June 2018

Northern Ireland cross-border supply chain report

The Department for the Economy (DfE) has now published a range of material in relation to movements across the NI-ROI border. This shows that cross border travel is extensive with some 110 million movements of people across the border per annum, for all sorts of everyday purposes while previous publications have also shown the likely family linkages across the border.

For commerce and industry, that previous work has also demonstrated the extent of trade in goods and services by businesses across the border. There are a significant number of our small businesses engaged in cross border trade and much of this has the characteristics of local trade that just happens to occur across an international boundary.

This latest publication has added further to our understanding of those cross border commercial and industrial linkages, and to what extent those are integrated. It demonstrates that much of our cross border trade is in intermediate goods rather than final goods and that much of our cross border trade is integrated within Cross Border Supply Chains. It also shows that those interactions can actually be very frequent for relatively modest individual amounts, again reinforcing that much of our trade is more characteristic of local rather than international trade, involving small companies, facilitated by proximity and the land connection. Our trade with ROI is important in its totality, it is important for many small firms and it is important for existing supply chains. While it may technically be international trade it actually looks much more like local trade in local markets.

Report Executive Summary

Although existing data sources describe the nature and value of trade between Northern Ireland (NI) and Ireland (IE) at a high level, there is limited information available on the frequency with which goods are moved across the border and the purposes for which they are used. Establishing the degree of interdependence between cross-border businesses is clearly more important than ever in the context of EU Exit. The Department for the Economy commissioned NISRA to undertake a survey of NI businesses trading with IE and an analysis of HMRC microdata with a particular focus on how goods were moved across the border and the nature and extent of supply chain linkages. The main findings from the Cross-Border Supply Chain Report are:

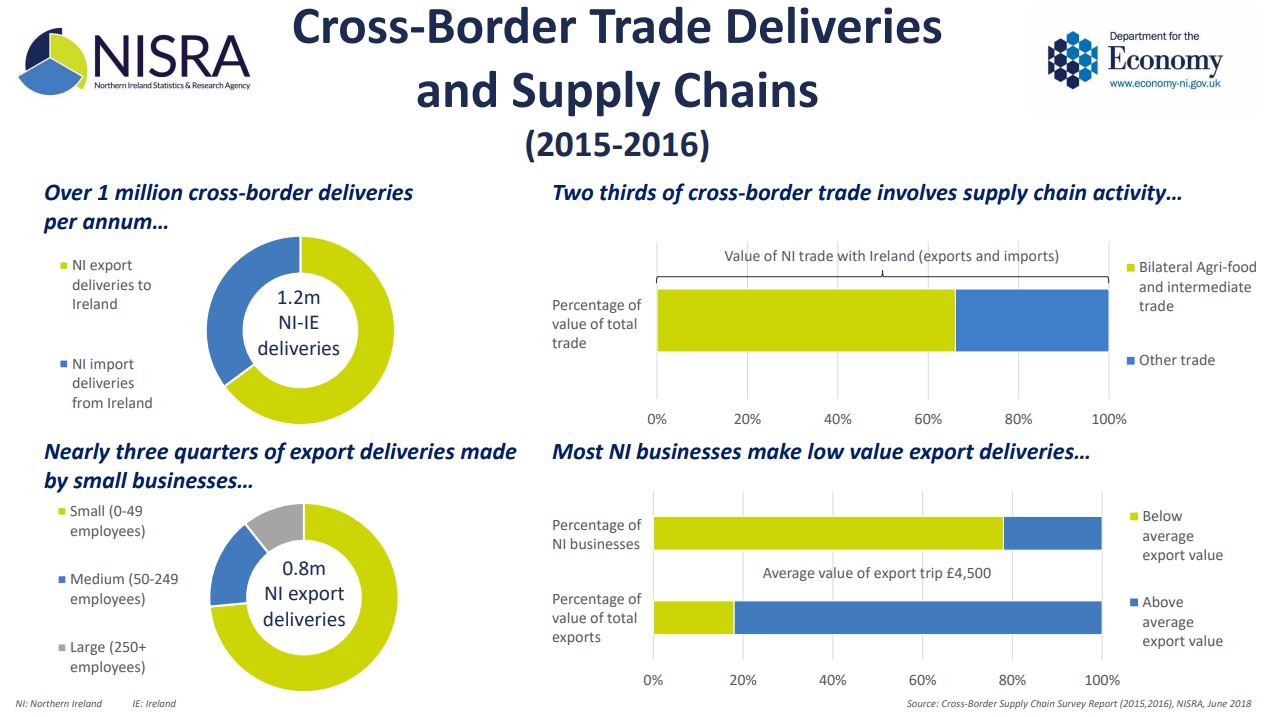

- Provisional estimates indicate that NI VAT and PAYE registered businesses (in the non-financial and non-farm sectors) made some 758,000 cross border export deliveries to IE, estimated to be worth some £3.42bn to the local economy in 2016. In addition there were approximately 410,000 import deliveries in 2015 from IE to NI businesses worth nearly £2.0bn in the sectors covered by the survey.

- The majority of those cross-border transactions were made by micro and small businesses, which dominate the NI economy, with approximately 74% of export deliveries involving NI businesses with fewer than 50 employees and 33% carried out by businesses with fewer than 10 employees.

- Northern Ireland businesses exporting to IE made on average nearly 100 deliveries valued at approximately £4,500 per trip in 2016. Most businesses tended to make low value deliveries but these accounted for just less than one fifth of the total value of exports. Conversely, just over twenty percent of businesses made deliveries worth more than £4,500 per trip and these accounted for most (82%) of the total value of NI exports to IE.

- Exports to IE accounted for more than 15% of businesses' (NI + IE) sales for five of NI's District Council Areas (DCAs) with most border DCAs showing a greater propensity for trade with IE, than DCA's not adjoining the border.

- Analysis of HMRC trade data indicated that 39% of NI trade (total exports and imports above the respective Intrastat reporting thresholds - see explanatory panel on page 4) with IE was comprised of trade in "intermediate" goods i.e. goods that are used to produce other goods, which may be considered as evidence of supply chain activity.

- When NI businesses who are both exporting and importing agri-food products that are ready for the market (Meat & Fish Products, Foodstuffs, Dairy Products and Beverages) are also included, two-thirds of goods traded with IE can be considered to be part of such supply chain activity. This wider definition of supply chain activity reflects agri-food products that were intensively traded across the border and were frequently time sensitive.

- While trade in intermediate goods or bilateral trade within the same sector are not unequivocal indicators of supply chain activity they nevertheless highlight the critical importance of North-South business to business inputs for traders above the reporting thresholds.

- As a small open economy NI trade is also integrated into trade with the Rest of the European Union (REU) and the Rest of the World (RoW). Sixty two per cent of trade with the REU met this wider definition of Supply Chain activity as did 53% of NI's trade with the RoW.

- Trade in capital goods can also be considered as a further type of input to the production process. Northern Ireland was much more likely to trade in capital goods with the REU (21% of above threshold trade) and the RoW (23%) than with IE (7%). Thisis in addition to the wider definition of Supply Chain activity described above and provides further evidence of NI's integration into markets beyond these islands.

- The current research paints a rich picture of the web of cross-border connections and trade between NI businesses and businesses and consumers in IE. This is, however, only a partial picture of the movement of goods across the border, as NI relies heavily on moving and receiving goods through IE ports for its trade with GB. Previous estimates have indicated that NI sales of goods to GB are worth nearly 4 times that of sales of goods to IE of which the current exercise does not take account. North-South supply chains cannot be considered in isolation from trade with GB and this remains an area for further research.

Download the full report from the Department for the Economy (DfE) and the Northern Ireland Statistics & Research Agency (NISRA) on the link below.

Downloads Keypoint Intelligence launch pre-drupa reseach study

Keypoint Intelligence launch pre-drupa reseach study

February 2024

BPIF Associate member Keypoint Intelligence are conducting some industry research in the run-up to drupa. Can you spare a few minutes to get involved?

Intergraf Economic News (Paper Prices) - March 2024

Intergraf Economic News (Paper Prices) - March 2024

March 2024

Access the latest edition of the Economic Newsletter for the European Printing Industry for data on paper consumption, and pricing data for pulp, paper and recovered paper. Data for packaging papers and board is also available with this edition.