9 July 2018

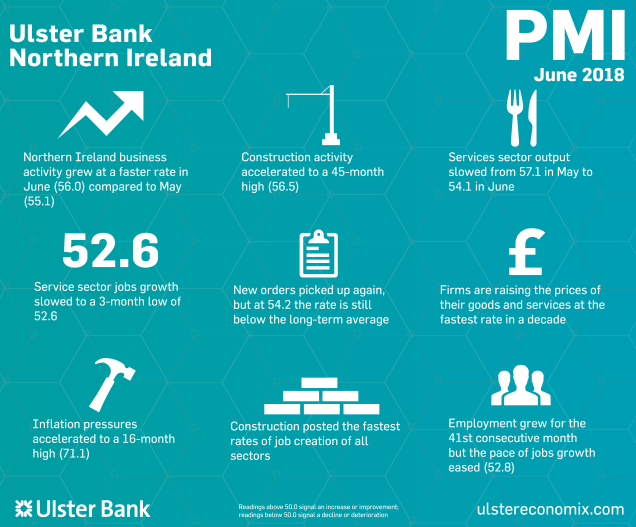

Northern Ireland business activity grew at a faster rate in June compared to May

The June data from the Ulster Bank Northern Ireland PMI® report – produced for Ulster Bank by IHS Markit – signalled that the Northern Ireland private sector ended the second quarter of 2018 on a positive note, with sharper rises in output and new orders recorded. There were further signs of increasing inflationary pressures, however. Meanwhile, business confidence dipped and was the lowest for almost a year.

Commenting on the latest survey findings, Richard Ramsey, Chief Economist Northern Ireland, Ulster Bank, said:

"Earlier this year, we were talking about how the Beast from the East adversely impacted on the Northern Ireland economy at the end of the first quarter. Last month, we saw the hottest June in more than 170 years, and this seems to have had the opposite effect, providing a boost to local businesses.

"Overall business activity and new orders rose at their fastest rates in four months during June, with export orders growth remaining particularly strong, driven by demand from customers in the Republic of Ireland. Meanwhile, firms increased staff numbers for the 41st consecutive month, albeit at a slightly slower rate than in May.

"At a sector level, manufacturing is the main beneficiary of the buoyant export environment, with output growth accelerating to a 44-month high in June. Construction output, meanwhile, accelerated sharply to a 45-month high, with the good weather a factor in high-levels of activity on building sites.

"Construction order books filled up at their fastest rate in 28-months, which bodes well for construction activity in the short-term. However, in the longer-term, construction firms are concerned that the pipeline of work will begin to dry up in the absence of decision-making in government around capital investment.

"In terms of the services and retail sectors, orders were much less buoyant than in manufacturing and construction. Services saw new orders growth ease, while retail remains the weakest of all sectors as far as orders are concerned.

"The one factor continuing to impact negatively across all sectors is inflationary pressures. Indeed, input cost inflation intensified in June, driven by higher wages, fuel cost increases and raw material price rises. Firms are passing these higher costs onto customers, meaning that they are raising the prices of their goods and services at the fastest rate in a decade.

"Inflationary pressures are rising faster in Northern Ireland than elsewhere in the UK, and linked to this, Northern Ireland firms are less optimistic than businesses in any other UK region. Whilst local firms are still relatively optimistic, their lower levels of confidence than amongst their UK counterparts can also be attributed to factors including Brexit and the local political situation. These issues, alongside skills shortages, will remain prevalent into the months ahead."

The main findings of the June survey were as follows:

The headline seasonally adjusted Business Activity Index rose to 56.0 in June, up from 55.1 in May and posting its highest reading since February. The data signalled a sharp and accelerated monthly increase in output, with growth in Northern Ireland outpacing the UK average. Good weather and stronger market conditions were reportedly behind the latest rise in output. These factors also supported new order growth in June. Although employment continued to increase during June, the rate of job creation eased from that seen in May. Construction firms posted the fastest rise in staffing levels, while manufacturers increased employment for the first time in three months.

June data pointed to building inflationary pressures in the Northern Ireland private sector, with rates of increase in both input costs and output prices quickening from May. In both cases, Northern Ireland recorded the sharpest inflation of all 12 UK regions. Panellists reported higher staff costs, as well as rising prices for fuel. Sterling weakness was also mentioned as a factor leading to higher cost burdens. The passing on of increased input prices to customers resulted in a sharp monthly rise in charges during June. Moreover, the rate of inflation quickened to the fastest since July 2008. Northern Ireland companies remained confident that output will increase over the coming year. That said, sentiment dipped from May to the lowest since July 2017.

Source: Richard Ramsey, Chief Economist Northern Ireland, Ulster Bank.

Downloads Intergraf Economic News (Paper Prices) - March 2024

Intergraf Economic News (Paper Prices) - March 2024

18 March 2024

Access the latest edition of the Economic Newsletter for the European Printing Industry for data on paper consumption, and pricing data for pulp, paper and recovered paper. Data for packaging papers and board is also available with this edition.

STUDY EXPOSES HIGH COST OF PHARMACIES PRINTING MEDICAL INFORMATION LEAFLETS

STUDY EXPOSES HIGH COST OF PHARMACIES PRINTING MEDICAL INFORMATION LEAFLETS

7 March 2024

Intergraf welcomes the release of a study by our partner MLPS (Medical Leaflet = Patient Safety), a subgroup of the European Carton Manufacturers Association (ECMA) shedding light on the potential economic costs associated with the proposed use of Print on Demand (PoD) leaflets in the pharmaceutical legislation revision.

The BPIF is the printing industries champion. By becoming a member you join a diverse and influential community. We help you solve business problems, connect you to new customers and suppliers and make your voice heard in government.

Call 01676 526030