16 April 2018

Slowest rise in NI private sector activity since July 2017

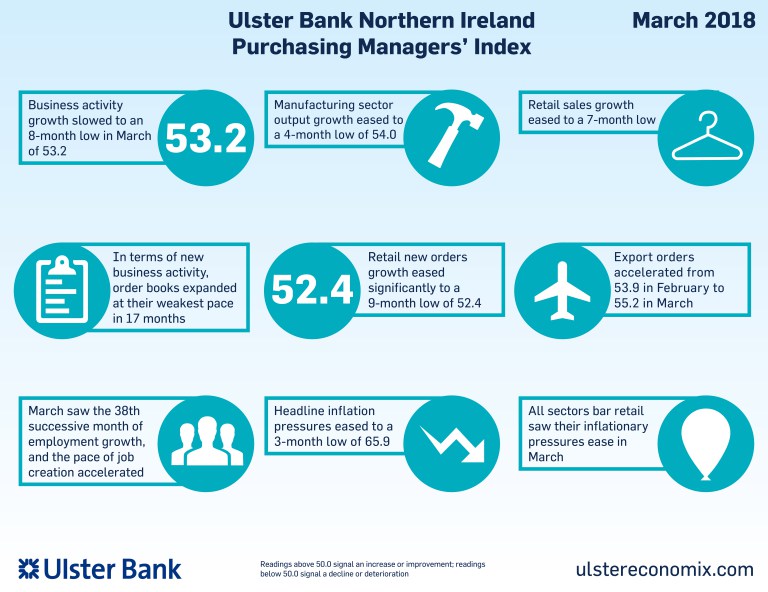

The March data from the Ulster Bank Northern Ireland PMI® report - produced for Ulster Bank by IHS Markit - pointed to weaker rises in both output and new orders at Northern Ireland companies.

That said, growth was sustained in March amid a stronger rise in exports, and firms increased their rate of job creation. Meanwhile, both input costs and output prices rose sharply again, albeit at slightly weaker rates than in February.

Commenting on the latest survey findings, Richard Ramsey, Chief Economist Northern Ireland, Ulster Bank, said:

"March brought the first quarter of the year to an end and in many respects it was a better three-month period than had been expected. However, the data from the March PMIs suggests that the private sector has come off the boil across Europe, including in the UK and Northern Ireland. The Beast from the East has clearly had an impact on activity in areas including construction and manufacturing and has also caused disruption to supply chains. Almost all regions of the UK experienced a slowdown last month, driven at least in part by the weather conditions, with Northern Ireland output and new orders easing to eight-month and 17-month lows respectively, with the services sector the worst hit. However, the one-off weather factor makes it difficult to ascertain to what extent this is a blip that will be reversed in April or something more fundamental.

"On a positive note, the pace of job-creation accelerated, as did export orders, with the latter buoyed up by the positive tailwinds coming from the Republic of Ireland, one of the fastest growing economies in Europe. Inflationary pressures also eased outside of retail but remain elevated, with high staff costs and sterling weakness as factors. Respondents also cited the higher cost of steel as a component in the inflationary pressures, in part due to high global demand. With steel and other raw materials being a target for tariffs, this trend could well continue and economies around the world will not want to see an escalation in the opening shots of a trade war.

"Interestingly, firms remain relatively optimistic about the year ahead, albeit that Northern Ireland's private sector is the least optimistic of all the UK regions for the third month running. Political uncertainty though is one risk firms have cited that could hamper growth prospects in the months ahead."

The main findings of the March survey were as follows:

- The headline seasonally adjusted Business Activity Index dropped for the second month running in March, down to 53.2 from 56.3 in February.

- The latest reading signalled a solid monthly increase in output, albeit one that was the slowest since July 2017.

- Growth slowed across each of the four sectors covered by the survey.

- Where activity increased, panellists linked this to higher new orders. That said, there were some reports of a softening of demand.

- This softening of demand was evident with regards to new orders, which increased only slightly and at the weakest pace in the current 17-month sequence of growth.

- In contrast to the trend in total new orders, new export business increased at a marked and accelerated pace.

- Staffing levels increased at a solid pace in March, and one that was faster than in February. Panellists reportedly raised workforce numbers in response to higher new orders and to help boost operating capacity.

- Northern Ireland companies continued to record strong rises in input costs during March, despite the rate of inflation easing to the weakest in 2018 so far. Higher staff costs were mentioned by a number of respondents, while sterling weakness contributed to higher prices for raw materials.

- Output prices also increased at a sharp, but reduced pace, with companies often passing on increased input costs to their clients.

- Companies remain confident that output will increase over the coming year, with sentiment broadly unchanged from February.

Source: Richard Ramsey, Chief Economist Northern Ireland, Ulster Bank.

Downloads Intergraf Economic News (Paper Prices) - March 2024

Intergraf Economic News (Paper Prices) - March 2024

18 March 2024

Access the latest edition of the Economic Newsletter for the European Printing Industry for data on paper consumption, and pricing data for pulp, paper and recovered paper. Data for packaging papers and board is also available with this edition.

STUDY EXPOSES HIGH COST OF PHARMACIES PRINTING MEDICAL INFORMATION LEAFLETS

STUDY EXPOSES HIGH COST OF PHARMACIES PRINTING MEDICAL INFORMATION LEAFLETS

7 March 2024

Intergraf welcomes the release of a study by our partner MLPS (Medical Leaflet = Patient Safety), a subgroup of the European Carton Manufacturers Association (ECMA) shedding light on the potential economic costs associated with the proposed use of Print on Demand (PoD) leaflets in the pharmaceutical legislation revision.

The BPIF is the printing industries champion. By becoming a member you join a diverse and influential community. We help you solve business problems, connect you to new customers and suppliers and make your voice heard in government.

Call 01676 526030