June 2019

BPIF Research – the UK printing industry

As the BPIF's internal research department, BPIF Research has become a leading authority on the economic situation of UK Printing Industry. Expertise in a considerable range of primary and secondary research, combined with a growing network of collaborators and esteemed contacts ensures that BPIF Research is leading and developing industry research that would not otherwise exist.

Aside from the headline Facts and Figures, Printing Outlook and some Wage Benchmarking guidance – BPIF Research also conducts other ad hoc primary research on the industry. We also collate and publish relevant data from secondary sources, and are happy to signpost and support industry data and research originating from other organisations.

BPIF Research has made a big effort in the last year in ensuring that industry economic knowledge and intelligence is available and used. More information is now available on our website and a series of presentations have been done to and for BPIF members at numerous events around the country (including at the request of BPIF Associate members such as Canon, Antalis and Intelligent Finishing Systems).

A new Facts and Figures flyer will be published in July 2019 here.

The Print Economy

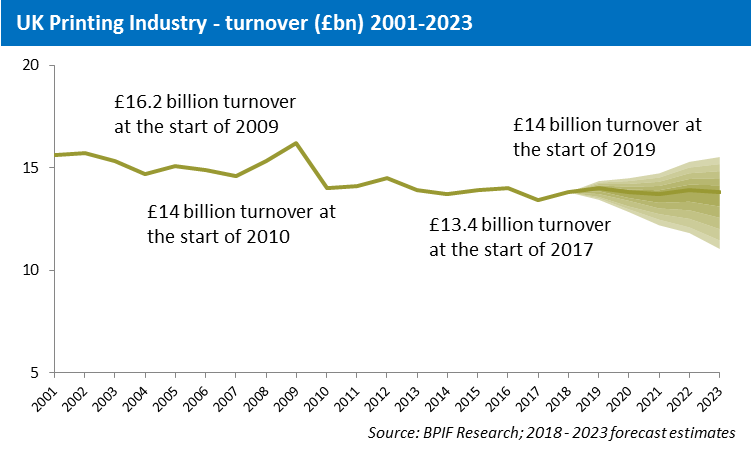

Industry turnover is estimated to be £14 billion (in 2018), employing around 112,000 people in 8,000 companies. The UK Printing sector is an important economic contributor and employer in all UK regions.

The UK is the fifth largest printing county in the world (after USA, China, Japan and Germany).

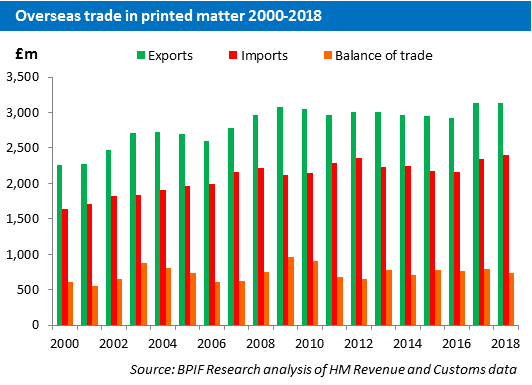

Printed matter contributed £742 million to the UK's balance of trade in 2018. (Just under 50% of exports are to the EU - £1.5bn of £3.1 billion. 41% of imports are from EU - £1 billion of £2.4 billion. The vast majority of the positive trade balance is as a result of EU trade.)

The overall number of companies and employees in the industry is expected to continue to decline slowly in the next few years. The rate of this decline has levelled out but, as we saw from the financial crisis in 2008 - a shock may significantly reduce stability. New revisions to 2016 data suggest that the EU referendum also had a detrimental effect on industry turnover.

Sector Performance

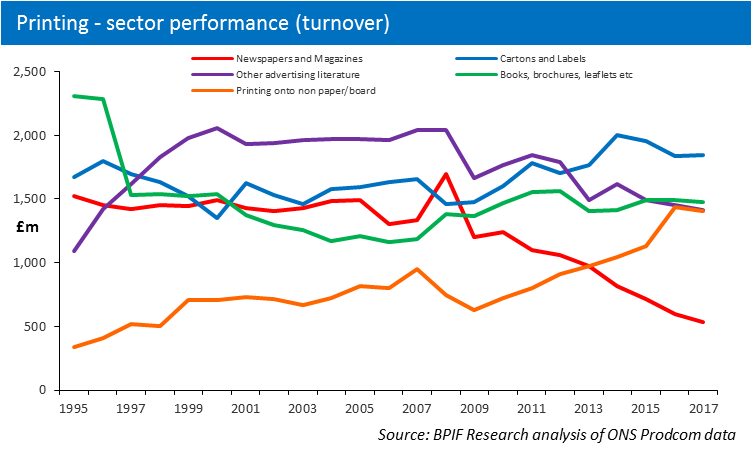

Many of the headlines about Printing are often dominated by the changes that have been occurring in the newspaper and magazine sectors - which are facing considerable disruption from the rise of digital media and changing consumer behaviour. That - and perhaps books and direct mail are often the public perception of print - but this is only the tip of the print iceberg; there is a whole lot more hidden below the waterline. Other sectors have shown more stability and some have seen healthy growth.

In particular the book sector has recorded strong growth in recent years, after the decline experienced in the mid-90s it really is a good news story how the UK book printing sector has adapted to the demand for short-run stock management and developed appropriate production techniques. Printing on to materials other than paper/board (such as signage, large format, textiles and vehicle graphics) has grown considerably to become a significant sector. Paper and board based printed packaging and labels has now become the industry's largest sector.

Now, more than ever, starting to see more emphasis on truly integrated marketing campaigns (online, mobile, and the print channels) with the potential for more personalisation and customisation and the development of distribute and print models (rather than print and distribute) there is much more to come. This has been touted for some time - but only now are we starting to so some real change here; print is fighting to show its credentials, prove its effectiveness and keep its place in the marketing mix.

Also, it is notable that a number of high profile brands (Ikea, Apple, Facebook, Amazon, Asos, Uber, Airbnb and Google being some examples) are returning to print and being highly positive about their use of print.

Top Business Concerns

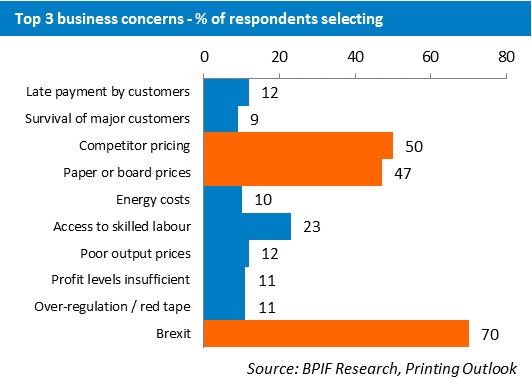

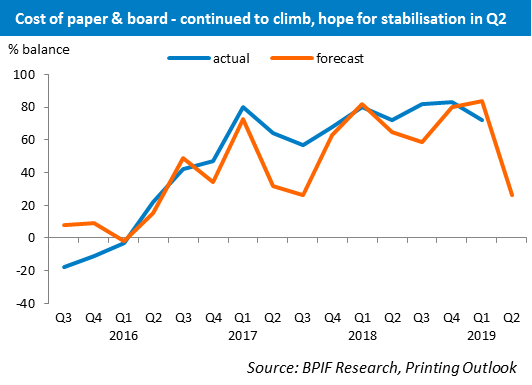

Our Printing Outlook survey uncovers the main concerns facing companies in the industry. Currently these are; Brexit, competitor price competition and paper and board prices. Paper and Board price levels did dominate the business concerns for much of the last year, but the various Brexit deadlines have heightened concerns (from all viewpoints) more recently.

Brexit

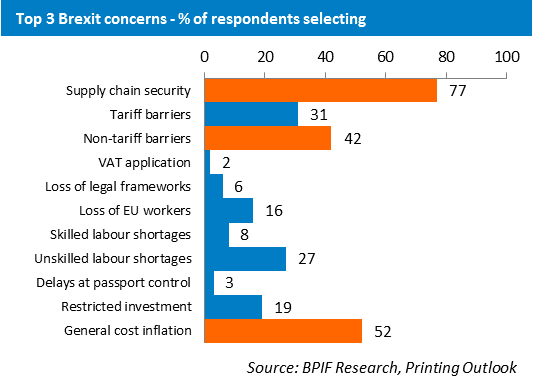

The printing industry makes a positive contribution to the UK's trade balance. However, there is also a significant amount of trade in the supply chain. The major material input is of course paper and board - almost all of which is imported (80% from Europe). Furthermore the investment market (technology, capital equipment, software etc.) is a worldwide market.

As such, there are concerns over uncertainty, exchange rate fluctuations, supply chain security, potential cash flow pressure caused by VAT payments due on imports which may not be timely recovered and the impact on costs and profits.

However, some companies may be in a position to exploit opportunities arising from changes in the economy, interest rates staying lower for longer or improved exporting competitiveness and import substitution.

As the Brexit timeline has continued it is the lingering uncertainty, frustrations with the lack of progress and incredulity at the political manoeuvrings that are effecting company's investment, planning and confidence.

Examine more Brexit resources here.

FOCUS ON

Printing Outlook

Response rates have been strong throughout the last year. The Q2 2019 report was based on detailed data from 131 companies, encompassing 9,894 employees and a combined turnover of £1.4 billion. This is one of the highest response levels ever achieved.

The Printing Outlook report has helped provide members a view on how the wider industry is performing so that they can gauge their own performance; not just changes in order and output levels but capacity fluctuations, cost pressures, margins, profit levels and regular monitoring if industry pay review levels. Importantly, Printing Outlook has a direct influence on our industry representation and lobbying activities, it has been particularly useful in the last year on matters related to Brexit and late payment and extended payment terms.

Get the latest Printing Outlook here.

Wage Benchmarking

Continued developments from the industry wide Salary Survey, specific wage benchmarking projects, pay review monitoring and access to national pay data from the Office for National Statistics.

Detailed wage benchmarking specific to the printing industry can be extremely complex, never mind difficult and expensive to obtain. The involvement of our membership network in our wage benchmarking projects means that we are able to offer a growing level of detail on wage and salary benchmarks back to members, at no cost. This can help ensure that appropriate rates, conditions and benefits can be set with more confidence.

Access wage benchmarking information here.

Trade Statistics

We have now made available a detailed dataset on the import and export of printed matter in to and out from the UK.

UK sees record exports for printed matter in 2018:

- The UK is a big exporter of printed products - to the value of £3.1 billion in 2018.

- The UK is also a large importer of printed products - almost £2.4 billion in 2018.

- This trade data means that the UK printing industry has a considerably positive contribution to the UK's trade balance - £742 million in 2018.

- The book sector forms the main component of UK trade in printed matter - in 2018 exports of books were valued at around £2 billion, imports of books were around £1 billion.

- The UK exports more printed matter than it imports to all but 11 countries in the world.

Download printing industry trade statistics here.

Paper and Board Pricing

With collaboration from Intergraf, the European federation for printing industry trade associations, we now provide BPIF members with a two-page briefing document summarising the latest developments regarding pulp, paper and board demand and prices. This helps companies provide independent information and intelligence on paper prices to their clients.

The UK paper and board prices update is available here.

Gender Analysis 2018

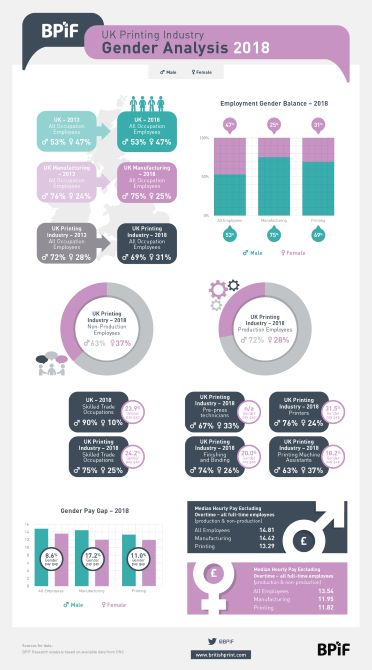

For International Women's Day, the BPIF did some research to see exactly where the industry stands in terms of gender split and pay.

Gender Balance

Looking firstly at the proportions of male and female employees in the UK economy - the UK breakdown for all employees is 53% male and 47% female. Within manufacturing (of which the printing industry is part) is 75% male and 25% female. However, the UK printing industry - with 69% male and 31% female - has greater female representation than the manufacturing total (though does remain well below the national balance).

Gender Pay Gap

The gender pay gap fell from 2017 to 2018, to stand at 8.6% among full-time employees. The gap among all employees is higher (17.9%), driven by more women working in part-time jobs, which are lower paid (an average hourly rate is £9.36 compared with £14.31, excluding overtime, for full-time jobs).

Within the UK printing industry the gender pay gap is 11% - greater than the national figure (8.6%) but lower than the manufacturing disparity of 17.2%; this is for all full-time employees (i.e. includes directors, managers, office staff and production employees). The UK printing industry gender pay disparity comes primarily from the production occupations - the gender pay gap for the printing industry skilled trade occupations is 24.2%.

Intergraf Economic News (Paper Prices) - March 2024

Intergraf Economic News (Paper Prices) - March 2024

March 2024

Access the latest edition of the Economic Newsletter for the European Printing Industry for data on paper consumption, and pricing data for pulp, paper and recovered paper. Data for packaging papers and board is also available with this edition.

STUDY EXPOSES HIGH COST OF PHARMACIES PRINTING MEDICAL INFORMATION LEAFLETS

STUDY EXPOSES HIGH COST OF PHARMACIES PRINTING MEDICAL INFORMATION LEAFLETS

March 2024

Intergraf welcomes the release of a study by our partner MLPS (Medical Leaflet = Patient Safety), a subgroup of the European Carton Manufacturers Association (ECMA) shedding light on the potential economic costs associated with the proposed use of Print on Demand (PoD) leaflets in the pharmaceutical legislation revision.