15 February 2018

Northern Ireland PMI - sharp rise in private sector activity at the start of 2018

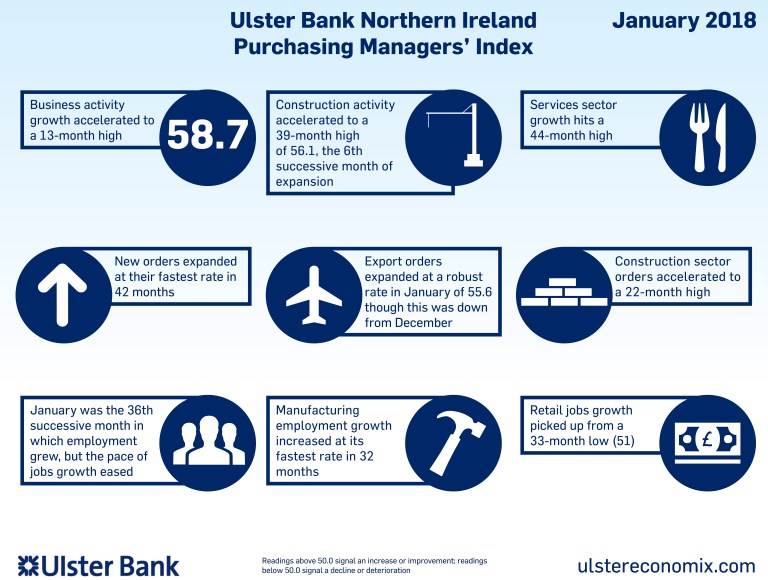

The Ulster Bank NI PMI for January 2018 shows a pick-up in growth momentum in the Northern Ireland private sector. Business activity rose at the fastest pace since December 2016. A sharper increase in input costs was also recorded, however companies continued to raise their prices at a marked pace.

Commenting on the latest survey findings, Richard Ramsey, Chief Economist Northern Ireland, Ulster Bank, said:

"Moving into 2018 the external economic environment has continued to strengthen. Global output growth hit a 40-month high in January. Meanwhile firms in the Eurozone posted their fastest rate of growth in almost 11½ years. This positive backdrop jars with the latest UK PMIs with the pace of growth decelerating across all sectors. The overall UK PMI eased to a 17-month low in January.

"According to the latest Ulster Bank PMI, Northern Ireland's private sector is following the trajectory of its global and Eurozone peers rather than the UK. Private sector growth amongst local firms accelerated to a 13-month high in January.

"Northern Ireland's rate of private sector expansion in January was the second fastest of all the UK regions. Retail remains the fastest growing sector. But the marked acceleration in the private sector output amongst Northern Ireland firms was due largely to construction and services. Output growth in these sectors hit 39-month and 44-month highs respectively. Meanwhile retail sales growth increased at its fastest rate in almost 4-years.

"Despite this strong demand, employment growth in retailing was very modest. Manufacturing was the one sector to report a slowdown in output growth in January. That said, manufacturing activity remains robust and above its historical long-term average. Indeed, manufacturers increased their staffing levels at their fastest rate in 32-months. Service and construction sector firms reported faster rates of jobs growth than manufacturing but both saw hiring ease relative to December.

"Alongside a pick-up in demand, Northern Ireland firms also report a pick-up in the rate of input cost inflation. January's reading marked an 8-month high and remains well above the inflation rates in the UK and its historical average. Higher fuel and wage costs were cited as factors with these most prevalent amongst manufacturers and retailers. Inflation pressures are expected to ease, but interest rate rises will be required.

"According to the PMI, January represented the best start to a year amongst Northern Ireland's private sector since 2007. Back then, the challenges that lay ahead were largely unseen and unknown. In contrast today, the geopolitical risks, fiscal challenges and ongoing Brexit uncertainty have certainly been well flagged. Despite these challenges, firms remain upbeat about the year ahead and the most optimistic since May 2017. What does or doesn't happen with Brexit will have a large bearing on whether this optimism is realised."

The main findings of the January survey were as follows:

- The headline seasonally adjusted Business Activity Index rose to a 13-month high of 58.7 in January, from 56.9 in December. The reading pointed to a substantial monthly rise in output at Northern Ireland companies, and one that was much faster than the UK average.

- Central to the latest rise in output were increases in new business and improving client demand. New orders expanded sharply, with the rate of growth little-changed from December's 40-month high.

- Backlogs of work were accumulated again in January. Companies indicated that higher new orders and issues with the supply of materials had been behind the latest build-up of outstanding business.

- Firms responded to higher workloads by taking on additional staff. The rate of job creation eased from December but was solid and faster than the UK average.

- Higher fuel prices and increased staff costs were the key factors behind another monthly rise in input prices at the start of the year. The rate of inflation quickened to the fastest since May 2017, with the retail and manufacturing sectors seeing the steepest increases.

- Prices charged continued to rise sharply as panellists responded to higher input costs. Further positivity was signalled by data on business confidence, with optimism among firms the strongest since May 2017.

- The launch of new products, further growth of new orders and a favourable exchange rate are all set to support increases in output over the coming year.

Source: Richard Ramsey, Chief Economist Northern Ireland, Ulster Bank.

Downloads

Intergraf Economic News (Paper Prices) - March 2024

Intergraf Economic News (Paper Prices) - March 2024

18 March 2024

Access the latest edition of the Economic Newsletter for the European Printing Industry for data on paper consumption, and pricing data for pulp, paper and recovered paper. Data for packaging papers and board is also available with this edition.

STUDY EXPOSES HIGH COST OF PHARMACIES PRINTING MEDICAL INFORMATION LEAFLETS

STUDY EXPOSES HIGH COST OF PHARMACIES PRINTING MEDICAL INFORMATION LEAFLETS

7 March 2024

Intergraf welcomes the release of a study by our partner MLPS (Medical Leaflet = Patient Safety), a subgroup of the European Carton Manufacturers Association (ECMA) shedding light on the potential economic costs associated with the proposed use of Print on Demand (PoD) leaflets in the pharmaceutical legislation revision.

The BPIF is the printing industries champion. By becoming a member you join a diverse and influential community. We help you solve business problems, connect you to new customers and suppliers and make your voice heard in government.

Call 01676 526030