18 September 2017

DfE Economic Update for Northern Ireland

The Department for the Economy's Analytical Services Unit has published their September 2017 edition of the Monthly Economic Update. The update provides a brief summary of the main trends and events arising each month within the local, national and global economies.

September 2017

The latest forecasts from the European Central Bank suggest that the economic expansion in the Euro area is expected to continue with

predicted growth of around 2.2% in 2017, 1.8% in 2018 and by 1.7% in 2019. The Bank noted that domestic demand, supported by favourable financing conditions and improving labour markets, will continue to drive the growth outlook. The UK inflation rate has risen to 2.9% in August 2017, up from 2.6% in July 2017.

In Northern Ireland, the latest labour market statistics provide a mixed picture. The number of claimants stood at 29,800; a fall by 200 over the month and the 18th consecutive monthly decrease of this figure. Furthermore, the unemployment rate decreased over the quarter (0.1pps) and year (0.2pps) to 5.3% and is the lowest in the quarterly series since Aug - Oct 2008. However, the employment rate has fallen over the quarter (0.5pps) and over the year (1.3pps) to 68.2% and the inactivity rate has increased over the quarter (0.6pps) and over the year (1.5pps) to 27.8%.

The latest Quarterly Employment Survey shows that employee jobs increased over the quarter and year to 749,740. Increases were

experienced in all four sectors over the year with the services sector accounting for the majority (60.6%) of the growth. The private sector saw an increase of 2.0% over the year to 547,170 jobs while the public sector saw a decrease of 0.3% over the year to 201,920 jobs.

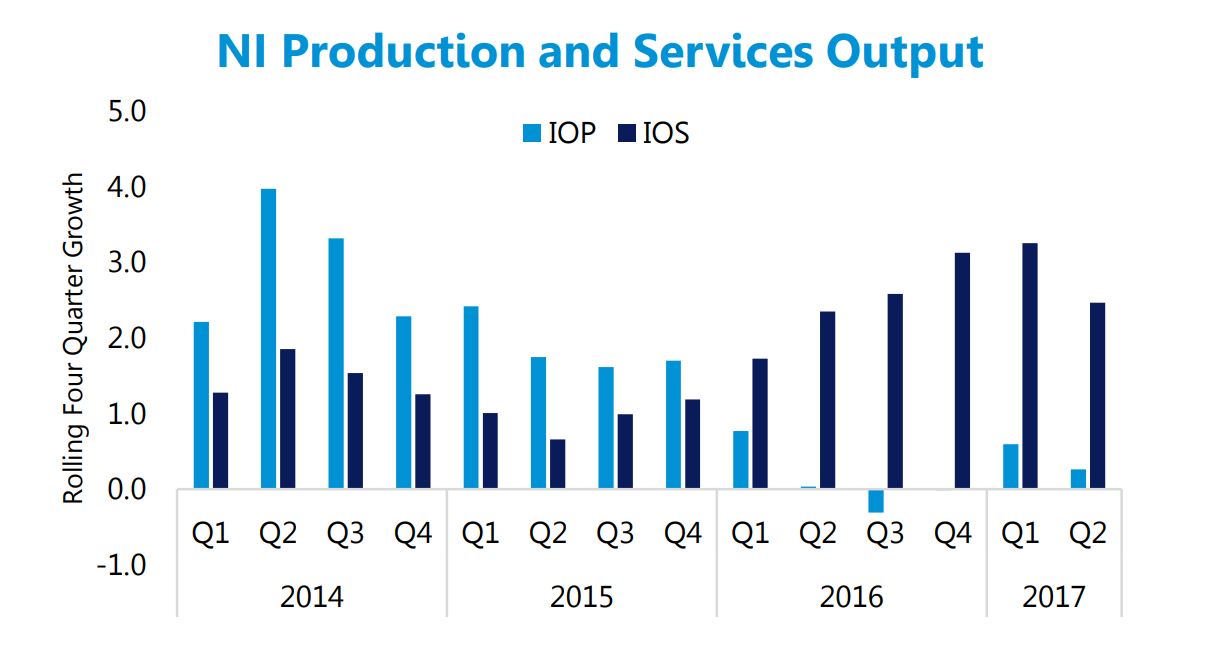

The latest figures from the Index of Production for Q2 2017 showed that output fell sharply in real terms over the quarter and year by 3.6% and 2.2% respectively. This decline was driven by a substantial fall in the Food, Beverages and Tobacco sub sector (-19.6% over the quarter). In the UK as a whole, production output fell marginally over both the quarter (-0.4%) and the year (-0.3%).

Similarly, services output decreased by 1.0% over the quarter but output increased over the year by 0.5% to Q2 2017. The Index of Services has shown an increase over the year for the last seventeen quarters including Q2 2017 however the NI index remains below the UK index.

The latest Ulster Bank PMI reported a marked rise in output and new orders during August 2017 at a faster rate than the UK average. All four segments of the private sector recorded rises in output, with services leading the way, posting the fastest rise since March 2014. Increased new orders were registered in services, manufacturing and retail with construction the only sector to report a modest fall in new business.

The latest Regional Trade Statistics Q2 2017 release due for publication on 7th September 2017 has been delayed to allow additional time to complete essential quality assurance.

Key Recent Statistics and Updates

- Private sector jobs increased over both the quarter and the year to an historical high of 547,170 jobs.

- The production and services sectors recorded annualised growth of 0.3% and 2.5% to Q2 2017 respectively.

Source: Department for the Economy, Analytical Services

Downloads Intergraf Economic News (Paper Prices) - March 2024

Intergraf Economic News (Paper Prices) - March 2024

18 March 2024

Access the latest edition of the Economic Newsletter for the European Printing Industry for data on paper consumption, and pricing data for pulp, paper and recovered paper. Data for packaging papers and board is also available with this edition.

STUDY EXPOSES HIGH COST OF PHARMACIES PRINTING MEDICAL INFORMATION LEAFLETS

STUDY EXPOSES HIGH COST OF PHARMACIES PRINTING MEDICAL INFORMATION LEAFLETS

7 March 2024

Intergraf welcomes the release of a study by our partner MLPS (Medical Leaflet = Patient Safety), a subgroup of the European Carton Manufacturers Association (ECMA) shedding light on the potential economic costs associated with the proposed use of Print on Demand (PoD) leaflets in the pharmaceutical legislation revision.

The BPIF is the printing industries champion. By becoming a member you join a diverse and influential community. We help you solve business problems, connect you to new customers and suppliers and make your voice heard in government.

Call 01676 526030