9 August 2016

NI output declines for first time in 15 months

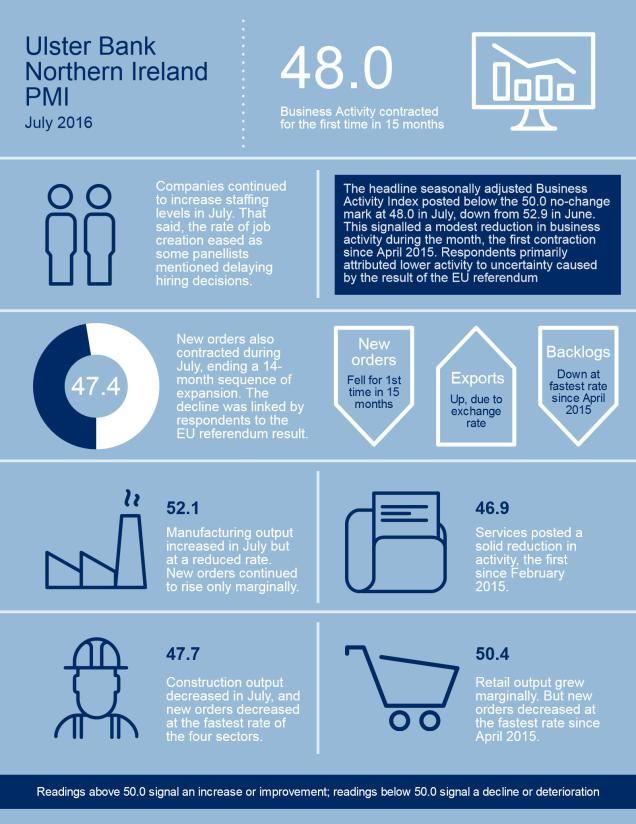

The release of July data from the Ulster Bank Northern Ireland PMI® report - produced for Ulster Bank by Markit - signalled that the month following the UK's vote to leave the EU saw declines in output and new orders in Northern Ireland. The weakness of sterling following the referendum also led to a sharp acceleration of cost inflation. On a more positive note, employment continued to increase and companies were able to secure greater new export business.

The main findings of the July survey were as follows:

- The headline seasonally adjusted Business Activity Index posted below the 50.0 no-change mark at 48.0 in July, down from 52.9 in June.

- Output also decreased across the UK economy as a whole.

- Respondents primarily attributed lower activity to uncertainty caused by the result of the EU referendum.

- Of the four monitored sectors, services was the worst performer as activity decreased at the fastest pace since February 2013.

- New orders also contracted during July, ending a 14-month sequence of expansion.

- In contrast to the picture for total new business, new export orders increased during the month, as the weakness of sterling helped companies to secure new work from clients in the Republic of Ireland.

- A decline in new orders contributed to a further monthly reduction in backlogs of work, the third in as many months.

- Despite reductions in output and new orders, companies continued to increase staffing levels in July in line with future growth plans.

- The rate of job creation eased as some panellists mentioned delaying hiring decisions.

- Input prices increased at a much faster pace in July as the weakness of sterling resulted in higher costs for imported items.

- The rate of inflation was the fastest since March 2012, with the manufacturing sector signalling a marked acceleration in the pace of increase in input prices.

- Charges also rose at a faster pace as companies passed on higher cost burdens to clients.

- The overall rate of inflation was a two-and-a-half year high, with manufacturing seeing the strongest rise since December 2013.

Commenting on the latest survey findings, Richard Ramsey, Chief Economist Northern Ireland, Ulster Bank, said:

“After last week’s UK PMI data showed falls in activity in each of the manufacturing, services and construction sectors in the month following the EU referendum, it is not a huge surprise to see the Northern Ireland private sector following suit and recording a return to contraction for the first time in 15 months. Output decreased on the back of a reduction in new orders, itself the first decline since April 2015.

“When looking at the UK regional breakdown, it is clear to see that Northern Ireland firms were by no means alone in reporting a more challenging July. In fact, only the East of England and East Midlands were able to eke out any growth of output, with activity declining in all other regions. Some comfort can perhaps be drawn from the fact that the reductions in output and new orders in Northern Ireland were weaker than the UK average. Another positive aspect of the latest survey was that employment continued to rise, suggesting that firms may not be completely resigned to an extended downturn and hold out hopes that the drop in July will prove transitory.

“The weakness of sterling following the referendum played a key role in certain aspects the local economy during the month. The rate of cost inflation accelerated sharply and was the fastest since March 2012 as the costs of imported items increased. But on the flip side firms were able to take advantage of an improved competitive position to secure growth of new export orders.

“Delving into the sector data shows companies in the service economy have had the most difficult month, with activity and new business falling at the sharpest rates since early-2013. Construction remained in contraction territory, but manufacturers were able to raise production on the back of new order growth and rising export demand in particular. Meanwhile, retail saw little change in activity but a reduction in new orders. The service sector was the only area not to record job creation in July, with staffing levels left unchanged.

“Overall, the latest PMI is no doubt concerning for the Northern Ireland economy. However, we shouldn’t read too much into one month’s survey. The data flow in coming months will give a clearer picture of the broader trajectory of the local economy.”

Downloads Intergraf Economic News (Paper Prices) - March 2024

Intergraf Economic News (Paper Prices) - March 2024

18 March 2024

Access the latest edition of the Economic Newsletter for the European Printing Industry for data on paper consumption, and pricing data for pulp, paper and recovered paper. Data for packaging papers and board is also available with this edition.

STUDY EXPOSES HIGH COST OF PHARMACIES PRINTING MEDICAL INFORMATION LEAFLETS

STUDY EXPOSES HIGH COST OF PHARMACIES PRINTING MEDICAL INFORMATION LEAFLETS

7 March 2024

Intergraf welcomes the release of a study by our partner MLPS (Medical Leaflet = Patient Safety), a subgroup of the European Carton Manufacturers Association (ECMA) shedding light on the potential economic costs associated with the proposed use of Print on Demand (PoD) leaflets in the pharmaceutical legislation revision.

The BPIF is the printing industries champion. By becoming a member you join a diverse and influential community. We help you solve business problems, connect you to new customers and suppliers and make your voice heard in government.

Call 01676 526030