14 October 2021

Energy sector commentary - special update ahead of the next Printing Outlook

In the last three months global gas wholesale prices have skyrocketed to record levels, dragging electricity prices with them - it is fair to call this an energy crisis. The themes touched on in the last Printing Outlook report remain the key drivers behind the huge market volatility we have seen recently - rebounding global economic demand and tight commodity supply. The gas and power markets are following a classic over-correction cycle that we normally see in crude markets. A downward demand 'shock' (Covid lockdown) causes a collapse in the price, then the robust recovery from that downturn leads to supply-side constraints, and the price leaps. In the period since the last Outlook's analysis, Brent crude has risen $10, or around 12%, to $83/barrel. Meanwhile, sterling has fallen around 1% against the dollar to $1.36/£, meaning that the rise in oil prices has been slightly higher for UK customers - 12.9%. Compared with a year ago, Brent crude has now more than doubled in both dollar (+125%) and Sterling (+113%) terms.

Gas markets have fallen back from record levels in the last couple of weeks but are still extremely elevated and volatile as we head into winter. Year-ahead natural gas wholesale quotations (out of April 22) are 26% higher than in July, however the greatest panic is reserved for the 'front months' for the coming winter, where the market is operating at a pricing level 4 or 5 times the equivalent levels of a year ago. Looking beyond the current winter, that year-ahead price is basically 2.5 times the price as at a year ago. Electricity prices are heavily influenced by the prevailing gas and coal markets, as those fuels used for power generation still tend to set or influence the marginal cost. Coal has been trading at record levels too, as markets look for an alternative to gas for power generation, and due to its dirtier nature in terms of emissions, this has also boosted the carbon price - which again feeds through to electricity wholesale prices. Like gas, electricity year-ahead markets (out of April 2022) are more than a quarter higher since the last update and are 2.3 times the level seen a year ago. The prices for this winter are even higher.

Buyers who took the opportunity in 2020 to contract long-term forward for business electricity and gas supply contracts will have been insulated from these impacts, whereas those still with exposure to unfixed contract renewals will be braced for very significant price increases, depending of course on when they placed their last contract. The 'traditional' business energy supply renewal season is for 1st October starts, with prices tending to be negotiated in advance, so if fixed price deals were struck earlier in the summer, then recent price spikes would have limited short term impact.

Oil markets have continued to increase in the last quarter on rebounding global demand for the fuel, and supply-side constraints. The resurgence in coal and gas prices worldwide also increases potential demand for oil products as heating fuel over the northern hemisphere winter. Global gas prices have hit record levels in multiple regions. Robust Asian demand has increased competition for global liquefied natural gas (LNG) tanker deliveries, with European markets having to 'bid up' to close the value gap. In Europe, the decline of the UK and Netherlands indigenous production has underlined reliance on Russian (and Norwegian) supplies. Both countries have faced physical supply difficulties, and Russia is prioritising filling its domestic storage facilities before the end of October. European storage levels have been significantly lower than the 5-year average, lending further volatility to the market ahead of withdrawal season. Finally, Russia is pushing for the EU to approve its NordStream 2 pipeline across the Baltic Sea to Germany. The US and some European countries are against the pipeline for strategic reasons, and there is concern that Russia may be holding back on supplies transiting through Ukraine to underline its preference to prioritise NordStream. The path of the markets from here will be driven by the weather as we move into winter, and both Russian and LNG physical deliveries. Volatility is almost certain.

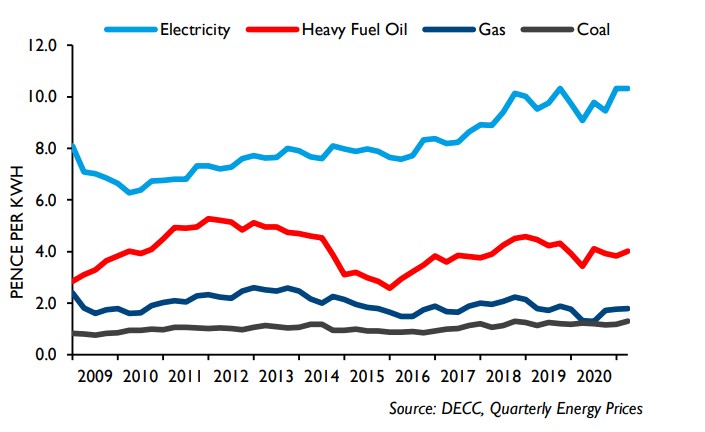

MANUFACTURING INDUSTRY FUEL PRICES – IN CASH TERMS

NOTE: The Q3 price data has not yet been published but will be available in the next BPIF Printing Outlook report.

Source: David Hunter, Director of Market Studies at Schneider Electric

Downloads Intergraf Economic News (Paper Prices) - March 2024

Intergraf Economic News (Paper Prices) - March 2024

18 March 2024

Access the latest edition of the Economic Newsletter for the European Printing Industry for data on paper consumption, and pricing data for pulp, paper and recovered paper. Data for packaging papers and board is also available with this edition.

STUDY EXPOSES HIGH COST OF PHARMACIES PRINTING MEDICAL INFORMATION LEAFLETS

STUDY EXPOSES HIGH COST OF PHARMACIES PRINTING MEDICAL INFORMATION LEAFLETS

7 March 2024

Intergraf welcomes the release of a study by our partner MLPS (Medical Leaflet = Patient Safety), a subgroup of the European Carton Manufacturers Association (ECMA) shedding light on the potential economic costs associated with the proposed use of Print on Demand (PoD) leaflets in the pharmaceutical legislation revision.

The BPIF is the printing industries champion. By becoming a member you join a diverse and influential community. We help you solve business problems, connect you to new customers and suppliers and make your voice heard in government.

Call 01676 526030