15 May 2017

Sharpest rise in output so far in 2017

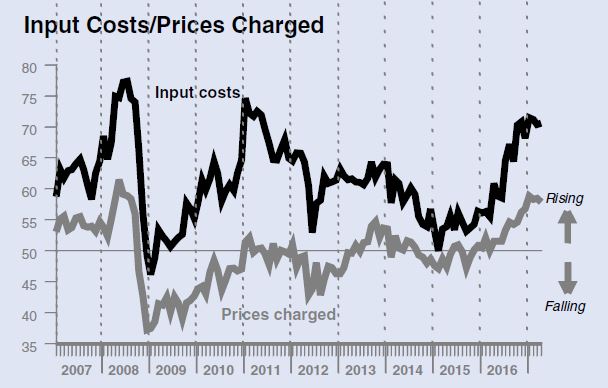

The April data from the Ulster Bank Northern Ireland PMI® report - produced for Ulster Bank by Markit - signalled the strongest rise in business activity of the year-to-date, while new orders continued to increase solidly and companies were optimistic of further output growth over the coming year. Meanwhile, the rate of job creation accelerated. On the price front, both input costs and output charges continued to rise sharply.

Commenting on the latest survey findings, Richard Ramsey, Chief Economist Northern Ireland, Ulster Bank, said:

"Northern Ireland's private sector has had an encouraging start to the second quarter of 2017. This was reflected in faster rates of growth in activity, export orders and employment. Indeed, output rose at its fastest pace so far this year, and firms increased their staffing levels more quickly than at any point in the last ten months. Inflationary pressures remain a challenge though, with sterling's recent bout of weakness pushing costs higher. Input cost inflation remains most acute for manufacturers. But retailers and service sector firms are far from immune, seeing their cost bases increase at the fastest rates since September 2008 and March 2011 respectively.

"Retailers have enjoyed a cross-border shopping tailwind since June last year. Not surprisingly though the rapid rates of growth in retail sales activity have eased significantly. The pace of job creation in retailing has also slowed, to its weakest rate since July 2015.

"In terms of the wider services sector, its recovery has been rather subdued of late. However, April's PMI survey reveals a marked improvement in conditions. Service sector output hit a 12-month high, whilst new orders and employment hit 13-month and 7-month highs respectively. Outside of services, manufacturing activity remains relatively buoyant, but construction firms saw activity stagnate and new orders contract in April.

"Overall, despite the ongoing uncertainty with Brexit, Northern Ireland's private sector firms remain confident about growth prospects for the year ahead. However, they are not as optimistic as their counterparts in Great Britain."

The main findings of the April survey were as follows:

- The headline seasonally adjusted Business Activity Index increased to 54.3 in April, up from 53.9 in March and pointing to the fastest rise in output during 2017 so far.

- Service providers posted the sharpest expansion in activity for a year, while manufacturing production also rose at a stronger pace.

- Construction activity was broadly unchanged over the month.

- Companies mainly linked higher output to increased new orders, which rose at a solid pace that was the same as seen in March.

- A number of respondents mentioned signs of improving client demand.

- Total new orders were supported by a further sharp rise in new business from outside the UK, often reflecting success in the Republic of Ireland as a result of sterling weakness.

- The rate of job creation picked up and was the sharpest in ten months. Job creation was widespread across the four monitored sectors.

- Meanwhile, backlogs of work decreased for the second month running in April, albeit only marginally. Panellists linked the reduction in outstanding business to the completion of projects.

- While helping firms to secure new export orders, the weakness of sterling also remained a main factor behind input cost inflation in April.

- The latest rise in input prices was substantial and slightly faster than in March.

- Manufacturers again posted the fastest rise, although multi-year highs were seen with regards to cost inflation for services and retail companies.

- The pass through of higher cost burdens to clients resulted in a further sharp rise in output prices, albeit the weakest in the year-to-date.

- Newly released data on business confidence shows that firms in Northern Ireland expect growth of activity to continue over the coming year.

- Sentiment picked up from that seen in March, with optimism largely reflective of predictions of sustained new order growth.

Downloads

Intergraf Economic News (Paper Prices) - March 2024

Intergraf Economic News (Paper Prices) - March 2024

18 March 2024

Access the latest edition of the Economic Newsletter for the European Printing Industry for data on paper consumption, and pricing data for pulp, paper and recovered paper. Data for packaging papers and board is also available with this edition.

STUDY EXPOSES HIGH COST OF PHARMACIES PRINTING MEDICAL INFORMATION LEAFLETS

STUDY EXPOSES HIGH COST OF PHARMACIES PRINTING MEDICAL INFORMATION LEAFLETS

7 March 2024

Intergraf welcomes the release of a study by our partner MLPS (Medical Leaflet = Patient Safety), a subgroup of the European Carton Manufacturers Association (ECMA) shedding light on the potential economic costs associated with the proposed use of Print on Demand (PoD) leaflets in the pharmaceutical legislation revision.

The BPIF is the printing industries champion. By becoming a member you join a diverse and influential community. We help you solve business problems, connect you to new customers and suppliers and make your voice heard in government.

Call 01676 526030