10 December 2018

Northern Ireland private sector experiences faster rise in activity, but new order growth remains modest

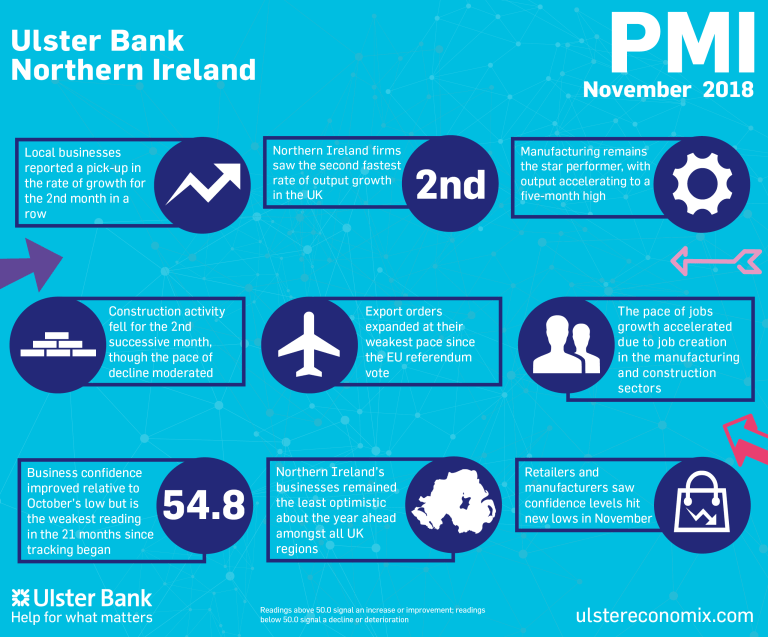

The newly released November data from the latest Ulster Bank Northern Ireland PMI® report - produced for Ulster Bank by IHS Markit - signalled that growth was maintained in the Northern Ireland private sector in November, with activity rising at a solid pace. That said, rates of expansion in output and new orders were weaker than seen earlier in the year and business confidence remained relatively muted.

Commenting on the latest survey findings, Richard Ramsey, Chief Economist Northern Ireland, Ulster Bank, said:

"As we approach the end of 2018, the PMI tells us that private sector firms in Northern Ireland remain in expansion mode across a range of indicators. This relatively strong end to the year means that 2018 will have been a better 12 months than had been anticipated. The latest survey points to rising business activity, expansion in order books, and staffing levels continuing to increase. Indeed, business activity and employment accelerated in November. Manufacturing is the main high-point of the latest survey, recording impressive rates of growth in orders books, employment and output.

"However, whilst continuing growth in the private sector is encouraging, the reality is that the rate of expansion is relatively subdued compared to longer-term averages. Indeed, the final three months of the year are shaping up to have the weakest rate of growth in nine quarters. Meanwhile export orders are set to have their weakest rate of growth in 10-quarters. Indeed, in November, the pace of export order growth slowed to its weakest rate since the EU Referendum.

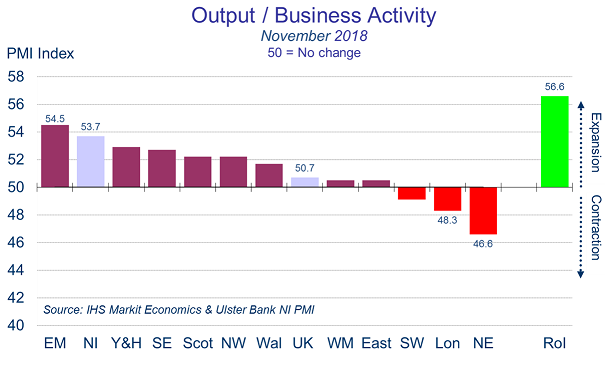

"This slowdown is clearly having an impact on sentiment for the year ahead. Business confidence improved in November from October's low, but this was solely due to the services sector. Retailers and manufacturers saw their confidence levels hit new lows when looking to the year ahead, while construction firms, which have been experiencing falling output and orders, expect more of the same next year. Another factor impacting on confidence in Northern Ireland is perhaps the relatively poor performance of the UK economy, which has experienced a marked slowdown in the fourth quarter. Indeed, three regions of the UK, including London and the South East, saw output fall in November. The overall health of the UK economy is the most important driver of activity in the Northern Ireland private sector. This trend therefore does not bode well for Northern Ireland in 2019."

The main findings of the November survey were as follows:

The headline seasonally adjusted Business Activity Index rose to 53.7 in November, thereby signalling a solid and accelerated monthly increase in output at companies in Northern Ireland. Up from 52.8 in October, the reading signalled the twenty-sixth successive monthly rise, and one that was much faster than the UK average. Three of the four monitored sectors saw output rise, led by manufacturing where production increased at the sharpest pace since June. The only category to record a drop in activity was construction, where a fall was registered for the second month running. New orders continued to increase, albeit at a slightly reduced pace amid some suggestions that Brexit had dampened demand. Brexit uncertainty was also mentioned as a factor restricting demand from abroad. Although new export orders continued to increase, the rate of expansion eased for the sixth successive month.

Backlogs of work decreased for the fourth month running, with the pace of reduction the most marked since August 2016. Meanwhile, companies in Northern Ireland continued to expand their workforce numbers. Moreover, the rate of job creation in November was solid, having quickened to a six-month high. The rate of input cost inflation eased to the weakest since August 2017 in November. That said, input prices continued to rise at a sharp pace amid higher staff costs and raw material price increases. Sterling weakness was again mentioned as a factor leading to higher cost burdens. Companies responded to rising input costs by increasing their output prices accordingly. Charges rose at a marked pace. Despite improving slightly in November, business confidence was the second-weakest since the series began in March 2017. Brexit was the foremost reason for pessimism.

Source: Richard Ramsey, Chief Economist Northern Ireland, Ulster Bank.

Downloads Intergraf Economic News (Paper Prices) - March 2024

Intergraf Economic News (Paper Prices) - March 2024

18 March 2024

Access the latest edition of the Economic Newsletter for the European Printing Industry for data on paper consumption, and pricing data for pulp, paper and recovered paper. Data for packaging papers and board is also available with this edition.

STUDY EXPOSES HIGH COST OF PHARMACIES PRINTING MEDICAL INFORMATION LEAFLETS

STUDY EXPOSES HIGH COST OF PHARMACIES PRINTING MEDICAL INFORMATION LEAFLETS

7 March 2024

Intergraf welcomes the release of a study by our partner MLPS (Medical Leaflet = Patient Safety), a subgroup of the European Carton Manufacturers Association (ECMA) shedding light on the potential economic costs associated with the proposed use of Print on Demand (PoD) leaflets in the pharmaceutical legislation revision.

The BPIF is the printing industries champion. By becoming a member you join a diverse and influential community. We help you solve business problems, connect you to new customers and suppliers and make your voice heard in government.

Call 01676 526030