September 2021

Widthwise 2021- the state of the UK and Ireland's wide-format print sector

It is 14 years since Image Reports conducted the first Widthwise survey of the UK's large-format printers. There has probably been more disruption in the marketplace in the last year than in all of those previous years put together. What that means for PSPs in this sector is where the 2021 Widthwise Report hopes to shed some light.

The worst of times has been the best of times for some. That may not be what you want to hear if Covid has just about sunk your business but, thankfully, according to the 195 large-format orientated UK/Ireland-based print businesses that answered the 14th Widthwise poll at the start of 2021, the sector has not fared too badly. That's not to say it hasn't suffered of course. Almost half (48%) had to cut staff levels, and a whopping 81% said they had needed to take advantage of Government aid during the pandemic.

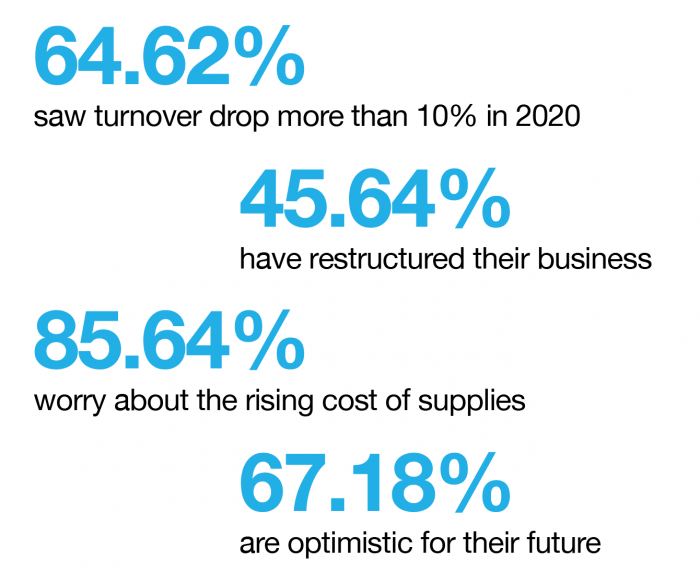

Two thirds of respondents (65%) said turnover dropped more than 10% in the past year, and another 13% said it had fallen 1 - 10%. But, 13% saw turnover grow - 9% by more than 10%. And though not everyone was feeling tickety-boo over what the next couple of years hold, more than two thirds (67%) said they were optimistic - more than a quarter (26%) ‘very optimistic'.

Asked if, in the short to medium term, they felt overall demand for large-format print in the UK would return to pre-Covid levels, almost two-thirds (64%) said yes, with 13% giving a decisive ‘no'.

The findings come from a cross-section of PSPs, all of which handle large-format digital inkjet print. To put things into perspective, 60% of the 195 companies had five staff or fewer, while slightly under 15% had 21 employees or more - nine companies polled had more than 100 employees. Almost half (49%) of those that responded reported a turnover under £250,000, though 8% had a turnover of £5m or more.

A good number (46%) of the sample said they had restructured their business during 2020, with new markets, new print - and non-print - applications, and ecommerce having been a focus for many, but with workflow efficiency measures at the top of the list, with 32% earmarking this as a key change. Asked about likely strategic moves over the coming two years, more than half (58%) of companies said further improving workflow efficiencies would be a top priority.

So what else is on the priority list? Well, not necessarily investment in new kit and software, a key priority for so many companies for so many years. Asked how much they were expecting to invest in new hardware/software right across their business in 2021 compared to 2020, a third (32%) said more, but another third (33%) opted for a zero spend in each period.

Interestingly, given that so many PSPs said they had been/would be on an efficiency drive, under one in ten (9%) said they would be investing in Industry 4.0 (eg the Internet of Things, automation, AI, remote diagnostics etc) in the year ahead.

Nigh on two-thirds (65%) of respondents said they would be spending under £20,000 on large-format technology specifically over the next two years, and 77% said there would be no investment in software or finishing kit.

Half (50%) said they were expecting to buy a new wide-format printer before the start of 2023. UV curable hybrid printers came out top of the wish list, with 35% of those planning to invest selecting that technology. Next in the planned purchases popularity contest came solvent printers, with 31% earmarking those despite the furore surrounding the need for the large-format print sector to green-up.

So, how important do respondents think it is to improve their green credentials? It's hardly surprising that 71% said it had become more important for them to be seen as environmentally friendly than it was two years ago - and 67% said they do now have environmental accreditations. What might be more surprising, is that 43% said few clients ask to see these credentials/policies, and 21% said none do.

When it comes to priorities and concerns going forward, the poll confirmed what we'd all expect - that growing turnover is the key focus for almost half (47%) this year, while the rising cost of supplies is what gives 86% the biggest headache.

A fear of further lockdowns, worry over paying back Government loans, uncertainty about UK economic bounce-back were all flagged up as reasons for sleepless nights, yet that fabulous optimism prevails. Let's hope it's well founded.

Widthwise Report 2021 www.imagereportsmag.co.uk/widthwise

Copyright SJP Business Media, Image Reports, 123 Cannon Street, London, EC4N 5AU, UK

Intergraf Economic News (Paper Prices) - March 2024

Intergraf Economic News (Paper Prices) - March 2024

March 2024

Access the latest edition of the Economic Newsletter for the European Printing Industry for data on paper consumption, and pricing data for pulp, paper and recovered paper. Data for packaging papers and board is also available with this edition.

STUDY EXPOSES HIGH COST OF PHARMACIES PRINTING MEDICAL INFORMATION LEAFLETS

STUDY EXPOSES HIGH COST OF PHARMACIES PRINTING MEDICAL INFORMATION LEAFLETS

March 2024

Intergraf welcomes the release of a study by our partner MLPS (Medical Leaflet = Patient Safety), a subgroup of the European Carton Manufacturers Association (ECMA) shedding light on the potential economic costs associated with the proposed use of Print on Demand (PoD) leaflets in the pharmaceutical legislation revision.