17 November 2017

Sharp rise in new orders supports growth in Northern Ireland

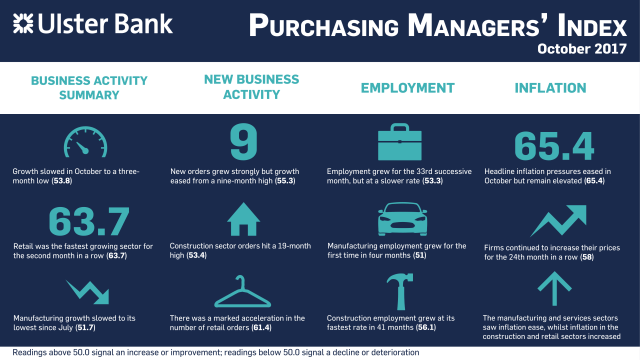

The October data from the Ulster Bank Northern Ireland PMI® - produced for Ulster Bank by IHS Markit - indicated that the private sector remained firmly in growth territory, despite rates of expansion in output and new orders easing from the previous month. Firms continued to take on extra staff at a solid pace. Meanwhile, input costs rose sharply again and the rate of output price inflation quickened.

Despite on-going inflationary pressures, Northern Ireland’s private sector continued to report expansion in activity, new orders, and employment; albeit at a slower rate. Northern Ireland mirrored the Republic of Ireland in the sense that the rate of business activity growth eased. This was in contrast to the UK picture where there was an acceleration in activity across most regions. As a result, Northern Ireland has slipped down the business activity growth table, with only Scotland now reporting a weaker rate of growth. This UK strength is reflected in the rate at which new orders are coming in at Northern Ireland firms; with overall new orders growth remaining robust, despite export orders easing back.

At a sectoral level, retail was the fastest growing for the second month in a row, with the construction industry also reporting much-improved business conditions. Output, new orders and employment also grew at faster rates in the sector, with employment growing at its fastest rate in 41-months. There were also some signs of encouragement for local manufacturing, with new orders growth rising to its highest level in over three years. Cost pressures remain the key challenge, with headline inflation remaining elevated largely due to rising commodity and fuel prices. As a result, firms continued to increase their prices for the 24th month in a row, which will continue to hit consumers’ pockets in the months ahead. In this environment, some caution is being displayed by consumer-facing firms. Retail has been a key driver of employment growth over the past few years. However, the latest survey indicates that the pace of job-creation within the sector is now sluggish. Despite no shortage of challenges, particularly on the political front, local firms remain optimistic about the year ahead; albeit slightly less so than they were in September.

The main findings of the October survey were as follows:

The headline seasonally adjusted Business Activity Index posted 53.8 in October, down from 55.1 in September but signalling a further solid monthly rise in private sector output. Activity has now increased in each of the past 13 months, though the latest expansion was the slowest since July and weaker than the UK average. Output growth was often linked by panellists to higher new orders, which have now risen on a monthly basis throughout the past year. Investment in advertising and sterling weakness reportedly contributed to new order growth. The latter factor also helped firms to secure new export orders. That said, the rate of growth eased to a 14-month low.

With workloads increasing, companies raised their staffing levels for the thirty-third successive month. The rate of job creation was solid, despite easing from that seen in September. For the first time since June, all four sectors saw employment increase.

The rate of input cost inflation remained sharp in October, with prices again increasing as a result of sterling weakness. Higher commodity and fuel costs were also mentioned. The passing on of increased input costs to clients resulted in a further sharp rise in charges, extending the current period of inflation to two years. Moreover, the latest increase was the joint-fastest in seven months. Finally, companies continued to predict growth of output over the coming 12 months, although sentiment eased to a three-month low.

Source: Richard Ramsey, Chief Economist Northern Ireland, Ulster Bank.

Downloads Intergraf Economic News (Paper Prices) - March 2024

Intergraf Economic News (Paper Prices) - March 2024

18 March 2024

Access the latest edition of the Economic Newsletter for the European Printing Industry for data on paper consumption, and pricing data for pulp, paper and recovered paper. Data for packaging papers and board is also available with this edition.

STUDY EXPOSES HIGH COST OF PHARMACIES PRINTING MEDICAL INFORMATION LEAFLETS

STUDY EXPOSES HIGH COST OF PHARMACIES PRINTING MEDICAL INFORMATION LEAFLETS

7 March 2024

Intergraf welcomes the release of a study by our partner MLPS (Medical Leaflet = Patient Safety), a subgroup of the European Carton Manufacturers Association (ECMA) shedding light on the potential economic costs associated with the proposed use of Print on Demand (PoD) leaflets in the pharmaceutical legislation revision.

The BPIF is the printing industries champion. By becoming a member you join a diverse and influential community. We help you solve business problems, connect you to new customers and suppliers and make your voice heard in government.

Call 01676 526030