headcount since August 2012 while manufacturing firms reduced their staffing levels at their fastest pace in six years. Job losses amongst retailers remained modest in April but with confidence in this sector slumping to a series low this may change in coming months.

"Overall, aspects of Northern Ireland's private sector growth were flattered by the levels of stockpiling taking place in the run up to the anticipated Brexit date. Similarly, as stockpiling has eased off, this is perhaps having the opposite effect. April's PMI data is particularly downbeat relative to recent years but, outside of retail, it would be premature to read too much into it at this stage."

The main findings of the April survey were as follows:

The headline seasonally adjusted Business Activity Index dropped to 45.8 in April from 48.0 in March. This signalled a second successive monthly reduction in private sector output in Northern Ireland, and the steepest since December 2012. The fall in activity in Northern Ireland contrasted with a rise across the UK as a whole, and was the fastest of the 12 regions covered. Brexit was the main factor leading output to decline, but some companies also cited the lack of government in Northern Ireland.

The picture regarding new orders was similar to that of activity, with new business declining to the greatest extent since the end of 2012. Some panellists indicated that the delayed Brexit date meant that customers had reduced stockpiling activity. All four monitored categories recorded falls in new orders, led by retail. Meanwhile, Brexit worries also impacted negatively on exports. New business from abroad decreased at a substantial pace that was the fastest in almost six-and-a-half years. Falling new orders resulted in a further decline in outstanding business in April. With workloads declining sharply, companies opted not to replace departing staff members. As a result, employment decreased for the fourth month running.

Input prices continued to rise sharply in April, linked to higher staff costs and currency weakness. In contrast, the rate of output price inflation slowed to a 37-month low. Respondents indicated that falling customer demand reduced their pricing power.

Source: Richard Ramsey, Chief Economist Northern Ireland, Ulster Bank.

Downloads Intergraf Economic News (Paper Prices) - March 2024

Intergraf Economic News (Paper Prices) - March 2024

18 March 2024

Access the latest edition of the Economic Newsletter for the European Printing Industry for data on paper consumption, and pricing data for pulp, paper and recovered paper. Data for packaging papers and board is also available with this edition.

STUDY EXPOSES HIGH COST OF PHARMACIES PRINTING MEDICAL INFORMATION LEAFLETS

STUDY EXPOSES HIGH COST OF PHARMACIES PRINTING MEDICAL INFORMATION LEAFLETS

7 March 2024

Intergraf welcomes the release of a study by our partner MLPS (Medical Leaflet = Patient Safety), a subgroup of the European Carton Manufacturers Association (ECMA) shedding light on the potential economic costs associated with the proposed use of Print on Demand (PoD) leaflets in the pharmaceutical legislation revision.

The BPIF is the printing industries champion. By becoming a member you join a diverse and influential community. We help you solve business problems, connect you to new customers and suppliers and make your voice heard in government.

Call 01676 526030